United States

Inflation in 18 charts

Inflation concerns are increasing on both sides of the Atlantic. The big question is whether this is temporary or longer lasting. Below we use 18 key charts to discuss how transitory inflation really is in the eurozone and the US

There are multiple stories influencing the inflation rate at the moment…

Source: ING Research

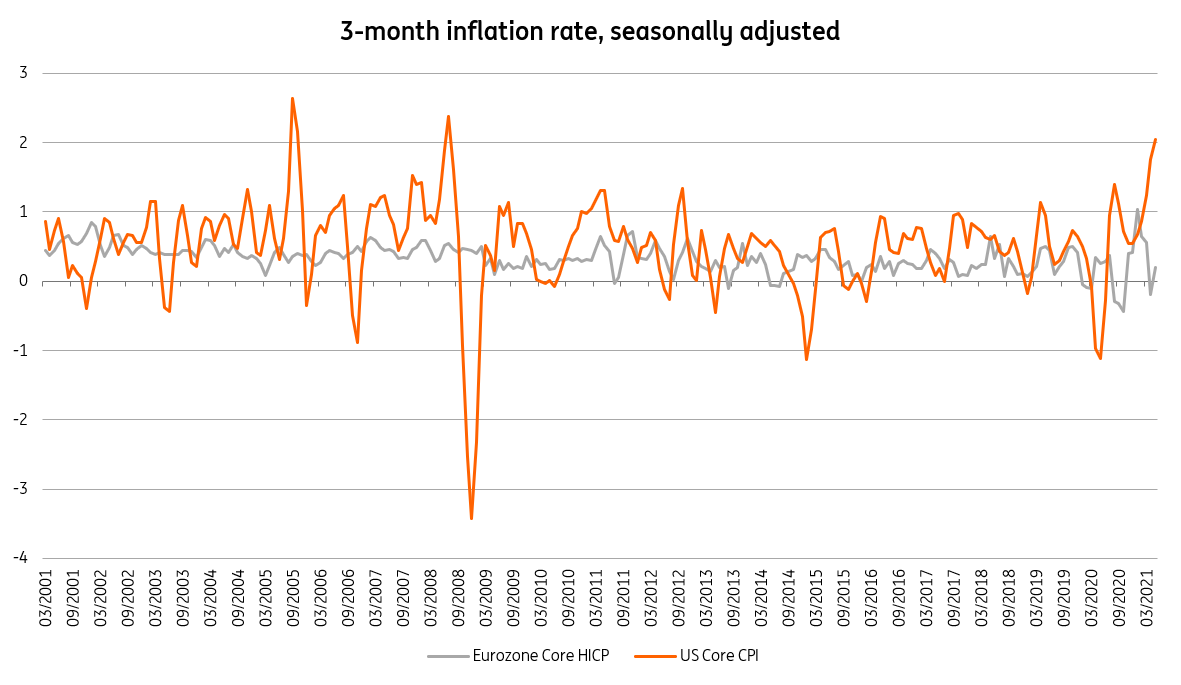

The US sees much more “current” inflation, with base effects more important in the eurozone

