Iron Ore: Grade is king but the throne will swing

ING presented at the Metal Bulletin Iron Ore Symposium and heard miners' and traders' efforts to exploit China’s growing preference for higher quality feed. We agree a higher premium for higher grades is the new normal but also think these quality spreads will be the new centre of volatility

A brave new world for iron ore prices: Grades break apart

Higher grade premiums keep trucking as lower grade discounts stall

Higher grades breaking free

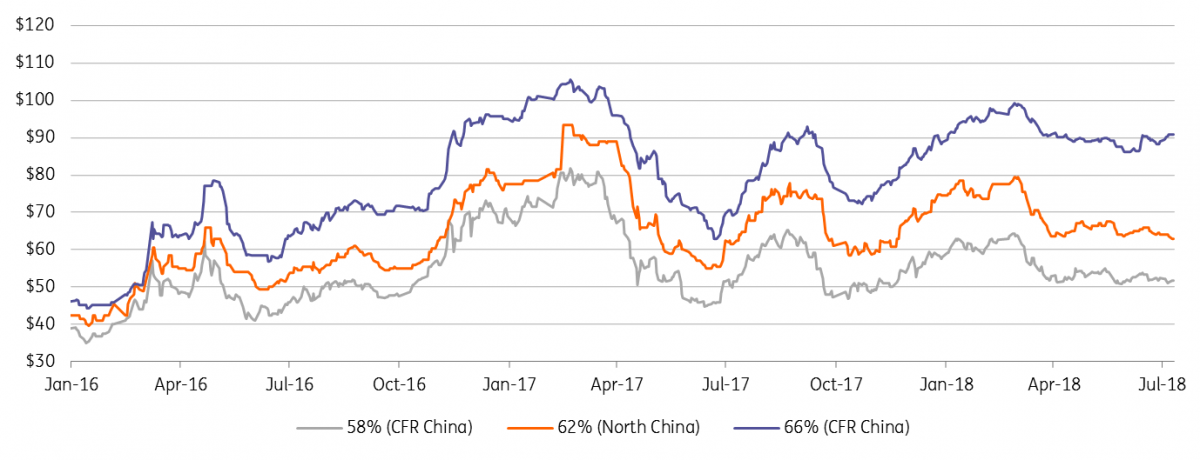

Since transitioning to an active spot market, iron ore prices have centred around those of the 62% iron ore grade fines (“the benchmark”). A high flow of consistent product from Australia’s Pilbara into China had provided the 1Bn+ tonne seaborne iron ore market this liquid reference price point from which premiums/discounts to other products (lumps, pellets, etc), impurities and grades could be pegged. But our conversations with iron ore traders, miners and steel mills gives us a firm conviction that the new Chinese drive for quality ores has changed these pricing dynamics for good.

Specifically, it’s the higher grade prices (64%+ Fe) that are now diverging from the benchmark. The premium for the higher grades has become wedded to the profits of Chinese steel mills (profits=purchasing power). Thus prices at the higher end can increasingly be found to swing in almost complete disregard for a more tepid over-supply picture set to put a lid on the broader iron ore complex: low grades and perhaps more controversially the same fate holds for benchmark grades (62%) as well. See our forecasts: Iron ore, better supported post disruptions

