Indonesia’s carbon tax on hold, but investment in electric cars could pay off

The ongoing conflict in Ukraine has delayed Indonesia's planned carbon tax indefinitely

Where it wants to be: Net-zero emissions on or before 2060

Indonesia recently submitted its updated national climate commitment (NCC) to the United Nations (UN), pledging to lower emissions by an unconditional 29% or by 41% conditional on international financial and technical support, against a business-as-usual 2030 scenario. Furthermore, Indonesia submitted to the UN its long-term strategy on low carbon and climate resilience 2050, which commits to seeing emissions peak by 2030 and progression towards net-zero emissions by 2060 or sooner.

What it's been doing to get there

Ambitious shift to renewable energy by 2060

Since its initial National Council for Climate Change submission to the UN in 2015, Indonesia has implemented several programmes to help lower emissions over the past few years. The National Electricity Master Plan of 2019 (UKEN) plans to increase the use of renewable energy power generation, as the country currently generates most of its power from coal.

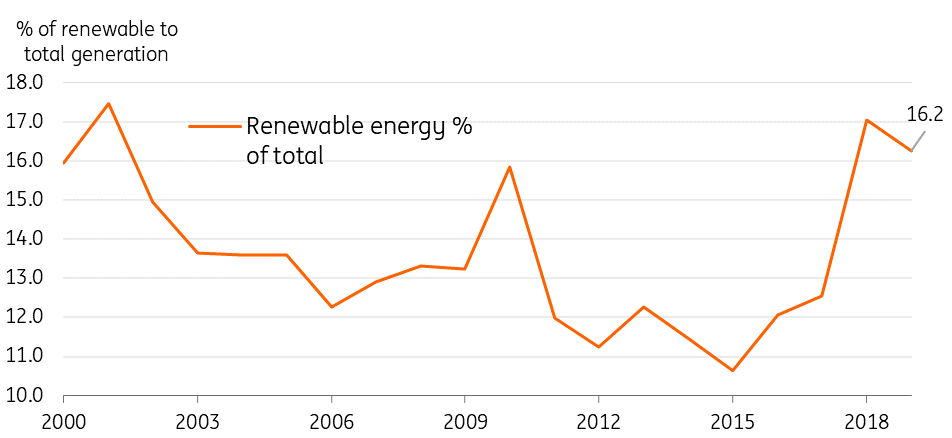

More recently, Indonesia drafted its National Grand Energy Strategy 2022 setting an ambitious plan to increase renewable power generation to 100% by 2060. However, despite the targeted increase in the overall supply of renewable power, coal is still projected to provide the bulk of energy supply (47% of total) in the near term. Currently, energy generated by renewable sources comprises only 16.2% of the total.

The planned carbon tax of $2.1 per ton of carbon covers coal plants and it will be interesting to see if this will have an impact on energy generation in the medium term. Although relatively low compared to some other countries such as the Netherlands ($46 per ton) and France ($49.3 per ton), Indonesia’s $2.1 per ton carbon tax is more comparable to that of Japan ($2.4 per ton) and Singapore ($3.7 per ton).

Indonesia % of renewable power to total

Driving up the biodiesel blend

Indonesia also aims to lower its dependence on imported fossil fuels by blending domestically produced Fatty Acid Methyl Ester (FAME) or Distillated Fatty Acid Methyl Ester (DPME) with diesel fuel derived from crude oil. Apart from the benefits of lower dependence on imports, blending biofuel with diesel should lower emissions from transportation.

In a span of a little over 10 years, Indonesia has increased its mandated fuel mix from 1% in 2009 to 30% presently. Indonesia’s Ministry of Energy and Mineral Resources has indicated that it plans to implement the increase of the minimum requirement to 40% before the end of 2025.

Mandatory biodiesel blend

Indonesia betting big on electric vehicles

Lastly, Indonesia has jumpstarted the country’s electric vehicle (EV) industry to lower carbon emissions generated by transportation. President Joko Widodo passed Presidential Regulation 55 (the Acceleration Program for Battery Electric Vehicles for Road Transportation) in 2019 to initiate the push for local EV production, EV battery production and charging infrastructure in the country.

More recently, the Ministry of Industry Regulation announced its EV Roadmap under regulation 27 of 2020, granting tax incentives (zero tariffs) for new EV purchases and laying out guidelines for incentives for EV vehicle and battery production. Indonesia also plans to build EV infrastructure and increase the number of EV charging stations to 25,000 by 2030 from 147 in 2021.

What’s happened since the Ukraine war

Indonesia moves to fill global energy demand with coal

The impact of the Ukraine war on energy prices has led to an increase in Indonesia’s coal exports as the world’s top exporter of the product takes advantage of higher prices. After a self-imposed ban on coal exports in January, monthly shipments of coal have been above the pre-pandemic average and Indonesia has indicated it would like to produce and export more coal to satisfy global demand.

Indonesia to push for B35

Indonesia’s Ministry of Energy and Mineral Resources recently announced a further increase in the mandated minimum biodiesel blend to 35%, indicating that the new biodiesel named B35 could be the new mandate by the end of July. The ministry’s readiness to shift to a higher biodiesel blend may be viewed positively in terms of lowering vehicle emissions but it will have implications for the domestic palm oil supply.

Indonesia banned exports of palm oil last April to ensure a stable domestic supply of cooking oil. Since then, the ban has been lifted and export levies removed until 31 August. However, months of export restrictions have led to a supply glut and falling prices. Increasing the mandated biofuel content of biodiesel to 35% may address the current domestic oversupply although this could translate to higher cooking oil prices domestically.

Delayed until further notice

Indonesia was scheduled to impose carbon taxes in April 2022 under the Tax Regulation Harmonization Law of 2021. The new law would have charged $2.1 per ton of carbon on coal plants but has been delayed indefinitely.

EV roadmap has some takers

Indonesia’s strategy to develop its EV market is supported in large part by its reserves of nickel, the key commodity used in EV battery production. In 2022, Hyundai Motors rolled out its first EV produced in Indonesia after inaugurating the vehicle plant in March 2022 and the EV battery plant in September 2021. More recently, Indonesia’s Investment Coordinating Board announced that Volkswagen would be investing in Indonesia to develop an EV battery ecosystem within the year.

Indonesia’s coal exports rise to fill energy gap due to Ukraine war

Conclusion

The fallout from the Ukraine war on global commodity prices has benefited the resource exporter Indonesia in the first half of 2022. Higher prices of coal have bolstered the trade surplus to record highs, which in turn has helped keep the currency stable and the central bank on hold. The accommodative stance from Bank Indonesia could help to provide an environment for investments to transition to renewable sources of energy – but at the cost of global partners still utilising Indonesia’s coal as a source of energy in the near term.

Meanwhile, Indonesia’s strategy to increase mandated biofuel content in diesel may result in lower emissions from road vehicles. However, Indonesia’s aggressive push to develop palm plantations has led to concerns about deforestation. Thus, despite the positives of lower vehicle emissions, Indonesia may need to develop sustainable measures in the development of palm oil plantations in the long run.

Lastly, Indonesia’s decision to delay the planned carbon tax last April has been linked directly to the uncertainty caused by the Ukraine war. Since then, the planned carbon tax has been delayed indefinitely suggesting that the war has directly delayed the implementation of this measure.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 August 2022

How the Ukraine war has affected Asia’s race to net zero This bundle contains 9 Articles