Indonesia: Inflation to hit growth; solid external position cushions impact

Inflation has started to heat up in Indonesia but a solid external position should limit the impact on growth

GDP grew 5.0% in 1Q 2022 but faster inflation cap growth momentum

Indonesia’s economy grew 5.0% in 1Q 2022, bolstered by solid domestic consumption and a recovery in manufacturing. A surge in exports has also helped to boost overall economic activity with PMI manufacturing tracking export growth. The onset of faster inflation could cap some momentum in the second half of the year however as households postpone purchases of durable goods and stick to basic items.

Recently, Bank Indonesia (BI) Governor Perry Warjiyo, retained his growth forecast for the year at 4.5-5.3% but admitted that GDP could settle closer to the lower end of the range, and we expect full-year GDP to settle at 4.8%.

Indonesia’s economy recovers after Covid stumble

Indonesia’s protectionist export policy a cause for concern?

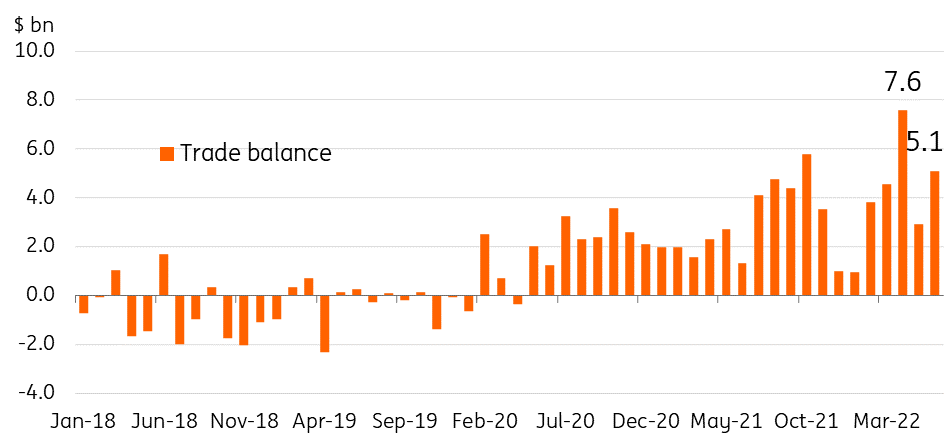

Geopolitical developments in 2022 have pushed commodity prices higher, which has actually benefited countries such as Indonesia given their export portfolio. Indonesia’s top exports include mineral fuel (coal), iron & steel and vegetable oil (palm oil), both of which benefited to some extent from the pickup in global commodity prices. Indonesia’s trade surplus widened to a record $7bn a month in April with exports surging past imports, a development that has supported the rupiah.

Despite the positive fallout, Indonesia resorted to protectionist export policies this year by implementing export bans for coal and palm oil and its derivatives. Coal exports were halted in early January while palm oil exports were banned in April.

Exports for coal and palm oil have since resumed, however, the uncertainty caused by these developments heightens the possibility of bans in the future. The Indonesian authorities justified such moves to ensure domestic price stability however sudden supply stoppages could force global commodity prices higher in the short term.

