Indonesia: Looking to consumption to carry the load

A more challenging global landscape means Indonesia will look to domestic consumption to bolster growth aspirations in 2023

Indonesia’s economy grew by 5.3% in 2022, which was the fastest pace of expansion in almost a decade. Economic growth was underpinned by robust household spending as well as a healthy dose of manufacturing and exports. Domestic consumption was brisk with Covid-19 restrictions fully eased and headline inflation staying relatively well-behaved in the first half of the year. Meanwhile, Indonesia’s export sector benefited from the commodity price rise in 2022 as demand for energy and oil increased due to the fallout from the Ukraine war. Surging exports in turn helped support domestic manufacturing, which boosted growth further.

Economic growth

Indonesia is expected to churn out another solid growth performance in 2023, however challenges to the outlook have surfaced. The Bank of Indonesia (BI) expects growth to settle at the upper end of the forecast range of 4.5-5.3%, banking on private consumption, investments and exports to match last year’s growth. Given our expectation of a sustained moderation in commodity prices, we believe Indonesia will need to rely more heavily on household consumption and investment outlays to do the heavy-lifting as the boost from exports fades.

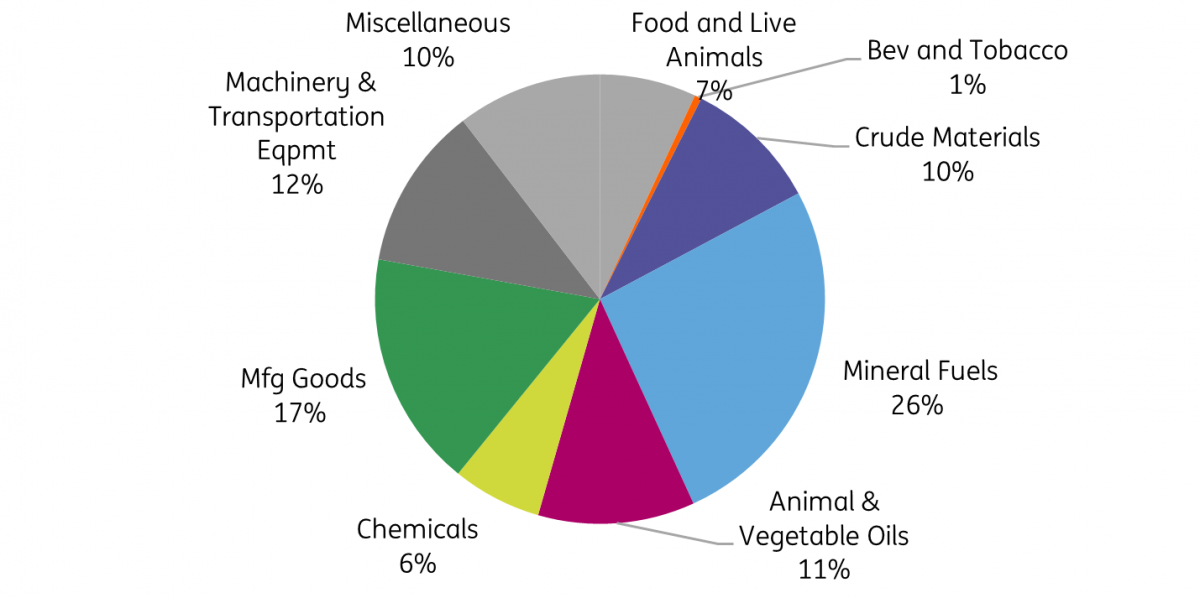

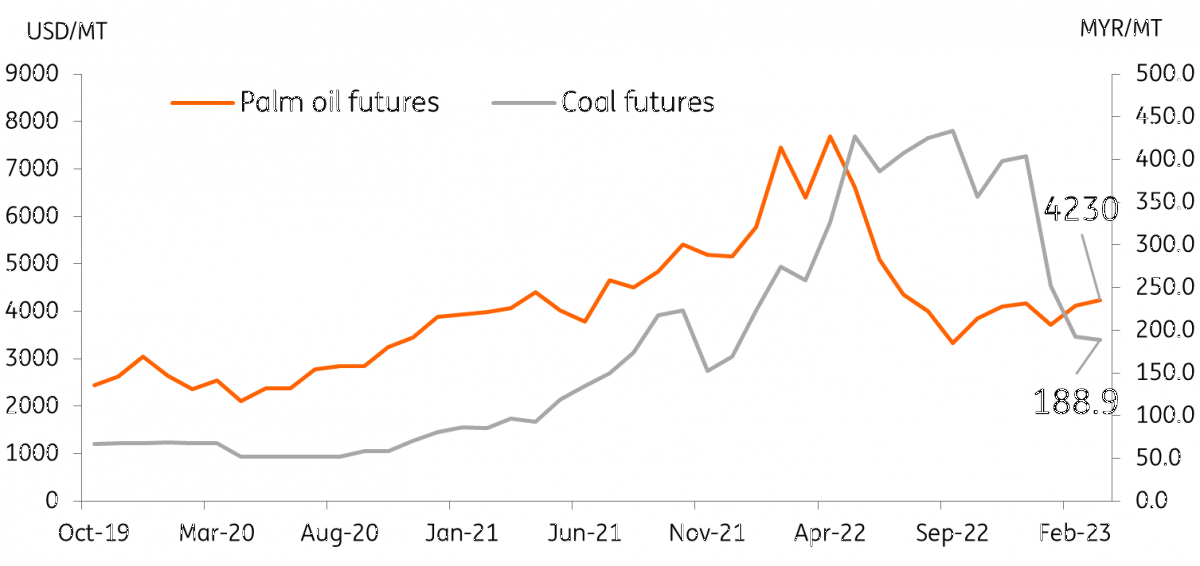

Exports and the external balance: fading commodity boom

The glow from the 2022 commodity boom had faded by the fourth quarter of 2022 and this development will likely impact Indonesia’s external position while also having a negative impact on manufacturing activity. Global prices for coal and palm oil, two of the major exports in Indonesia, have fallen sharply from their 2022 highs which would translate to more modest export growth and trade surpluses. Indonesia’s record trade surplus coincided with sharp price increases for these commodities which also helped deliver the highest current account % of GDP ratio (1.05%) since 2010.

On top of its impact on the external balance, fading export flows may also impact economic growth by way of weaker mining and manufacturing activity. Mining and related industrial activity (oil and gas refinery) accounts for 9.1% of total GDP and softer demand for exports could also weigh on economic activities related to the mining and refining of these export products.

