Industrial Metals Monthly: China rally cools as markets reassess stimulus bets

Our monthly report looks at the performance of iron ore, copper, aluminium, and other industrial metals. In this month’s edition, we take a closer look at China’s recent efforts to revive its economic growth and discuss whether it is enough to lift metals demand

YTD metals performance %

China stimulus sparks metals rally

Late last month, Beijing released a slew of stimulus measures, its largest stimulus package since the Covid-19 pandemic, including interest-rate cuts and targeted support for the property sector, which sparked a rally across industrial metals. Iron ore was the standout surging to a five-month high, while copper reached $10,000/t after Beijing vowed to reach the country’s annual economic goals. The bullish momentum continued over the past week with the metals industry gathering in London for LME Week while Chinese markets were closed for the Golden Week holiday.

Industrial metals rally on China stimulus boost

But post-holiday China briefing disappoints

The rally has now cooled after China’s mainland markets reopened this week after the week-long holiday and the anticipated briefing by China’s top economic planner, the National Development and Reform Commission, mostly disappointed, failing to deliver new pledges to boost government spending.

China, the world’s biggest consumer of metals, has been a drag on metals demand for over two years. A broad economic slowdown and, in particular, the crisis in the property sector has weighed on copper and other industrial metals. We have seen plenty of property support measures this year but so far they have failed to have a meaningful impact on metals demand.

We think that the recent stimulus measures still lack detail, and we struggle to find an additional demand growth driver for industrial metals in the measures announced so far.

Any sustained pick up in metals prices will depend on the strength and the speed of the rollout of the measures. We will look out for any potential investment into new infrastructure projects and into energy transition sectors.

Our China economist believes that last month’s measures are a step in the right direction, especially as multiple measures have been announced together rather than spacing out individual piecemeal measures to a more limited effect. However, he continues to believe that there is still room for further easing in the months ahead, and if we see a large fiscal policy push as well, momentum could recover heading into the fourth quarter.

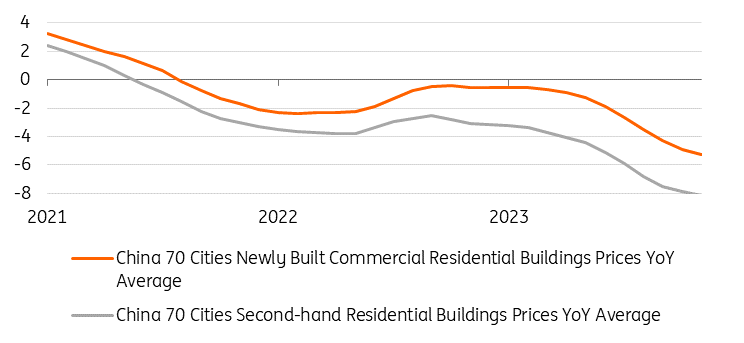

In terms of the property market, which is crucial for metals demand, our China economist believes two things need to happen. First, we need to see prices stabilise if not recover. Second, we need to see excess housing inventories come down towards historical norms. Until then, the drag on growth will continue.

We believe the continued weakness in the sector remains the main downside risk to our outlook for industrial metals. We believe that until the market sees signs of a sustainable recovery and economic growth in China, we will struggle to see a long-term move higher for industrial metals.

The question for the markets now is whether this is the long-awaited turning point for the world’s largest consumer of metals and whether we will see more supportive policies being rolled out that could have a significant impact on metals demand. We think it might be too soon to tell and we have not changed our forecasts yet.

China new home prices fell in August at the fastest pace since 2014

Downside risks persist

Although the macro conditions are starting to look brighter, and the Federal Reserve’s long-awaited rate cut has calmed sentiment, uncertainty surrounding the US presidential election is dampening risk appetite.

With geopolitical tensions lingering, a still uncertain recovery path for China's economic recovery, despite the recent stimulus boost, and rising protectionism, we remain cautious in the short-term on the industrial metals outlook.

However, we are more constructive from late 4Q and early 2025. We believe more certainty on US-China policy following the US elections and improving manufacturing sentiment amid central bank easing cycles should provide upside to industrial metals prices in the medium- to long-term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article