Ireland: Awaiting the decision on Brexit

The largest threat to the Irish economy remains a cliff-edge Brexit. With just weeks before the British exit is set to happen, there is still no certainty. Whether Ireland will continue its robust growth or perhaps even face a recession hangs on the final outcome of the withdrawal bill deal

Stellar growth for 2018

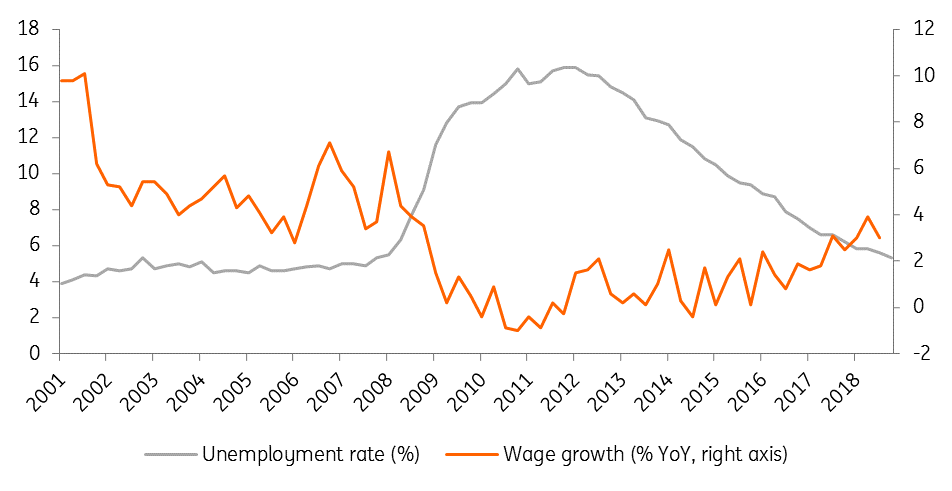

The Irish economy is likely to have ended 2018 with stronger growth than China. Significantly impacted by factors like multinational profits, we expect Irish GDP growth to come in at 6.8% for the year. Regular economic activity has expanded healthily in 2018, with consumption growth of 2.9% YoY in the third quarter. Also investment in building and construction continues to grow at a very rapid pace with 18.4% growth YoY. This indicates that the domestic economy is performing well at the moment, which can also be seen in the labour market. The Irish unemployment rate fell to 5.3% in November, which is well below the Eurozone average of 7.9%. Wage growth of around 3% in 2018, has helped along the consumption recovery. The strong housing investments are related to continued tightness in the housing market although price growth is dropping off somewhat now that significant investments are starting to have some effect.

The Irish labour market is getting very tight as wage growth is rising

But global growth and Brexit uncertainty moving forward

Moving ahead, economic uncertainty is starting to feed into the growth picture. Brexit is a key item here, as less than three months before the UK leaves the EU, it is still not clear what is going to happen. Ireland is like a team in the league that has already played its last match and is anxiously awaiting results from elsewhere to find out whether it’s been relegated or not. It is having an effect on the Irish economy as small business lending, in particular, has fallen. This indicates that businesses are delaying investment decisions ahead of some clarity on whether a cliff-edge Brexit scenario can be avoided. Alongside the uncertainty, weakness in sterling continues to have a negative impact on exports to the UK market for Irish businesses.

Businesses have also started to moderate their hiring intentions somewhat as new orders have been coming in at a slower pace than previously. This means that the domestic economy, even though still strong, is likely to be experiencing a slowdown ahead of the Brexit deadline, although it has to be said that hardly all of this can be blamed on Brexit. Any global slowdown has an important impact on the Irish economy, given how open it is. Therefore, trade war concerns and a slowing Eurozone economy are also likely to be important drivers of a slowdown indicated by businesses and uncertainty moving forward. That being said, Brexit will have a significant impact on the Irish economy. Recent estimates by ESRI show a lower GDP in all Brexit scenarios and estimates of a “no deal” Brexit leading to a 4% reduction in Irish GDP over time.

Healthy public finances make Ireland ready for next storm

For the first time since the crisis, Ireland has ended the year with a budget surplus in 2018. This marks a next step in the process of returning to sound public finances following the deep fiscal crisis Ireland was in after rescuing banks and the subsequent bailout required. Government debt rose sharply from 23.9% in the last quarter of 2007 to a peak of 124.6% in the first quarter of 2013. It has since been on the decline and has most recently reached 69.1%, rapidly approaching the threshold of 60% as demanded by the Stability and Growth Pact. The return to the black came faster than expected and has been helped by large corporate tax receipts, partly driven by multinational corporations placing more intellectual property assets in Ireland on the back of the US corporate tax overhaul. The risk of depending on corporate taxes is that the proceeds can be very volatile, making the forecast for the budget in coming years challenging. Regardless, given the state of the Irish economy and government expenditure plans, expectations are that Ireland will continue to run a budget surplus for the years ahead. This could of course be impacted significantly if economic risks were to materialise, but at least it is a sign that Ireland is ready to weather an economic storm again. With Brexit turning into a nail-biter, it could well be that this is just in time.

The Irish economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 January 2019

ING’s Eurozone Quarterly: Tiptoeing around the ‘r’ word This bundle contains 13 Articles