India: Rupee takes no comfort in stabilisation measures

Investors may start pricing in more aggressive tightening in India after recent measures failed to stem the currency weakness. But we're in no rush to change our forecast of two more 25 basis points central bank policy rate hikes at the October and December meetings, or a USD/INR rate of 73.50 by end-2018

Markets fail to cheer stabilisation measures

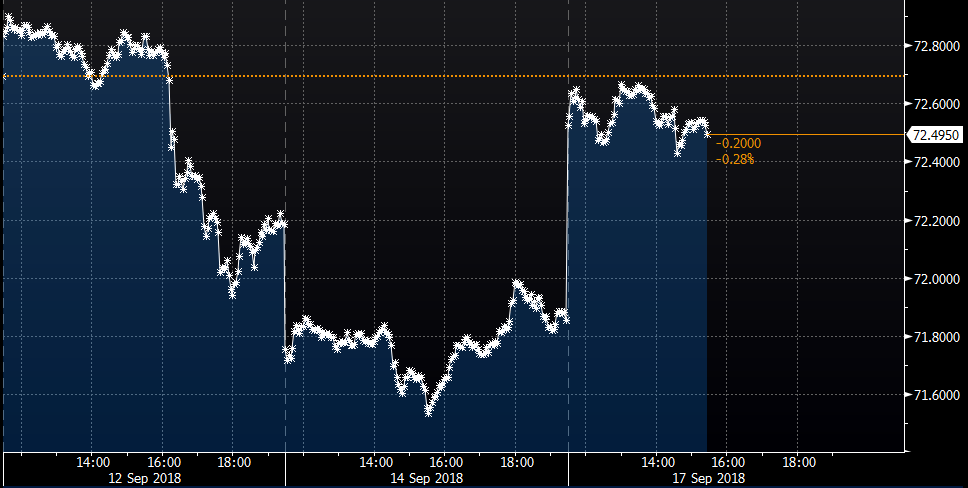

After a brief hiatus, India’s currency slide resumed today despite new measures to stem the rupee (INR) depreciation. At the start of trading today, the INR reversed almost all its gains against the US dollar, which had been eked out in the last two trading sessions in anticipation of some significant action from the government and the RBI to stabilise the currency market.

Late Friday, the finance ministry announced measures including the relaxation of regulation of foreign borrowing up to $50 million by manufacturing companies for a year compared to the current minimum of three years, the scrapping of withholding tax on masala (INR-denominated) bonds, and a possible easing in the current 20% limit on foreign ownership of corporate bonds. Nothing more.

It’s hard to imagine these measures being immediately effective in curbing the currency depreciation, as the external payments situation remains on a deteriorating path. Today's market reaction testifies to this. As such, more measures are expected. Some potential steps have been widely-discussed, including:

- A central bank policy rate hike

- Exchange market intervention

- Tapping funds from overseas Indians

- Raising import tariffs

- Swap window for oil companies

All eyes on the Reserve Bank of India policy

The markets may start pricing in an aggressive Reserve Bank of India policy rate hike, as also implied by two-thirds of odds of the 50 basis point hike at the next meeting in early October. It wouldn’t come as a complete surprise to us. However, we remain sceptical that the RBI will follow that path, now that inflation is running in the lower half of the 2-6% inflation target.

The current currency weakness will eventually push inflation higher at some point in the future. A pre-emptive aggressive move would be a welcome support for the currency. But this could also depress economic activity, while external risks from the trade war now loom large.

We aren’t rushing to change our forecast of two more 25 basis point hikes at the October and December meetings, and a USD/INR rate of 73.5 by end-2018.

USD/INR: Trading on Monday kicks off with INR sell-off

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 September 2018

Good MornING Asia - 18 September 2018 This bundle contains 5 Articles