Mineral fuels and oils account for 37% of total exports

Commodity boom not likely in 2023

Consumption here to save the day? Depends on inflation

With the boon from the export sector fading this year, Indonesia will be looking to domestic consumption to deliver the bulk of growth. The outlook for domestic consumption does have some upside after inflation appears to have peaked in late 2022. Headline inflation slowed to 5.5% year-on-year as of February (vs the 6% peak) while core inflation moved closer to target at 3.1%YoY.

Despite inflation coming down from its peak, however, price pressures remain evident with inflation still quite high for major items such as food (7.2%YoY), transport (13.6%) and utilities (3.4%). If headline inflation does eventually slow, this development could be supportive of household spending (53% of economic activity last year) and growth momentum overall.

One economic variable we will be watching carefully to approximate domestic consumption is retail sales. Retail sales, which had been relatively healthy in the first half of 2022, showed signs of slowing when faced with the sharp uptick in prices. If inflation does continue to slide this year, retail sales could potentially recover and provide some lift to overall growth. If inflation fails to slow, however, we could see only modest gains in retail sales with household spending only partially able to compensate for softer export receipts and weaker mining and manufacturing activity.

Inflation moderates somewhat, dips from peak of 6%

Improvement in retail sales dependent on inflation trajectory

BI now in the mood to support growth, but does it have the space?

Faced with accelerating inflation in late 2022, BI had little choice but to join fellow regional central banks in hiking rates aggressively. The central bank rattled off a string of aggressive tightening in the second half of last year, lifting policy rates by a total of 225bps to steady the Indonesian rupiah (IDR) and combat inflationary pressures.

However, after seeing inflation moderate, BI Governor Perry Warjiyo declared victory over inflation and left policy rates untouched at the 16 February meeting. Warjiyo went so far as to indicate that he need not hike rates for the rest of the year suggesting that the current policy rate of 5.75% will be the peak for this tightening cycle. Dovish commentary from Warjiyo clearly shows that BI is now shifting its focus to bolstering growth to help offset the challenging global landscape.

