Our September guide to global central banks

Everything you need to know about central bank policy around the world

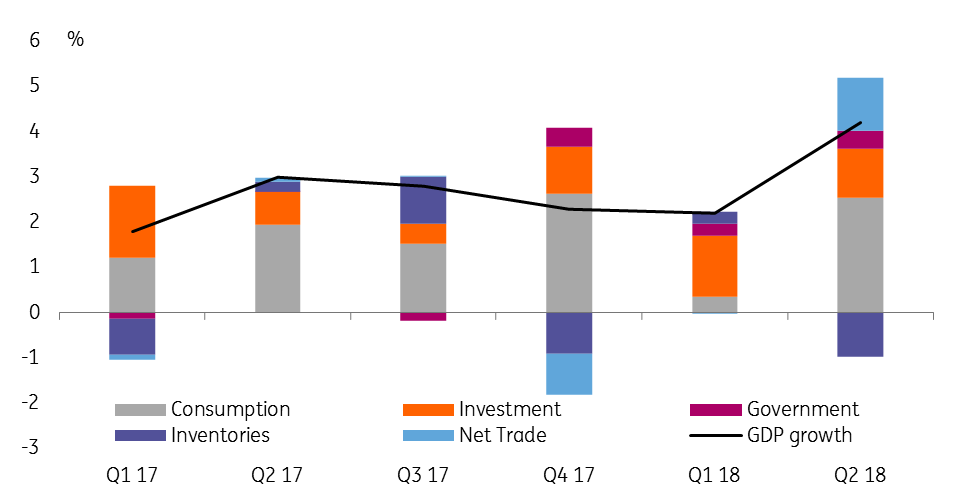

Federal Reserve: Onwards and upwards

The Federal Reserve continues to suggest monetary policy is “accommodative” and that it expects to maintain its policy of “gradual” rate hikes. We interpret this as one 25bp rate rise per quarter. Indeed, the growth backdrop remains very strong with the economy expanding by 4.2% in 2Q18. Tax cuts are supporting consumer spending and are boosting the profitability of US corporates with the economy likely to record another 3%+ GDP figure in 3Q18.

Headline inflation may be close to a temporary peak, but we expect core measures (excluding volatile food and energy components) to continue grinding higher. Should wage growth intensify then those inflation risks will increasingly lie to the upside. Consequently, we look for both September and December hikes from the Fed.

We expect modest policy tightening in 2019 – just two rate hikes next year

Economic activity is likely to slow in 2019 as the lagged effects of tighter monetary policy and the stronger dollar act as a brake while the fiscal stimulus support will gradually fade. Trade protectionism could also increasingly weigh on sentiment and spending, so medium-term inflation fears should recede progressively. This would point to more modest policy tightening in 2019 – we expect just two rate hikes next year.

Contribution to annualised US GDP growth (QoQ% ann)

European Central Bank: On auto pilot

Thanks to the June announcement of an anticipated reduction of the monthly quantitative easing purchases to €15bn after September and an end of the net purchases by the end of 2018, the European Central Bank has put itself on autopilot. In fact, as long as there are no real accidents in the economy or inflation developments, the ECB can lean back and relax. No need to hint at upcoming actions, no need to prepare markets, no need to think about tweaks to its communication.

Mario Draghi has two opportunities to hike rates before he leaves office - we think he'll use at least one

Even though wage increases in several countries have still not found their way into higher core inflation and trade tensions or Italian fiscal policies bear the risk of increasing uncertainty, the underlying solidity of the Eurozone recovery should comfort the ECB to stay on autopilot. With the end of the net purchases of the QE programme in sight, the market focus will shift to the length of reinvestments and the timing of the first rate hike. Here, ECB president Mario Draghi was very clear: interest rates will remain unchanged at least through the summer of 2019. This would give him two opportunities to hike rates before he leaves office: in early September and late October. In our view, he will use at least one.

Bank of England: It all comes down to the deal

The Bank of England raised interest rates in August, but we suspect this will be the last such rise for quite some time. Uncertainty surrounding Brexit is ramping up, and talk of the possibility of a 'no deal' scenario increases.

