ING’s Transport and Logistics sector outlook

The global transport and logistics sector has been heavily impacted by the pandemic. At the same time, underlying sub-sector development shows historic differences. 2021 will bring a significant bounce for road transport, shipping and logistics services (goods). Recovery in aviation and public transport will only start in 2021 and will take years

An uneven recovery following an extraordinary downturn

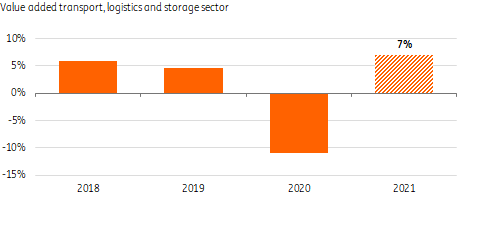

The global transport and logistics sector, ranging from land transport to shipping, aviation, and logistics services, has suffered significantly due to the pandemic and government restrictions. Global volume (value-added) dropped over 10% in 2020, reflecting a larger downturn than during the global financial crisis (-5%).

Due to social distancing measures, passenger traffic is much more affected than goods transportation this time around. Aviation and public transport are expected to start recovering in 2021; road transport, logistics and shipping benefit from the relatively strong bounce back in goods' consumption and world trade.

Although the new year started in the midst of ongoing uncertainty around re-openings, continued recovery on the goods side, as well as the prospect of vaccines and easing travel restrictions in the second half of the year, can in our view, lead to an expected rebound of 7% in 2021.

Nevertheless, we can't expect a global-scale full recovery before the end of 2022.

Global transport and logistics sector expected to rebound in 2021

Europe lags in 2021 after a larger downturn

The transport & logistics sector is a widely operating service provider for clients and shippers in manufacturing, construction, wholesale and retail.

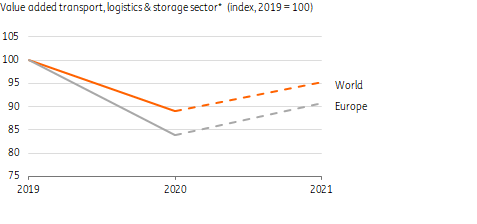

As global GDP estimates show, Europe has been more heavily impacted by the pandemic than the global average (including China, which even enjoyed slight growth). This resonates in a larger downturn in the European transport & logistics sectors as well, which for example came across in relatively weak seaport figures and deterioration in European airline traffic.

Global transport and logistics volume less impacted than European volume

Passenger transport suffering more than goods transport

Normally global demand for transport & logistics services is in line with the development of the global economy showing an almost similar and highly correlated global development in terms of growth. Typically goods transportation (some 70% of total volume) suffers the most in a severe recession but given the nature of the pandemic driven downturn, this time it's different.

The need for social distancing has had a devastating impact on passenger transportation (aviation, public transport) and pushed sector results south.

Recovery in aviation and public transport will take several years

In the first quarter of 2021, international travel restrictions and working-from-home delayed the start of a recovery in most of the world. Consequently, we expect public transport (land transportation) and aviation to only start the long road to recovery in 2021. Full recovery is expected to take several years.

Although supply factors are responsible for most of the volume loss in passenger transport, demand is affected too. As commuter behaviour is expected to show structural changes and business travel will lag, volumes in public transport and passenger aviation are expected to remain well below 2019 levels even after economies fully re-open.

Read our section on aviation here

Public transport still significantly below normal levels

Goods show the way to recovery as upward trend in world trade remains

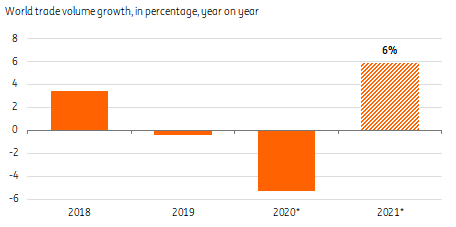

World trade is the most relevant indicator of international goods logistics. As most international trade is transported by sea, shipping volume is particularly highly correlated with world trade. After a forecasted drop of just over 5% in 2020, we expect world trade to show an annualised growth of 6% in our base case for 2021 (assuming a gradually re-opening of economies in the second quarter).

World trade volumes have been relatively resilient, benefiting from recoveries in retail sales and industrial production, while other sectors (especially services) remain much harder hit by lockdowns and uncertainty. A similar pattern is likely to repeat itself for the second wave of lockdowns, although this is expected to cause a smaller hit to economic activity overall, with the most imports-intensive parts of the economy seeing fewer restrictions.

Read our section on shipping here

Trade tariffs and higher freight costs weigh on trade recovery

A full return to the pre-pandemic trend depends on the pace of the global recovery, and that's expected to be uneven around the globe. On the one hand, trade relations between countries are expected to be positive and focused on reforming the system, but higher trade war tariffs remain in place. And hidden trade costs, such as the effects of state subsidies to support industries during the pandemic and sharply higher freight costs, may also weigh on the recovery.

World trade volumes expected to fully recover in 2021

Pandemic to boosts e-logistics and create buffer stocks in 2021 and beyond

We see a couple of structural implications of the Covid-19 crisis for transport and logistics:

- Improved digital skills and experiences and a tendency to hybrid working will temper the return of passenger commuting and business travel.

- More e-commerce and e-logistics after the Covid-19 related acceleration are here to stay, although growth will continue at a slower pace. Parcel companies, such as DHL and UPS, profit from that and this also lead to the ongoing demand for logistics real estate (like Walmart starting e-commerce warehouses).

- Supply chain resilience is under review, leading to multiple sourcing (leading to more diverse supply chains, as shipper DSV noticed) and higher buffer stocks. Simultaneously, the comparative advantages of trade, resulting in lower prices still hold, keep supporting international trade.

- A trend gaining traction is container liners such as CMA CGM and Maersk seeking integration and diversification to take more control of supply chains as online-sales soar and retailers such as Amazon and Alibaba gain influence in logistics.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 March 2021

Come fly with me This bundle contains 8 Articles