Inflation and energy prices force six in ten Belgians to cut daily expenses

A new ING survey on a representative panel shows that nine in ten Belgians are reducing their energy consumption and six in ten are even saving on daily expenses. Over the next six months, they plan to step up their efforts. Online spending is also under pressure, even more so than in other countries. This will adversely impact economic activity

High inflation prompts six in ten Belgians to save on daily expenses

Belgians are looking for savings to cope with the rising cost of living. An international ING survey, conducted in early November in Belgium, the Netherlands, Germany, Romania, Poland, Turkey and Spain, shows that almost six in ten Belgians are saving on fresh food and groceries (see chart 1). A slight majority of Belgians also cut their clothing expenses. The Belgian urge to save is also slightly higher than in Germany for most product categories. While in Belgium, 58% already save on daily expenses, in Germany this is 'only' 50%. Remarkably, about half of Belgians also cut back on their spending on catering, travel and leisure activities, sectors that benefited greatly from the end of the pandemic.

Compared to the results of the same survey in March 2022, the number of households cutting back on their consumption has risen sharply. In addition, many households plan to reduce their spending further in the coming months. While this was only 44% in March, 57% of Belgians say they are already saving on daily expenses and 60% expect to do so in the next six months.

More and more Belgians are cutting back on their spending

Due to rising prices, I try to save on... (% of respondents)

Four in ten Belgians see energy bill more than doubling in last six months

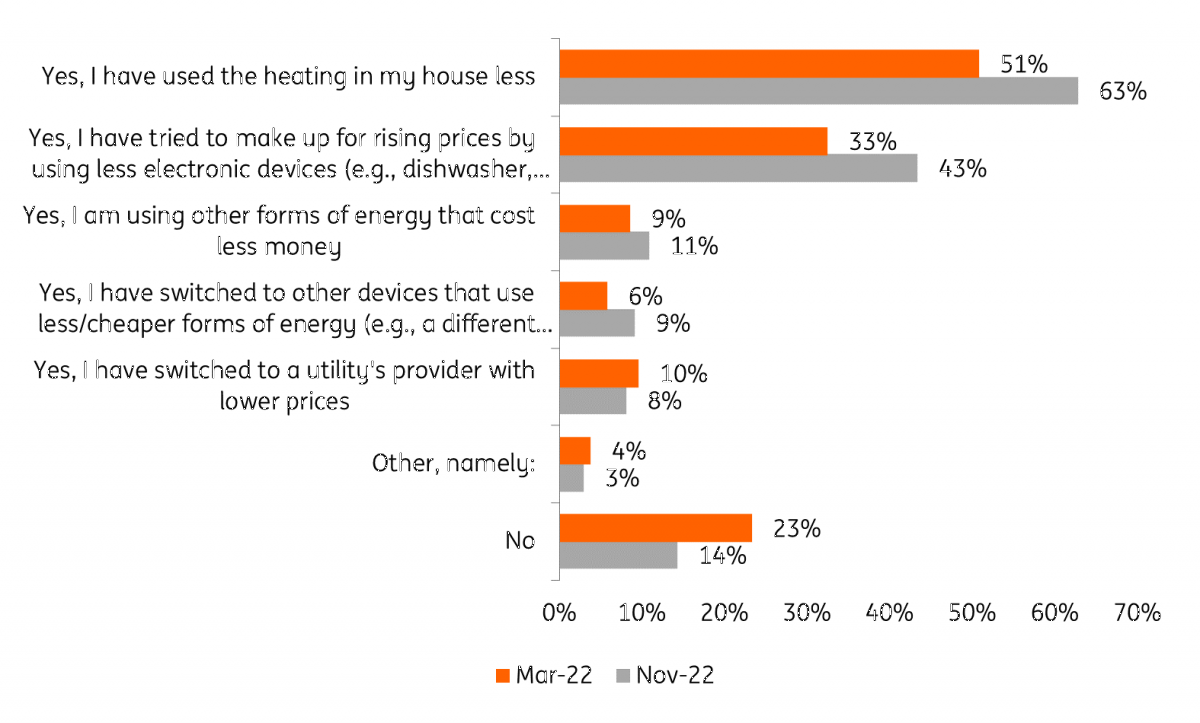

The extreme caution of households is obviously due to the energy crisis. According to the survey, the energy bill has more than doubled for four out of ten Belgians over the last six months. For almost one in ten, it has increased more than fivefold. In this context, the number of households taking measures to save energy and try to reduce the impact of the price increase has risen sharply, from 77% in March to 86% today. More than six out of ten Belgians say they are cutting back on heating, while four out of ten respondents say they are more economical with the use of electrical appliances, such as dishwashers (see chart 2).