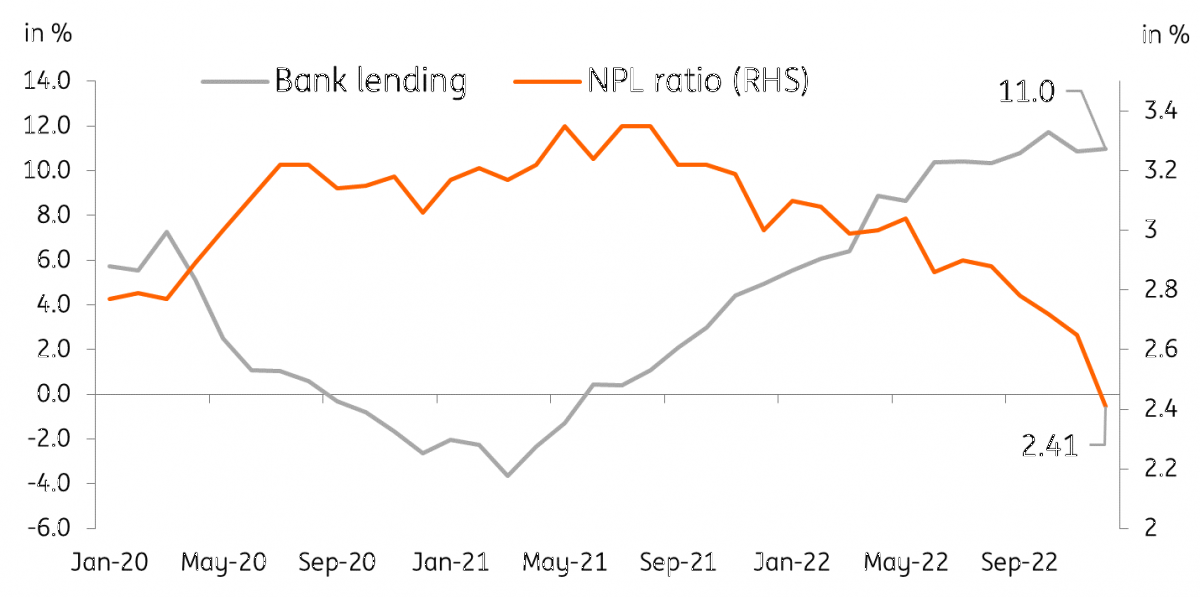

Industry trends show that bank lending growth remained healthy despite the aggressive 225bps worth of tightening from BI and investment outlays could very well be a source of growth this year. Lending activity may have been supported by BI’s “macroprudential policies” such as the 0% downpayment for automotive loans, and looser loan-to-value ratios for property lending among others.

Furthermore, at least so far, growth in bank lending appears to have come without any detrimental impact on quality as the latest non-performing loan ratio slipped to 2.4%, the lowest since the start of the pandemic. Sustained economic expansion and the end of BI’s rate hike cycle bode well for bank lending, but with BI likely prevented from cutting policy rates further, the upside for capital formation may face some constraints.

Loan growth not at the expense of quality. Can it be sustained?

Policy uncertainty as attention shifts to 2024 election

This could prove to be a pivotal year as this will be the last full year of President Jokowi with the presidential election fast approaching in February 2024. Indonesia’s elections will go ahead as planned despite a recent court ruling postponing the polls for two years.

Current polls show no clear-cut favourites with three names surfacing as potential successors to Jokowi. General Subianto (Gerindra party) who lost to Jokowi in 2014, Java Governor Ganjar (PDI-P) and forever Java Governor Anies (independent) are all still very much in the race. Very recently, Anies was nominated by three major parties with the incumbent PDI-P still yet to nominate their candidate. We believe attention will shift to the presidential elections with not much reform or legislation likely to take place between now and February 2024.

Market outlook: IDR pressured, rates on hold and growth likely to slow from last year

Indonesia is set to post another year of decent growth in 2023 although challenges, especially on the external front, suggest that the pace of expansion could slow from last year. The economy will be missing the boost coming from the export sector as global demand fades, impacting both net exports and the mining sector's contribution to overall GDP growth.

Slower export receipts suggest a weaker external balance with the current account possibly slipping back into negative territory. A current account in deficit means that the IDR will face pressure throughout the year and the currency will likely lag any regional rally.

Meanwhile, fresh from declaring victory over inflation, we believe BI will be hard-pressed to cut rates at least in the near term as inflation will likely stay elevated. The projected long pause by BI means that the upside to capital formation and investment outlays could be capped despite some promising growth seen in bank lending.

Overall, the challenging external headwinds mean that Indonesia will be relying on domestic consumption and capital formation to drive growth momentum. And although we expect both household spending and investment activity to improve this year, the challenges posed by stubbornly high inflation and the inability on BI’s end to cut rates further point to an economic expansion that could very well fall short of last year’s growth mark.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).