Source: ING Research

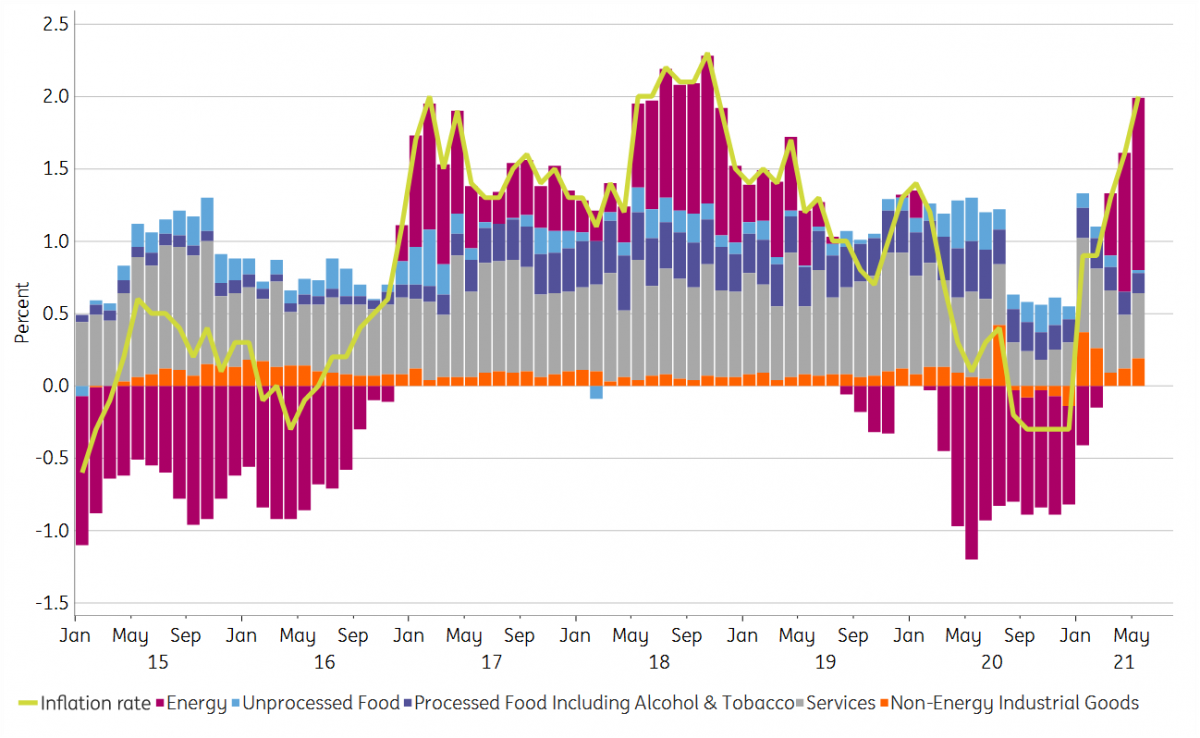

Eurozone inflation is at 2%, but mainly on energy effects for now…

Source: ING Research

Energy price impact on inflation is set to fall

Source: ING Research

But supply chain problems are leading to large build-up of pipeline inflation

Source: ING Research

In the US, supplier delivery times have also run up to record highs

Source: ING Research

US supply has a very hard time meeting demand at the moment, resulting in higher price expectations

Source: ING Research

Price expectations for goods have reached all-time highs on both sides of the pond

Source: ING Research

But for inflation to be longer lasting, wage growth seems key

Eurozone slack has been coming down though

Source: ING Research

And furlough schemes still hide slack in labour market figures

Source: ING Research

And vacancy rates have yet to return to pre-crisis levels except for education and health

Source: ING Research

Wage pressures have fallen over the course of the pandemic

Source: ING Research

In the US, labour market slack is deceiving…

Source: ING Research

The number of people out of the labour force that want a job has seen a much smaller increase than total labour market dropouts