Six in ten Belgians turn down heating

In what ways do you try to reduce your energy bills? (% of respondents)

Decline in online purchases for all spending categories

During the pandemic, Belgians appeared to be very active online shoppers, but the unusually sharp increase during the pandemic seems to be normalising somewhat. Almost a quarter (23%) of respondents say they have been buying online less often since the end of the pandemic, compared to only 15% who say they are buying online more often. When asked whether they expect to spend more online during the holidays than last year, one in four Belgians (25%) said they would spend less.

The survey results show that the decline is mainly due to a general deterioration in the economic climate and not to consumers buying more in physical shops since the relaxation of health restrictions. Indeed, the percentage of respondents saying they spend relatively more in physical shops than online (21%) is balanced by the percentage saying they buy relatively more online than in physical shops (23%).

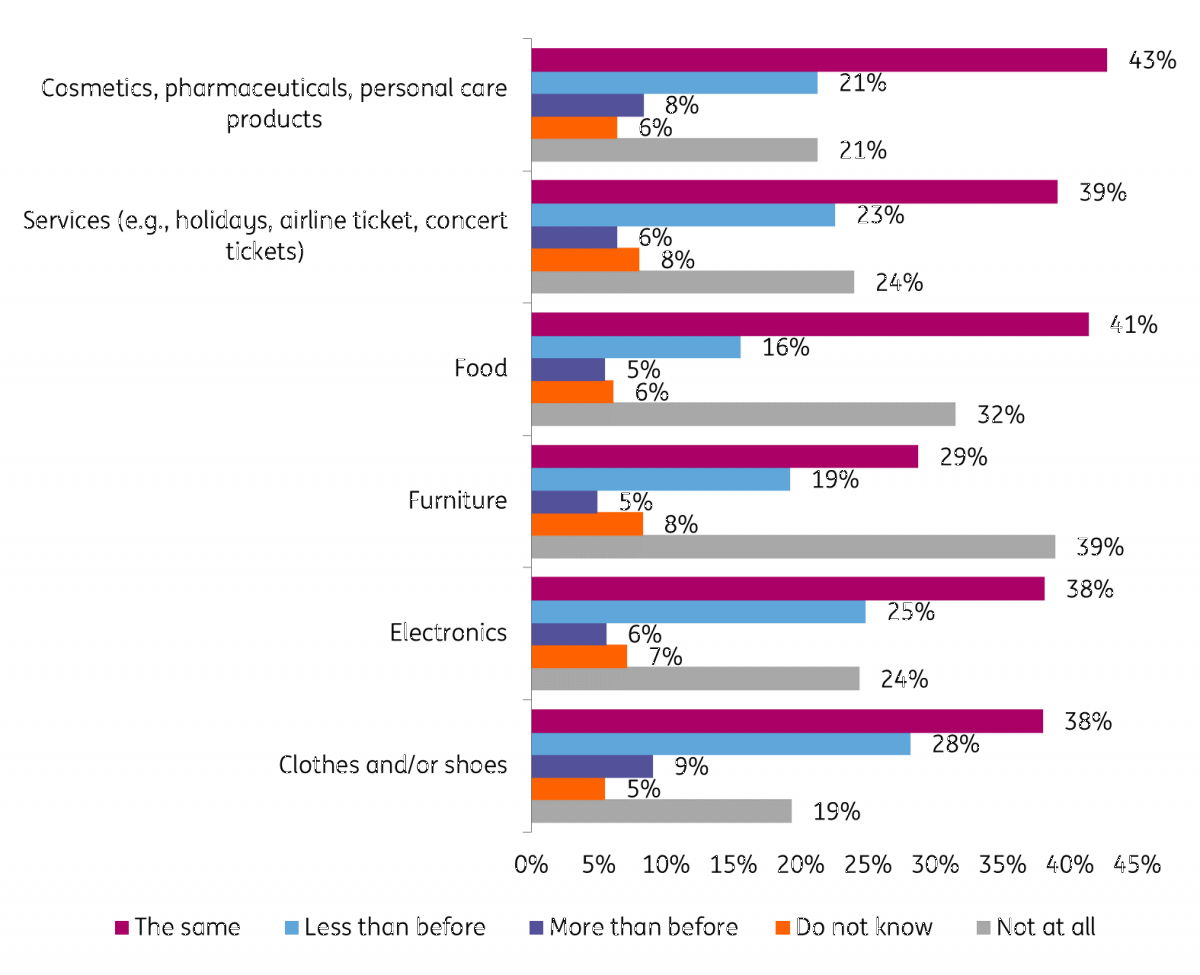

Moreover, a significant proportion of the households also say they plan to further reduce their online purchases in the coming year. For instance, only 9% of respondents plan to buy more clothes online in the coming year, while 28% plan to buy less (see chart 3). Although the decline seems stronger for electronics and clothing, the trend is clearly felt across all product categories. It is therefore likely that the decline in online spending will be widespread in the coming months. No sector seems to be able to escape the economic downturn.