Admittedly, we think the probability of a 'no deal' is still relatively low. However, it all comes down to a crunch vote in the UK Parliament in early 2019 which means uncertainty is only likely to rise as we head into the winter and could begin to test business and consumer sentiment even further - particularly if a few dramatic headlines related to the government's 'no deal' preparations begin to cause concern.

In the case of a 'no deal', the economic impact would be significant and any tightening plans would be taken off the table. In fact, we would likely see the probability of a rate cut increase

This makes it very unlikely that the Bank will hike again before March 2019, and we think there are three scenarios for what happens after that. Firstly, if the parliamentary process in early 2019 is relatively smooth - in other words, MPs approve the deal with relatively little fuss - then there is a possibility of a rate hike in May next year.

However, if the process is more fractious and lawmakers demand concessions before approving the withdrawal agreement, this raises the possibility that we won't know for sure if 'no deal' will be averted until the last minute. Even if a solution is eventually found, confidence is likely to take much more of a hit in the first quarter and growth momentum would likely slow. In this case, we suspect the Bank would keep rates on hold for longer to monitor how the economy recovers.

In the case of 'no deal', the economic impact would be significant and any tightening plans would be taken off the table, and in fact, we would likely see the probability of a rate cut increase.

The road to Brexit in March 2019

Bank of Japan: Talk is cheap

The Bank of Japan continues to play a game of moving closer to ending quantitative easing while pretending it's doing exactly the opposite. The last BoJ rate decision in July involved a modest tweak to the language while at the same time loosening the yield target for Japanese government bonds. 10-year JGB yields have been trading consistently above zero for some weeks now, and 0.1% has become the de facto new target as far as the market is concerned.

The forward guidance that was supposed to have made such a big difference in this statement is contained in the following short phrase: “The Bank intends to maintain the current extremely low levels of short and long-term interest rates for an extended period, taking into account uncertainties regarding economic activity and prices including the effects of the consumption tax hike scheduled to take place in October 2019”. The statement itself was titled “Strengthening the Framework for Continuous Powerful Monetary Easing”.

The chronic shortage of available assets to purchase means the Bank of Japan is now having to merely talk a good game about QE, rather than actually delivering it

If you, like me, read this and came away unmoved, or possibly just puzzled, then you're not alone. Coupled with a slight softening of the BoJ’s commitment to keeping JGB yields at about zero, the July statement was, in fact, a slightly more hawkish swing in policy, wrapped up as a more dovish one. Why? The chronic shortage of available assets to purchase means the BoJ is now having to merely talk a good game about QE, rather than actually delivering it.

The problem is, no-one is buying into this, and it would be better for them to come clean and just admit that QE is happening at a fraction of the pace it used to or is officially supposed to do and depending on how the economy does, that will inevitably have to be wound down at some point. And by the way, this would be a lot easier to achieve if they ditched their far-fetched 2% inflation target. The October 2019 consumption tax hike is the only way they are going to hit that…briefly.

People's Bank of China: Making more room for yuan to weaken

Even though the People's Bank of China did not change the 7D policy rate, the Shanghai interbank offered rates (Shibor) has fallen quickly, from 4.1550% at the end of June to 3.1740% in July and now 2.8940% in August. We believe this is a result of the window guidance from the central bank to cushion the economy from the damaging effects of the escalating trade war.

The central bank has shut down capital outflow channels via the Shanghai Free Trade Zone and has penalised cases that violated cross-border fund regulations. It has also managed to support the yuan by imposing a 20% charge on short yuan positions in forward contracts, and it restarted the counter-cyclical factor for the daily fixing in August.

We see the counter-cyclical factor as a tool to control the speed of yuan depreciation, not a tool to change yuan direction

We don't believe this implies that the central bank would like the yuan to appreciate against the dollar even if the dollar strengthens against most currencies. Instead, we see the counter-cyclical factor as a tool to control the speed of yuan depreciation, not a tool to change yuan direction. As capital outflow channels have been almost closed, this gives more room for yuan depreciation as the worry of massive capital outflows is minimised. We retain our end-year forecast of USDCNY 7.0.

