India: Weak rupee to push RBI to tighten next week

An accelerated currency depreciation trains the market focus on the Reserve Bank of India’s (RBI) forthcoming policy meeting on 6 June. We expect the RBI to tighten with a 25bp policy interest rate hike

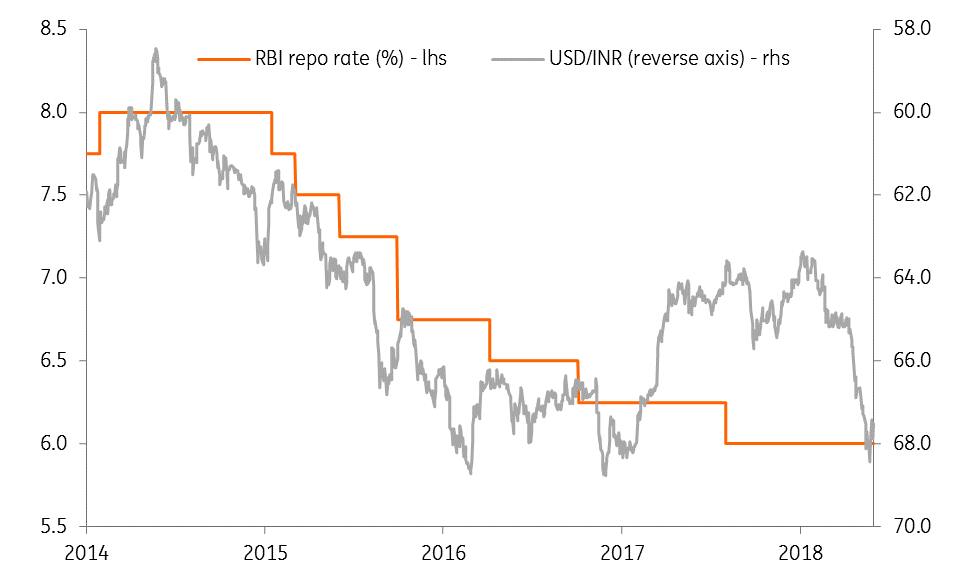

Will the Reserve Bank of India follow its emerging markets counterparts in raising policy interest rates to curb the currency depreciation? We believe it will. We bring forward our forecast timing of the first 25bp policy rate hike to June from August, taking the repo rate to 6.25% and reverse repo rate to 6.00%. However, absent any policy support next week another downgrade of our USD/INR forecast, currently, 68.3 for end-2018, will become inevitable (spot 67.5).

Room for downside growth surprise in 4Q FY18

India’s GDP data for the final quarter of FY2018 (ended in March 2018) is due on Thursday 31 May. The consensus is looking for a modest pick-up in growth to 7.4% year-on-year from 7.2% in the previous quarter. Our forecast is 7.3% growth.

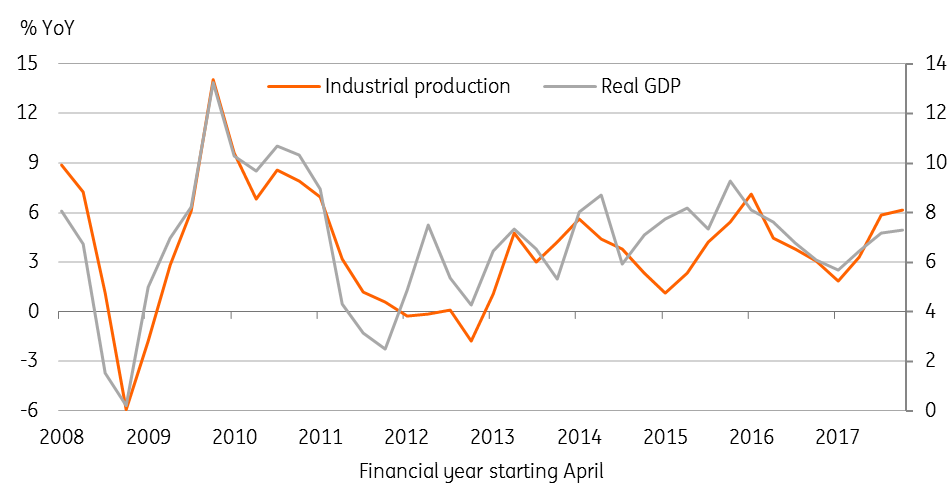

Hopes are pinned on the low base effect supporting upward growth momentum. However, the monthly activity indicators suggest no improvement in 4Q FY18 from the 7.2% pace recorded in the previous quarter. Slower exports and a wider trade deficit were the main negatives for GDP growth, while higher inflation likely weighed down consumer spending. On the positive side, manufacturing gained some momentum as reflected by better industrial production growth, supporting the consensus of a better GDP outcome (see below).

A close correlation in India’s GDP and IP growth

Little in GDP data to curb INR depreciation pressure

GDP data is unlikely to resuscitate investor confidence in the Indian rupee (INR), in our view. The 6% year-to-date INR depreciation against the US dollar is the steepest among Asian currencies this year. The accelerated depreciation in the current emerging market turmoil poses the question: will the Indian central bank follow its emerging markets counterparts in Turkey, Indonesia, or the Philippines in raising policy interest rates to curb the currency depreciation?

This trains the market focus on the forthcoming RBI policy meeting next week (6 June). Unlike Turkish or Indonesian central banks, the RBI has no history of thrashing policy measures. There is a significant minority in the Bloomberg survey, only three out of 14 forecasters as of this writing, looking for a 25bp rate hike next week. And the consensus within the six-member RBI monetary policy committee (MPC) until the last policy meeting in April had been biased towards a continued neutral stance, though we can anticipate some shift towards tightening in the coming week.

| 6% |

Year-to-date INR depreciation against USDThe most among Asian currencies |

Expect RBI policy tightening as early as next week

It’s going to be a tricky call though. Up until the last RBI meeting in April, there was only one dissenting vote supporting a rate hike. But at the same meeting the deputy governor in charge of monetary policy, Dr. Viral Acharya signalled his decisive vote for tightening in June. The rest of the MPC members are well aware of potential inflation risks due to several external and domestic factors. Now with a further intensification of inflation risk due to a weak currency, we believe the odds have increased for a majority vote in favour of a rate hike next week.

We bring forward our forecast timing of the first 25bp RBI policy rate hike to next week's meeting from the August meeting, taking the key policy rates, the repo rate and the reverse repo rate to 6.25% and 6.00% respectively. We also expect a further pre-emptive tightening by 25bp at the August meeting. However, without any policy support next week another downgrade of our USD/INR forecast, currently 68.3 for end-2018 (which we revised from 66.6 a month ago), will become inevitable (spot 67.5).

INR needs policy support

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 May 2018

Good MornING Asia - 31 May 2018 This bundle contains 5 Articles