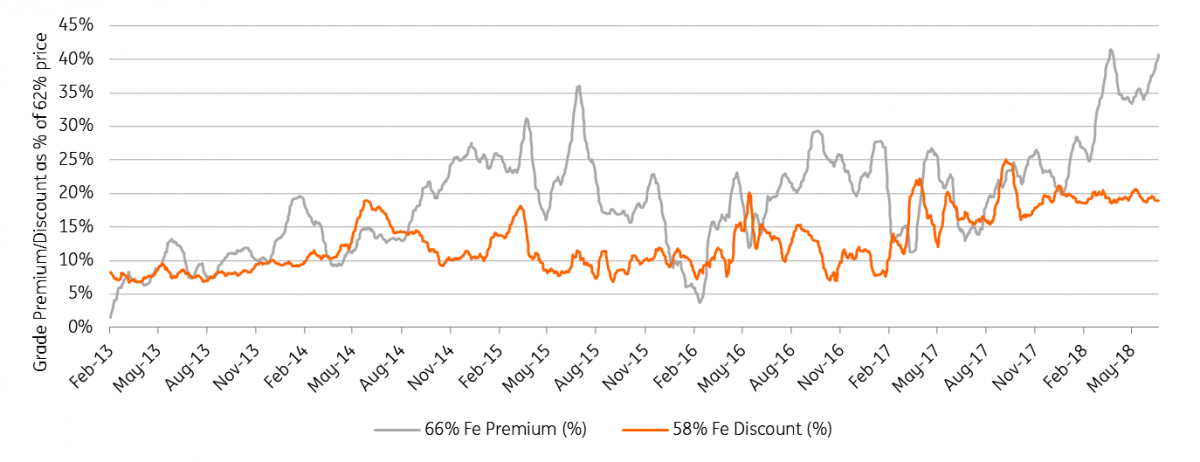

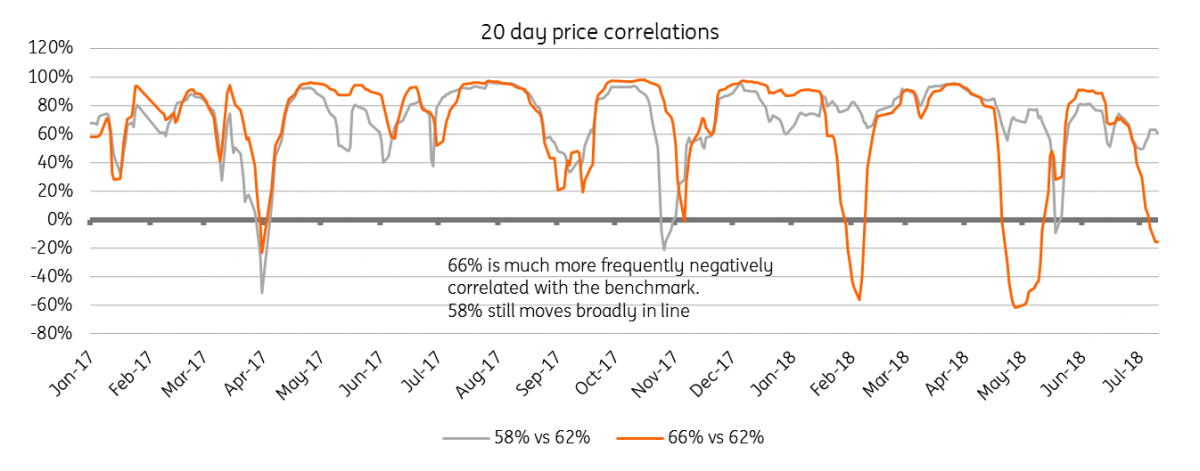

The collapse in correlation explains why the industry is calling out for new derivatives to hedge the prices of higher grades. The premium between 66% Fe and benchmark 62% Fe iron ore fines has swung dramatically in the last 12 months. From a long-running normal 15% price spread, it is now above 50%. In fact, a steel mill that locked in the 62% price this time last year, but buys at 66% Fe will have lost 3% on the hedge position but pay almost 30% higher on the physical prices.

Whilst the higher grade premiums have surged, lower grade discounts have stalled and our main revelation at the conference was that the higher end of the grade split is expected to prove more substantial.

After dropping to a record discount of 40% (US$28/mt) in December, the discount for 58% Fe (from the 62% benchmark) is now down to 26% (US$16/mt). Correlations also show that whilst 58% and 62% clearly experienced a break in late 2017, it has only once been negative as the common Fe element contained preserves a pricing connection. This is especially true as the lower 58% price is already leading to cuts in supply. But it’s getting harder to say if the same holds for the higher grades (64%+) since negative correlations are becoming much more frequent.

As one participant put it: “64%+ is becoming the iron ore market”. This is in terms of the new pinch point where most buyer-seller demand swings to move prices, and actually in absolute tonnage as well. By 2025 CRU estimate 64%+ fines will be 41% of the seaborne iron ore fines market (up from 36% now) as lower grade is pushed out and medium grade grows much more slowly.