Indonesia’s coal and palm oil make up roughly 34% of total exports

Hefty trade surplus helps insulate Indonesia at least for now

Domestic inflation edges higher despite recent moves

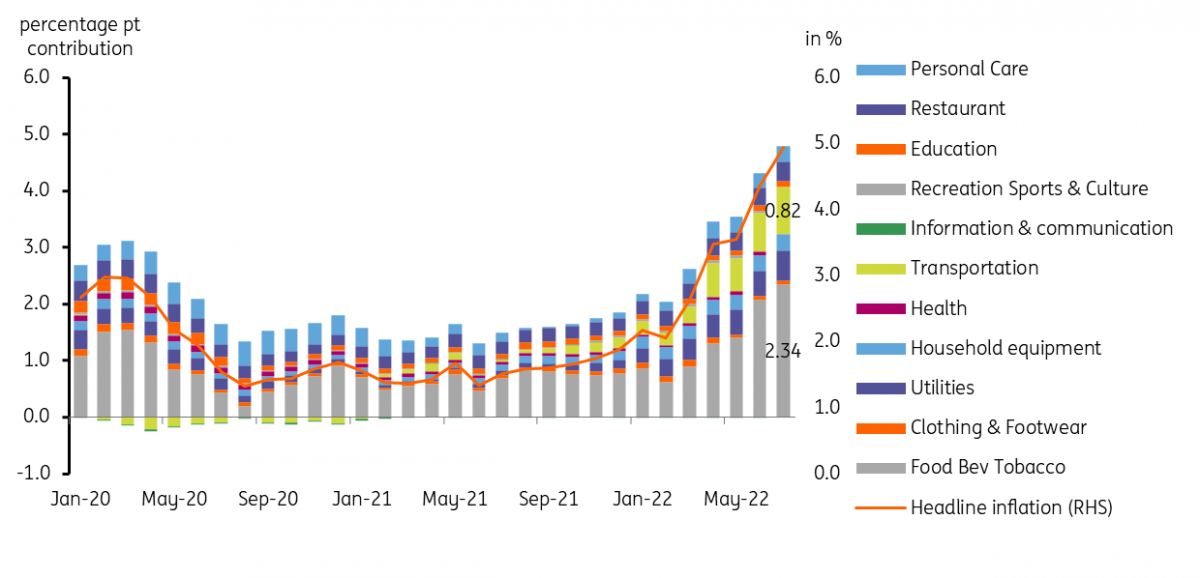

Despite resorting to these policies, headline inflation has moved past the upper threshold of the central bank target as food prices and transport costs have risen. Indonesia is a major importer of wheat, with roughly 11.2 million tonnes of wheat brought into the country and the ongoing conflict in Ukraine has helped drive up prices for bread items and noodles. Meanwhile, the price of Pertamax, Indonesia’s nonsubsidised high-octane gasoline, increased by 39% in 2Q with President Jokowi citing the global price surge for crude oil as the cause.

Food, restaurants, utilities and transport items are the main contributors to headline inflation, accounting for 81% of overall price gains. Also adding to price pressures this year was the implementation of an excise tax on tobacco products which has pushed up tobacco prices by 7.0%.

Recently, President Jokowi announced a deal with Russia to allow wheat imports from Ukraine to resume to curb food inflation, but so far only one shipment of grain has left Ukraine and thus it may take some time before this can impact Indonesia’s food inflation.

Inflation driven by food and transport items

Retail sales stay robust, but recovery remains patchy

Despite the recent buildup in price pressures, retail sales remain robust, posting a 15.4% YoY gain in June. The solid retail sales performance is supported mainly by spending on food, fuel and recreational activity, while retail sales of household appliances, communication and other items remained in the red.

This development suggests that although consumption has stayed quite healthy, households are limiting purchases to mostly basic items (food, beverages and fuel) while postponing purchases of durable equipment, communication and other items. Thus, despite the strong headline number, the recovery in retail sales remains patchy and accelerating inflation could see this trend continue.

Retail sales growth supported by spending on food and fuel

Inflation overtakes BI policy rate, core inflation next?

Despite the prolonged pause in rates, BI Governor Warjiyo has said he is open to rate hikes should core inflation heat up in the coming months. July’s inflation report showed core inflation at 2.9%, pointing to a probable “no-change” decision from BI in August with a first rate hike this cycle likely postponed to end 3Q.

Inflation overtakes BI policy rate, core inflation next?

Solid external position and receding risk bodes well for IDR and bonds

Despite inflation tracking higher due to both supply side (rising global commodity costs) and demand side (improved economic conditions) reasons, Indonesian bond yield moves have been less volatile in 2022 compared to previous episodes of financial market stress. However, after hitting a high of 7.418% on 20 June, the 10Y yield is down to 7.199%, tracking the slide and then the recent jump in US Treasury yields. Back in 2018, Indonesia’s 10Y yield peaked at 8.812% even though inflation was only at 3.4%. Two factors that can help explain this development are the central bank’s bond purchase programme and the relatively low bond holdings by foreign investors.

Firstly, throughout the pandemic, BI has been active in both the primary and secondary markets to help stabilise yields. And although BI has recently been active in selling down some of its holdings, BI’s presence for the most part of the year has helped smooth out volatility in 2022.

Secondly, foreign holdings in Indonesia’s bond market are now much lower compared to pre-Covid levels. Currently, only IDR750tr is held by foreign investors compared to the peak of IDR1,092tr in early 2020. Thus, periods of heightened anxiety see less pronounced swings even if foreign investors exit as the market is dominated by the central bank and local players. These two factors, alongside receding risk sentiment, could help bond yields edge lower and stabilise at around 7% even if BI eventually hikes in the coming months. Though the principal driver of the bond yield direction will remain erratic moves in US Treasuries.

Meanwhile, the IDR is one of the better performing Asia-Pacific currencies in 2022 and the currency’s outperformance will likely extend to at least the end of the year. A big part of the IDR’s resilience can be tied to the country’s solid external position with BI expecting a current account surplus of up to 0.3% of GDP by year-end. On top of this, Indonesia’s relatively manageable inflation situation (currently only at 4.9%) translates to a less severe negative interest rate environment, which has worked to limit capital outflows. These two factors, a solid external position and less negative real rate environment could help the IDR settle at 14600 by year-end.

Less negative real rate (policy rates minus current headline inflation) environment supports IDR

Indonesia poised to post robust growth but inflation could cap the upside

On the growth front, Indonesia is still poised to grow at a healthy and robust clip driven by consistent household spending. The Russia-Ukraine war initially forced commodity prices higher, benefiting Indonesia’s export sector. Accelerating inflation could cap consumption momentum and also result in rate hikes later in 3Q. Despite the threat of faster inflation and a modest rise in borrowing costs, we believe Indonesia’s healthy external position can insulate the economy to deliver a 4.6% YoY expansion for 2022 and 4.5% in 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article