Inflation’s second wave: Are we really watching a 70s rerun?

Another wave of global inflation is far from inevitable. But there are good reasons to think inflation will be structurally higher and more volatile over the next decade than the last

Are we heading for a 1970s re-run?

Inflation has only been falling for a matter of months across major economies, but the debate surrounding a possible “second wave” is well underway. Social media is littered with charts like the ones below, overlaying the recent inflation wave against the experience of the 1970s.

These charts are largely nonsense; the past is not a perfect gauge for the future, especially given the second 1970s wave can be traced back to another huge oil crisis. But central bankers have made no secret that nightmares of that period are shaping today's policy decisions. Policymakers are telling us they plan to keep rates at these elevated levels for quite some time.

Inflation: The 1970s versus today

Rewind 50 years and not only did inflation fail to return to prior lows in either the US or the UK after the initial 1974 spike, but both countries saw at least one additional spike over subsequent years. Germany fared better, but wages did respond to the second oil crisis, helping to push inflation up again.

The lesson was that for a second wave to really take off, you need a catalyst and an economic environment ripe for inflation to take hold.

The twin oil price shocks in the 1970s fell on a US economy that was already running hot, a byproduct of persistent US trade and fiscal deficits that grew through the 1960s, aided by the often loose monetary policy of then-Federal Reserve Chair Arthur Burns. That excess demand helped end the Bretton Woods system of fixed currencies and the US dollar lost a quarter of its value between 1970 and mid-1973 as the agreement collapsed, amplifying the hit from higher energy costs. And all of this fell upon an economy that was much more manufacturing-centric than it is today, and it was also heavily unionised. Wage growth typically kept pace with inflation.

Back to today, the economy looks very different. But we think there are valuable lessons, and these are our main conclusions:

- A second wave isn’t inevitable, but we think there are good reasons to expect inflation to be both structurally higher and more volatile over the next decade. The same is true for central bank rates.

- The US is less vulnerable to energy shocks than in the 1970s, but further gas price spikes are possible, and that could prompt renewed waves of eurozone inflation. With prices still well above 2021 levels, a shock would likely be smaller. However, a second energy price shock could lead to more pronounced feedback between eurozone wages and inflation.

- Shortages of metals, be it due to lack of investment or geopolitics, are a growing inflation risk, especially amid the green transition. This probably wouldn’t generate a 2022-style inflation shock by itself, but it is likely to be a source of constant price pressure in future years. Extreme weather is also likely to make food prices more volatile.

- Unionisation is less widespread than in the 1970s, but there are signs that worker power is increasing amid structural worker shortages. The ability of workers to protect real wages in future inflation shocks is set to grow.

- Tighter fiscal and monetary policy should act as a brake on inflation over the short-to-medium-term. Interest rates aren’t likely to return to pre-Covid lows in the foreseeable future, and quantitative easing is unlikely to be used as an economic bazooka. But Covid and the Ukraine war have lowered the bar to big government tax/spending intervention in future crises.

Like the 1970s, inflation is becoming more volatile

Energy prices

Energy must be the starting point when thinking about a second wave. Our base case sees oil edging higher this year, and the risk is that we continue to see a lack of investment in upstream production while demand continues to move higher. That would point to an increasingly tight oil balance in the years ahead. Stricter legislation on new US oil/gas drilling, though unlikely, would be a key source of upside risk given America has been a major driver of supply growth over the last decade. That aside though, the US is largely energy-independent and that makes it far less exposed to 1970s-style shocks.

Europe is more vulnerable, though the situation is evolving. National gas reserves are currently well filled and the eurozone looks better prepared to enter the winter heating season. Russian gas exports to Europe are marginal now, so any further supply cuts would be unlikely to take us back to 2022 highs.

We’d also argue that natural gas demand has peaked and suspect it will be gradually lower over the next decade. RePowerEU, the bloc’s flagship energy strategy, puts emphasis on moving aggressively towards renewables. At the same time, last winter’s price spike appears to have resulted in a permanent demand loss in energy-intensive industries.

Still, in the short to medium term, the continent is more reliant on liquefied natural gas (LNG). The combination of strike action at Australian producers and a colder-than-usual European winter could prompt a significant price response. So, too, would any disruption to Norwegian natural gas supply.

For inflation though, remember that in Europe electricity/gas prices are still more than 50% higher than they were in 2021 in Germany, and roughly double in the UK, according to CPI data. Even if we got another 2022-style shock to wholesale prices, arithmetically, the scope for a similar shock to inflation at this point is more limited.