Source: ING Research

Job openings have shot up in 2021, with hiring having a hard time keeping up

Source: ING Research

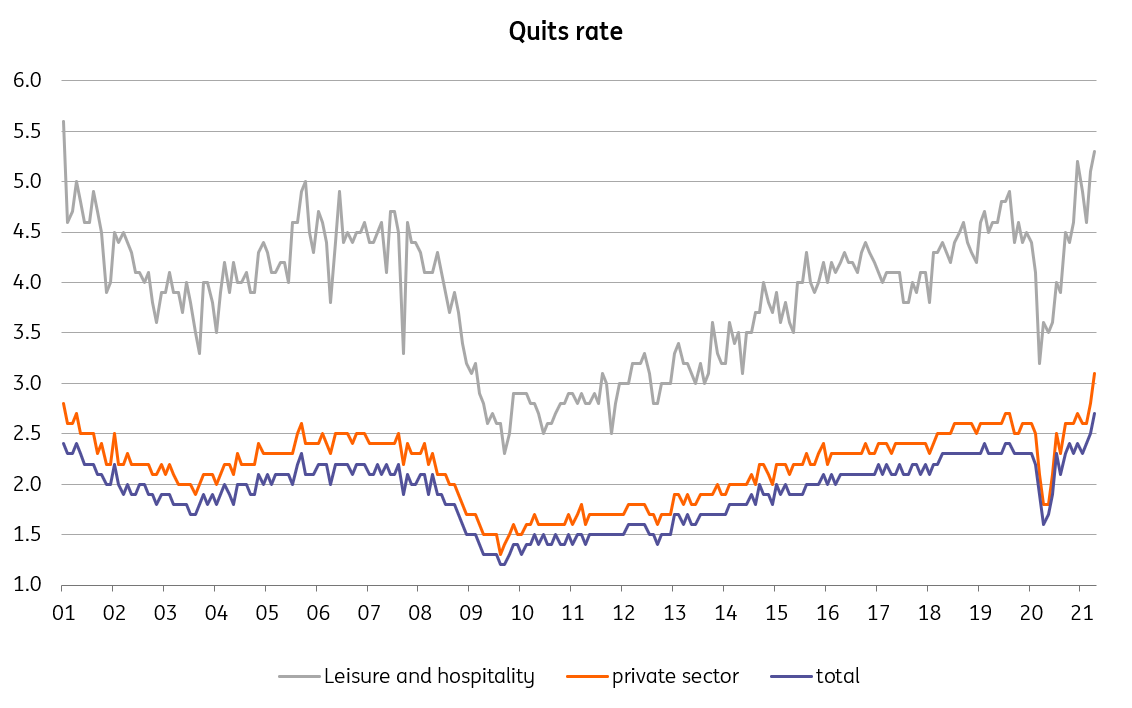

How temporary is the tightness in the US labour market? Rising quit rates are a sign of increased wage pressures

Source: ING Research

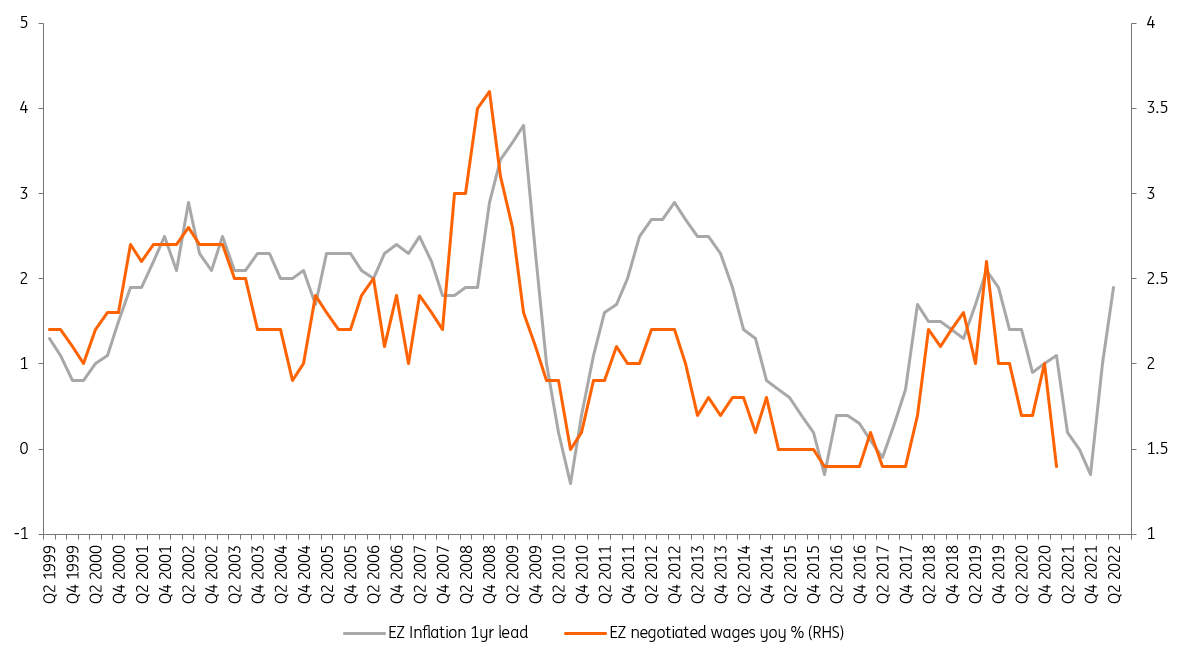

Eurozone wage growth is influenced by past inflation, increasing chances of a wage-price spiral on the back of a price shock

Source: ING Research

Modest fiscal support lowers chances of overheating substantially in the eurozone

Source: ING Research

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download articleThis article is part of the following bundle

22 June 2021

Inflation - really nothing to worry about? This bundle contains 2 Articles