Shibor has fallen quickly

Reserve Bank of Australia: Heading down, down under?

The Reserve Bank of Australia kept rates on hold at their August meeting at 1.5% (unchanged since February 2016), noting at the end of their accompanying statement that they didn't see a strong case to adjust the cash rate in the near term.

Financial markets take that a bit further, seeing no strong case for a hike even in the longer run. Australian bank bill futures do not have a full 25bp rate hike price into them until you get to September 2019, a full year off.

We think market pricing would be more accurate if it were closer to flat over the coming 12-18 months

However, recent data makes us question that too. Business investment in 2Q18 was very weak, and it now appears that the extraction industries have not fully finished downsizing, with plans for slower investment over the coming 12 month period, and likely softer investment outside the extraction industries. The RBA’s focus on the tightness of the labour market seems misplaced, as this is the most lagging part of the economy. The housing market is slowing in nearly every large metropolitan district, with excessive construction leading to an unhelpful build-up in inventories. Very high and growing household debt ratios provide a further hurdle for any tightening of policy. The RBA’s expectation that the next rate move is bound to upwards seem to us to lack solid support.

We still do not know the extent of damage to the primary sector as a result of the drought in parts of the country, And the loss of livestock and incomes is unlikely to be quick to recover.

In consequence, we think that market pricing would be more accurate if it were closer to flat over the coming 12-18 months, and we would not need much persuasion to view the next RBA move as downwards, though this still seems a step too far today.

Reserve Bank of New Zealand: Steady as she goes

The Reserve Bank of New Zealand's August statement indicates the current cash rate of 1.75% is likely to be maintained through 2019 and 2020. The guidance back in May did not push the cash rate stability out as far.

In contrast to Australia, implied market pricing looks for a chance of some easing, with about a one in four chance of a rate cut priced in by February 2019. This more downbeat projection reflects the New Zealand economy’s slowdown. Like Australia, there is some slowdown in the housing market, which is weighing on residential construction and could lead to softer consumer spending.

In contrast to Australia, implied market pricing looks for a chance of some easing, with about a one in four chance of a rate cut priced in by February 2019

The RBNZ acknowledge the possibility of some tightening in the scenarios they present, which alongside a more upbeat inflation scenario, with higher rates sooner, also considers the impact of growth failing to pick up after the recent slowdown, concluding that this would need the official cash rate to be reduced by around 100bp.

With the escalation of the trade war, questions over the resilience of their larger neighbour, and some signs of weakness in Asia, we think the market has priced the balance of risks to the current cash rate about right.

Bank of Canada: A hike is on its way – but not quite yet

We expect the Bank of Canada to keep its tightening cycle on hold at the September policy meeting this week, but our prediction of a 4Q hike still stands. This may come as soon as October if the domestic data stays strong. High inflation and strong growth support the need for a rise in rates before the end of the year, but the 2.9% 2Q GDP print, marginally undershooting the consensus, makes a September hike unlikely.

Our prediction of a fourth-quarter hike still stands - and this may come as soon as October

Canada re-joining talks last week was a positive sign for their NAFTA inclusion, but the idea of a three-way deal has somewhat dampened with no agreement reached (as of yet) and ‘Trump talk’ firing up again. Within his series of tweets, the US President – quite directly – targeted Canada, threatening that “Canada will be out” if no fair deal is made.

This heightens uncertainty with regard to the future of NAFTA, but this isn’t the first time Trump has used tough rhetoric as a negotiation tactic. Unless negotiations break down completely, the BoC’s outlook for another hike late 2018 should remain.