Metals and global supply chain vulnerabilities

Metals are another obvious vulnerability in the global economy, particularly those linked to the green transition. Scarcity due to a lack of production capacity and/or geopolitics are important risks.

The challenges in scaling up the production of electric vehicle batteries are a good example, as we highlighted in a recent report. Nickel-based batteries, currently favoured for their superior driving range, not only face constraints from long lead times on new mining development, but 20% of high-grade nickel, the type used in batteries, is sourced from Russia, and trade restrictions are also a key risk for supply. Supply chains of alternative battery technologies – lithium iron phosphate (LFP) and sodium iron (Na-ion) – are almost entirely reliant on China. Geopolitics is clearly a risk here too.

That battery story can be expanded to other metals associated with the green transition. While lithium and nickel are the most exposed to critical supply risks, according to analysis by the US Department for Energy (chart below), plenty of others are seen as near-critical. Those include aluminium, where more than 80% of inventory on the London Metals Exchange is Russian material. Meanwhile copper prices – currently dampened by China’s weak recovery – are more likely to rise in the longer term, in part owing to a lack of investment in mining facilities in South America.

Nickel and lithium are most exposed to critical supply risks

Against this backdrop, near-shoring (or “friend-shoring”) will undoubtedly rise – though it’s early days and evidence of companies exiting the likes of China in favour of alternatives is mixed. Green industrial policy, like the US Inflation Reduction Act, is also beginning to reshape supply chains at the margin. Near-shoring is likely to be a slow-moving ship, but ultimately, if firms are trading lower costs for greater resilience, that’s likely to be inflationary. A recent ECB working paper concludes that re-shoring increases the price level for both producers and consumers, particularly in trade-intensive manufacturing.

Is any of this capable of pushing inflation to the sorts of levels seen in 2022? Perhaps not. However, the glut of new vehicles and the resulting demand for used cars alone succeeded in adding more than a percentage point to US CPI in 2021. That showed that disruption for key products is capable of generating sizable upward inflation moves.

Food prices

Food inflation has started to ease sharply across the developed world, but this is another potential source of risk over the coming decade. Last year showed the cross-dependency of food prices on energy costs, and the ongoing risks associated with the Ukraine war and grain exports. But climate change is also creating increasingly volatile harvests, and the risk is that this results in more protectionism as producing nations seek to protect domestic supply. India’s recent bans on rice exports, and occasional threats of palm oil bans from Indonesia, highlight the risks here. This is a bigger threat to emerging markets, where food can exceed 50% of inflation baskets.

Fiscal support

Huge government deficits in the 1970s may not have caused the initial inflation spike, but they undoubtedly amplified it. So, too, did the massive interventions at the start of the Covid pandemic and the “excess savings” pile they helped create.

There’s a growing recognition that the rules need to be more flexible

That story is now clearly changing. The US fiscal position is tightening and in the short term, a resumption of student loan repayments is symptomatic of Congress’ reluctance to allow further big spending packages. In the EU, the Stability and Growth Pact – the rules that mandate fiscal responsibility by European governments – is coming back to the fore. As we wrote a few months back, there’s a growing recognition that the rules need to be more flexible, especially when it comes to public investment. However, political uncertainty in the Netherlands and Spain could undermine an agreement on the new rules. In this scenario, and in the absence of yet another activation of the escape clause, eurozone fiscal policies would become more restrictive.

That said, after a decade of austerity and ultra-low interest rates, particularly in Europe, the lesson from both the pandemic and the Ukraine War is that fiscal policy can be a powerful lever. Met with a fresh, unexpected shock, we suspect the bar to another large fiscal intervention is lower than it might have been in the 2010s.