Higher grades more frequently un-correlated

More profitable mills seek better ores for higher utilization

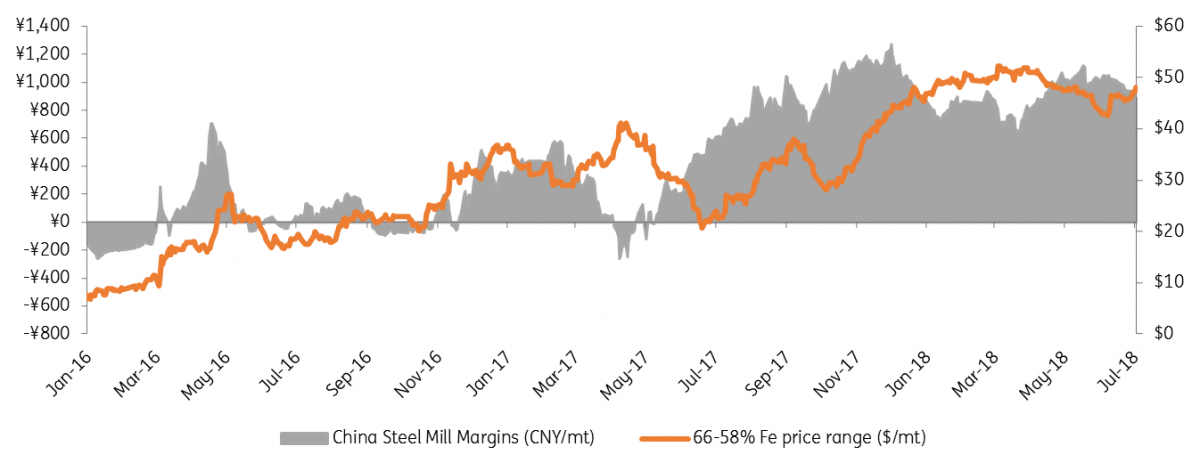

Higher profits at Chinese steel mills incentivise the industry to maximise (unrestricted) capacity in a way that didn’t exist when it was rarely breaking-even pre-2017. Higher iron ore grades boost the furnace's productivity by sparing slag volume in the blast oxygen furnace (less coke/lime usage) as well as demonstrating a higher permeability with the gasses. Rio estimates for every 1% of increased iron ore grade the productivity is 2% higher for the Chinese mills centred in the north. From the different behaviour in higher high grade premiums vs the now retreating low grade discounts however, it’s clear the value of quality isn’t linear.

Iron ore is fast becoming a more specialised and product-orientated market. Miners take pride in their specific brand of blends/ores and market their unique features and benefits for mills/sintering over other ores. Aside from just Fe grade impurities are becoming much more topical, especially Alumina. Metal Bulletin assesses the penalty per % of alumina has gone to nearly US$7 from just US$1 this time last year. Silica, phosphorous, permeability are amongst the list of criteria that can boost successful sintering (turning fines into bigger lumps), boost productivity and reduce costs (eg, amount of coking coal).

Alumina heavily penalised in iron ore price

Part structural, but also volatile

The miners naturally promote the structural changes in China's steel industry that will preserve a higher premium for their better grade ores, but we are also quick to caution on the volatile drivers of the grade premium. This will make hedging a necessity once higher grade derivatives become available.

On the structural side is the permanent steel capacity cuts. The government is close to cutting 150MT from 2016-18 and 290MT total capacity when including the illegal induction furnaces. By 2020 Hebei province (23% of 2017 production) is targeting to cut a further 40Mt by 2020. Tangshan, the largest city, wants to halve the number of steel mills, with smaller furnaces/sintering plants at the top of the list. Any new capacity is capped via capacity swaps and must be bigger and towards the south coast.

Chinese steel production is strong this year (ING estimates +3% YoY after subtracting unofficial closures from NBS figures) but even assuming output starts to slow down (especially on another round of winter cuts) we expect utilization to average above 80% for the next few years at least. The demand to make more use of unconstrained capacity incentivises the use of higher yielding ores.

Controls on new capacity will reinforce the trend. The shift from the North to the coast will make domestic Chinese mine supply increasingly uncompetitive, intensifying the existing pressure on the right hand side of the cost curve (many Chinese mines have adjusted to costs above $70/t). Limitations on domestic trucking will only intensify the issue.

But above all else, the price mills will pay for higher grade ores will be an economic decision.

A common misconception is that the low grade ores will no longer have a customer base. That's not how commodities work. At some price, or in this case a discount, a commodity finds a home. Now with a steel industry turning a profit and less overcapacity, those lower grades need to be sufficiently discounted if they are to be used in place of the higher grades. Clearly mill margins and grade premiums across the grade range (66-58%) have been well correlated, although since March the shift has been to the higher grade spreads instead of the lower ones. We caution that the higher mill margins are not just due to the lower overcapacity but are also directed more and more to volatile factors driving China's steel price: credit availability, construction trends, inventories and the huge amount of speculation on the SHFE exchange. Clearly steel prices and mill margins are in for a series of ups and downs as drivers swing and with it will be the grade premiums. Most experts we spoke to agree that Chinese mill margins (and with it grade premiums) are probably unsustainably high right now given steel demand is expected to fall off as construction activity eases.