Swiss National Bank: Ultra-loose monetary policy likely to continue

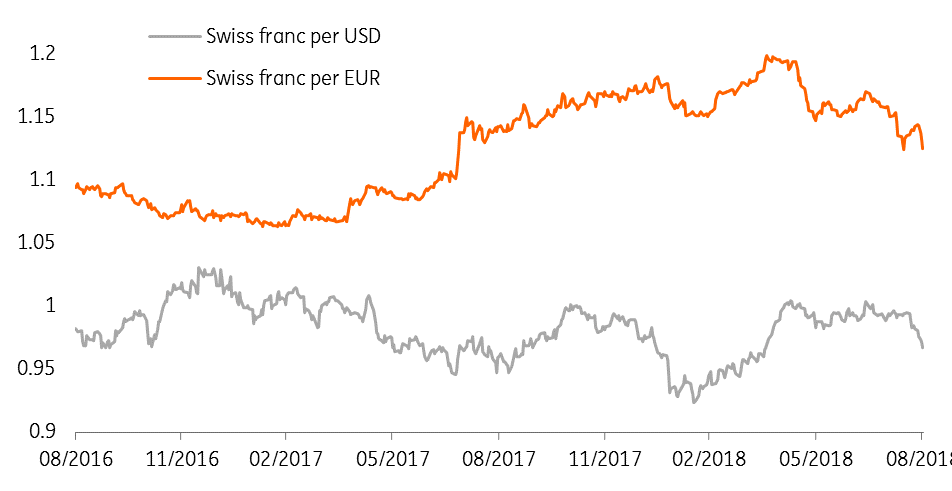

The Swiss National Bank is maintaining an ultra-loose monetary policy since the abandoning the peg with the euro in 2015. At its June meeting, the SNB left its main policy rates unchanged in negative territory, the target range for the 3-month Libor was kept between -1.25% and -0.25% and the interest rate on sight deposits remained set at -0.75%. The SNB also reiterated its willingness to intervene as needed in foreign exchange markets.

The Swiss National Bank's ultra-loose monetary policy is likely to continue for at least another year

Given the openness of the Swiss economy and its dependence on the EU for trade, the SNB’s worst nightmare is too strong an appreciation of the Swiss franc. The SNB believes the franc is “highly valued” and that it is still considered a safe-haven asset by investors. Indeed, when global risks increase, the Swiss franc’s value tends to increase drastically, especially against the euro. Turkey’s crisis illustrated this tendency clearly: the EUR/CHF exchange rate went from 1.17 on the 13th of July to 1.12 on the 15th of August, its peak since the summer of 2017.

Consequently, we don’t expect anything new from the SNB at its September meeting, apart from a strong emphasis on the Swiss franc’s value. We don’t expect a rate hike before the ECB starts raising its own rates. Given that the ECB is not expected to hike after the summer of 2019, we think the SNB won’t hike before December 2019.

Swiss franc exchange rate

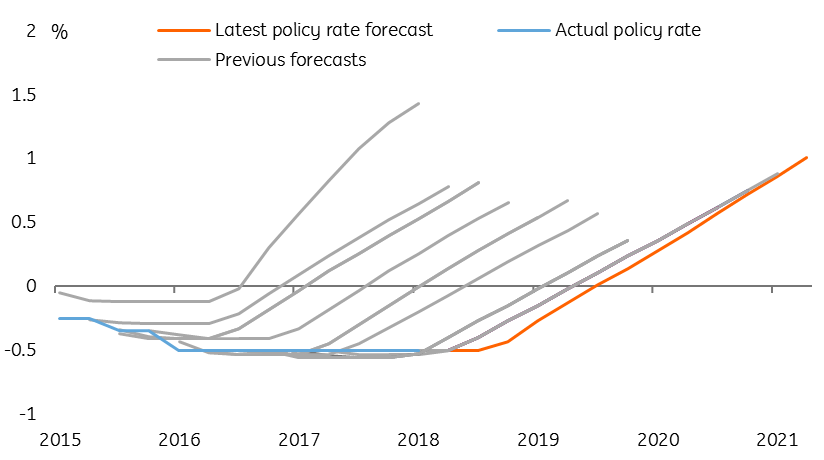

10 Riksbank: Still in stand-by mode

The Riksbank is in a tricky spot. It looks to us as the committee would like to start raising rates while the economy is still growing strongly. But given how adamant Governor Stefan Ingves and the dovish majority on the Riksbank's policy committee has been about inflation returning sustainably to target before monetary stimulus is withdrawn, the continued weak core inflation figures over the summer suggest that further delays lie ahead.