Worker power and unionisation

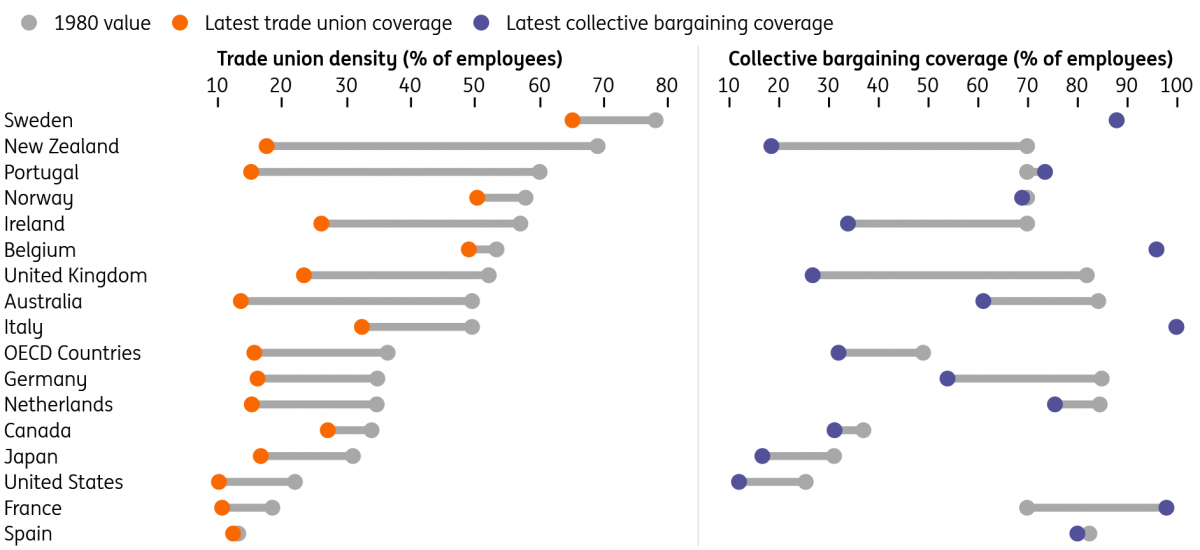

Trade unions were a powerful force in the 1970s, a sharp contrast to what we see today. The share of employees who are members of trade unions has decreased markedly, a trend that’s gone hand-in-hand with the decline of manufacturing across the West.

Trade union density and collective bargaining coverage

But we need to make a distinction between trade union membership (which is generally low in Europe, at least according to official data) and collective bargaining coverage. The latter is the proportion of employees whose wages are centrally negotiated, and in Europe, that’s often in excess of 90% and has typically changed much less since the 1980s. Negotiated wage growth is the highest in 30 years, albeit it has tracked well below headline inflation, and this looks more like a "catch-up" than any kind of wage-price spiral.

Even in countries where collective bargaining is unusual (the US and UK), there are hints that worker power is growing. On a one-year rolling basis, the number of strike days is at its highest level since at least the early 2000s in the UK and US. That doesn’t mean union membership is increasing per se, not least because the power of trade unions under law in the likes of the US and UK has reduced over time. But it does suggest workers feel they can push for inflation-busting pay rises.

Strike days in the US/UK are at multi-year highs

In short, regardless of whether unionisation increases over the coming years, the pandemic has shown that wage growth can still rise quickly if there are widespread worker shortages. This is changing, and most countries have seen participation rates return to pre-Covid levels. And even where they haven’t (as in the UK), there are signs that worker supply is improving. We think economic slack will increase as rate hikes increasingly begin to bite.

Still, the pandemic also gave us a flavour of how the ageing populations we see in many developed economies could actually be inflationary in the medium term. In the US in particular, we saw millions of people retire in a very short amount of time. And that undoubtedly contributed to worker shortages which fed through to higher wage growth. Many economies were already starting to see this in certain industries (e.g. long-distance lorry driving) before Covid-19, and worker shortages are likely to become a persistent issue over the coming years.

The ability of workers to protect real wages in future inflation shocks may well increase. That said, it’s possible that some of the labour scarcity associated with ageing will be countered by technological advances, not least Artificial Intelligence.

Central banks

The situation with central banks looks decidedly different to the 1970s, for two key reasons. First, while the response to the initial Covid wave was huge – and in hindsight probably too aggressive – policymakers have not shied away from applying the brakes ever since. No central banker wants to be remembered as the modern-day Arthur Burns, and there’s a clear incentive to err on the side of keeping rates too high for too long. While we expect rate cuts in 2024, it’s highly unlikely that rates will return to the ultra-low levels seen before the Covid pandemic. Meanwhile, central bank balance sheets are increasingly likely to be used for targeted financial stability interventions rather than to deliver large monetary stimulus.

Central banks will be reluctant to return to the days of ultra-low rates

The other major difference is that central banks are now independent, whereas with the exception of the German Bundesbank, that largely wasn’t the case in the 1970s. This independence, as well as monetary tightening in the 1980s, laid the basis for lower inflation expectations. Since the 1980s, central bank credibility has become an important asset in the fight against inflation. Therefore, central banks will be less inclined to ease monetary policy when inflation expectations are still high.

Will that change? It’s unlikely, and independence has so far survived the era of populism relatively unscathed, at least among G10 economies. High interest rates are likely to be a key topic going into elections in the US and UK, among others, in 2024. But ultimately, central banks will be reluctant to return to the days of ultra-low rates.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 August 2023

ING Monthly: Summertime sadness This bundle contains 13 Articles