Grade premium broadly correlating with Chinese mill profitability

But the premium is shifting to the higher grades

Pellet for your thoughts

China’s steel industry is going green, fast. By 2020 the government targets 50% of capacity to meet tough environmental restrictions. The environmental drive will direct mills to use less coke (via higher grade iron ore), but otherwise we think this will affect the premiums for pellets and lump more so than it does the grade premium. We think it’s the pollutive process of sintering (turning fines into larger particles) that will be hit hardest by the environmental curbs.

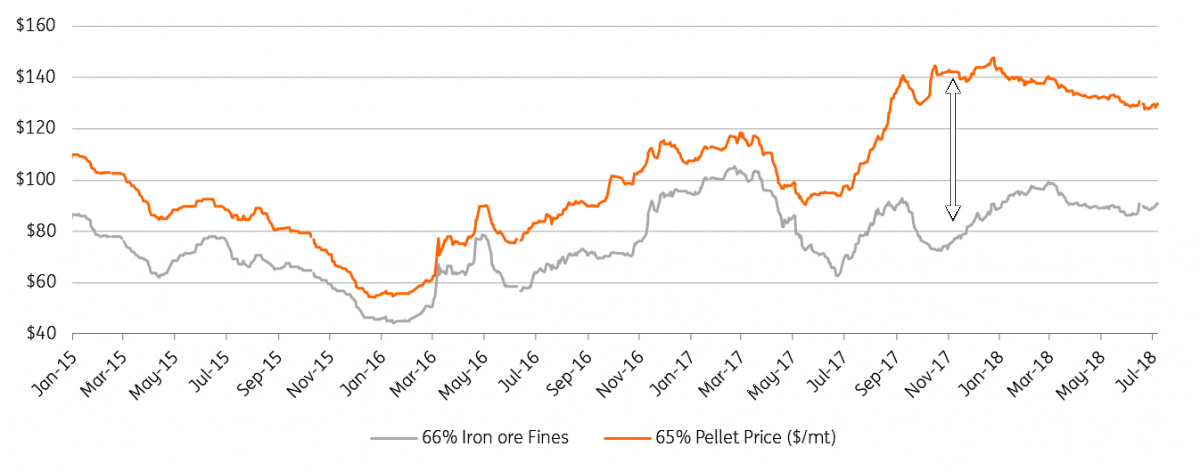

Sinter bans are now commonplace in Hebei even following the 50% winter cuts. As this capacity gets restricted Chinese mills will increasingly want to bypass sintering by using more lump and pellets. In the winter cuts the sinter ratio in the mill mix dropped from 76% to 74% and CRU expects it to trend to the low 60% level by 2030. The premiums for lump and pellets have naturally already soared.

The shunning of sinter will mostly be to the benefit of pellets.

60% of seaborne lump supply is by Rio and BHP, which are currently targeting only mild growth plans. Lump has such limited growth opportunity so conference participants expect a significant growth in pellet demand in place of sinter. To feed that demand all eyes are on the potential re-openeing of Samarco (30Mtpa pellet feed). Newsflow since is positive with preliminary settlements being made but consensus sees 2020 as the soonest re-opening.

Pellet premiums surge as China gets tough on sintering

Scrap: A 1Q flex of muscle, but steady on...

Conference participants saw the rise of scrap as the biggest risk to iron ore’s future pricing. Central to our forecast of a gradual decline in benchmark prices (but swings in the higher grade premiums) is the view of a fairly balanced seaborne market in 2018 opening to a gradual oversupply from 2019. We disagree with those bears who think prices will fall harder because our view is that demand will not be so quickly displaced by scrap and thus China's import demand only weakens slightly in the near term.

Last year’s closure of induction furnaces released masses of scrap into the Chinese market. At first some traders could avoid the export taxes and sent it overseas. But now, evidenced by the surging steel output against flat pig iron, domestic scrap consumption (in blast furnaces) has soured. Restrictions on hot metal (pig iron) output especially through the winter cuts drove that incentive to increase scrap usage, but as evidenced by the climbing price of scrap vs iron ore thereafter domestic scrap supply, has not managed to grow much beyond that initial release. The good news for miners is that if the c.15Mt of scrap boost in 1Q continues it would displace up to 90Mtpa per annum of iron ore imports.

Cost is king, but respecting environmental motivations neither grade nor scrap will be used for its own sake. High scrap costs see EAF margins lagging blast furnaces, which is why we also see that transition slower than some other industry estimates. The outlook keeps seaborne iron ore still well supplied but not catastrophically so. Low grade miners are gradually incentivised out and higher grades gradually grow to dominate both the supply of and the pinch point of iron ore pricing.

Lack of Chinese supply makes scrap expensive vs iron ore

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article