We don't see a rate hike until well into 2019, as core inflation is set to remain subdued and the Riksbank doves will prefer to be safe than sorry

At the Riksbank's policy meeting this Thursday (6 September) the policy rate and asset purchase programme will remain unchanged. But the new policy statement and interest rate forecast will be important signals for the path of policy later this year. We think the most likely outcome is that the committee shifts its forecast of interest rates to indicate a slightly later rate hike. While we think the committee will seek to keep the option open to hike in December, ultimately we don't see a rate hike until well into 2019, as core inflation is set to remain subdued and the Riksbank doves will prefer to be safe rather than sorry.

The ever-receding rate hike

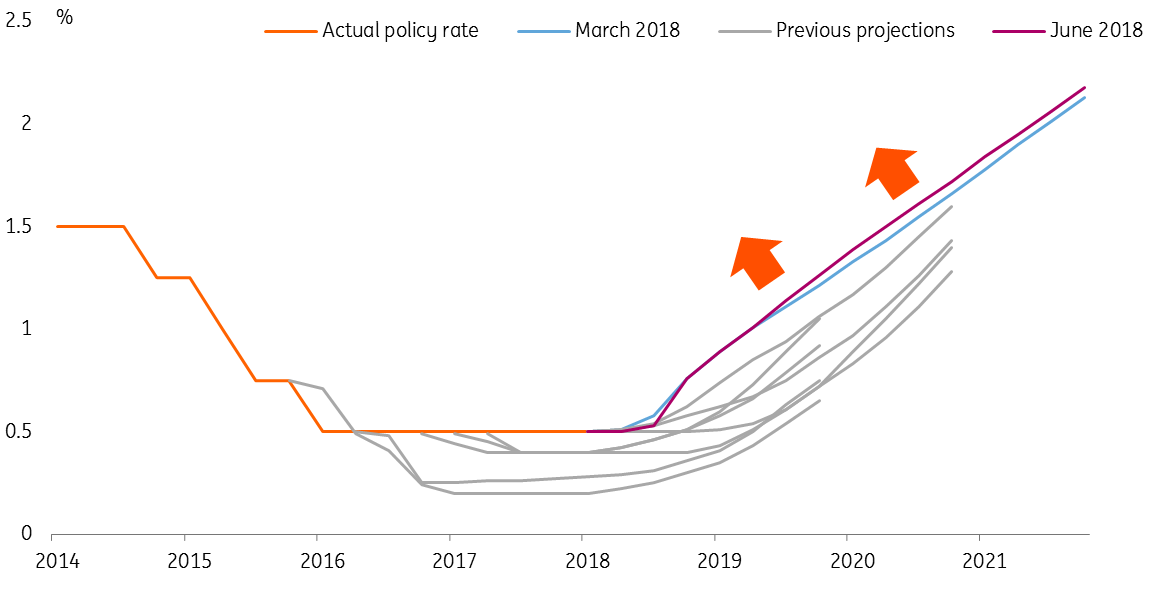

10 Norges Bank: Ready to hike

In contrast to their Scandinavian neighbours, the Norges Bank has a fairly straightforward situation (though clear and consistent communication also helps). The Norwegian economy is recovering well from the 2014-16 oil price shock: employment is growing solidly, inflation is picking up, and house prices are heading up again after a wobble last autumn. Oil prices have risen this year and remain comfortably in the $70-80 range, boosting investment in the all-important oil sector.

A second hike in December by Norges Bank is starting to look like a possibility

In June, the NB signalled it would raise interest rates in September, and little has changed since then to shift this decision. If anything, the weakness of the Norwegian krone over the past few weeks - the trade-weighted krone index is now nearly 3% weaker than in the NB's June forecast means the central bank is likely to shift its interest rate forecast forward again. A second hike in December is starting to look like a possibility, though we think the NB's guidance that rates will rise gradually means two hikes this year remains unlikely.

Gradually turning more hawkish

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article