Lots of families plan to further cut online budgets next year

Do you plan to purchase more online in the coming months (% of respondents)?

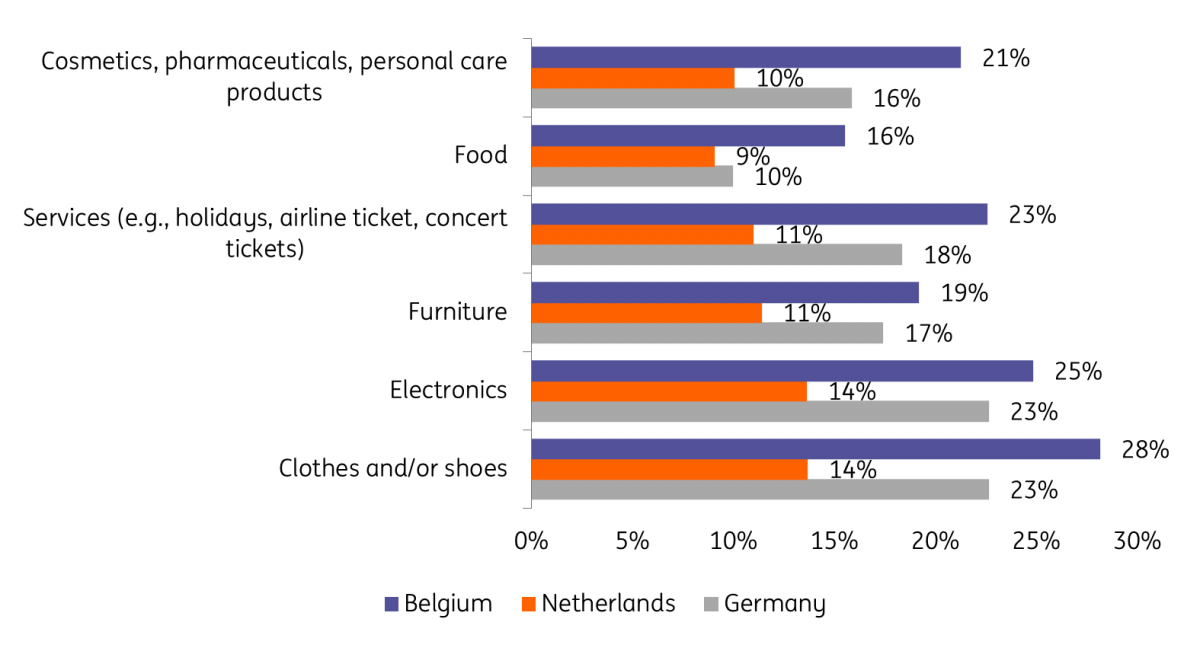

Belgians are much more cautious than their neighbours when it comes to budgeting

The share of households planning to reduce their online spending is significantly higher in Belgium than in the Netherlands and Germany, and this is true for almost all product categories (see chart 4). While, for example, 28% of Belgian respondents said they would like to buy fewer clothes and shoes online, this is only 14% in the Netherlands and 23% in Germany. Although Belgians' purchasing power is much better protected compared to other eurozone countries thanks to the automatic indexation of wages, the crisis seems to have a greater impact on consumption patterns in Belgium than in other countries. Belgians seem much more cautious and willing to economise more to get through this difficult period.

More Belgians cut online budget than neighbouring countries

Do you plan to buy less online in the coming months (% of respondents)?

Belgian economy dives into the red

Belgians are massively looking to save money to cope with the rising cost of living. This will have an impact on economic growth in Belgium. The Belgian economy has already contracted slightly (-0.1%) in the third quarter, and this is expected to continue in the coming quarters. We expect economic growth to be negative in 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article