India: RBI’s surprise rate cut appears premature

The Reserve Bank of India (RBI) has ignored the inflationary consequences of the fiscal splurge and eased policy in support of the government’s drive to boost growth before the elections. We think the markets will view such a policy move as premature and the rupee will be the main victim

| 6.25% |

RBI repo rate25 basis point cut |

| Lower than expected | |

An RBI rate cut with neutral policy stance

The RBI Monetary Policy Committee voted 4-2 to cut the key policy rate by 25 basis points, taking the repurchase rate to 6.25% and the reverse repo rate to 6.00%. The decision was surprising in that very few, only eight out of 38 participants in the Bloomberg survey anticipated it. As widely expected, there was no change to the banks’ reserve requirement rate of 4.00%. The MPC also switched its policy stance to ‘neutral’ from ‘calibrated tightening’, which was a unanimous decision by all members.

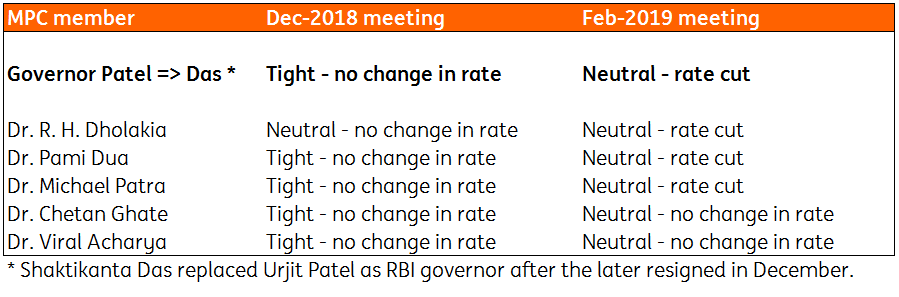

What’s more amazing though is the sharp swing in the policy perception within the MPC. Until late 2018, all but one member expressed caution on inflation and advocated a tighter stance with stable rates, whereas all favoured a neutral stance and the majority voted for a rate cut today.

A change in policymakers' thinking

Benign inflation, strong growth outlook

The RBI statement began by noting that, “These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 percent within a band of +/- 2 percent while supporting growth”. Inflation for the current quarter (the final quarter of FY2019 ending in March) is projected at 2.8%, picking up to 3.2-3.4% in 1H FY2020 and then to 3.9% in 3Q FY2020. This outlook rests on expectations of continued food and fuel price trends, the transitory nature of currently high healthcare and education costs, and moderating household inflation expectations. The upside risks stem from volatile vegetable prices, an abnormal monsoon, and the fiscal boost to aggregate demand.

Headline inflation is expected to remain contained below or at its target of 4 percent. - Governor Das.

The central bank forecasts an acceleration of GDP growth to 7.4% in FY2020 from 7.2% estimated for the current financial year, supported by strong credit growth, softer crude oil prices, and the lagged impact of the weak currency on net exports.

A premature policy move

It was a surprise that the RBI eased policy on the grounds of inflation continuing to be benign. Indeed inflation is unlikely to hit the RBI’s 4% policy mid-point anytime soon. But we expect the underlying pressure to remain upward. Food price inflation has bottomed as the January CPI data is expected to show, while the adverse base effect will likely push it higher going forward. High core inflation, running at about 6% in the current financial year, reflects still elevated inflation expectations. The loose fiscal policy and a weak currency are the other factors likely to push prices up going forward. We expect average inflation of 3.6% in 1H FY2020, rising to 5.4% in 2H 2020.

As such, we consider the decision to cut the policy interest rate premature. The key question it poses is: why do we need a loose monetary policy when the fiscal policy is already supporting growth well above 7%? Maybe a political push from the incumbent government aiming for a second term.

Now that elections are just around the corner, we aren’t expecting the RBI to move policy again this year. However, as inflation accelerates above 5%, the tightening pressure will return. We believe the next RBI policy will be a 25 basis point tightening by the end of FY2020.

CPI inflation by key components

INR to remain Asia’s weakest currency

Government bonds gained and the Indian rupee weakened in a knee-jerk reaction to the RBI’s decision.

It’s unlikely to be a lasting relief for bonds as the supply overhang to plug a persistently wide fiscal deficit will continue to pressure yields higher. The INR7.04 trillion government borrowing plan for FY2020 announced in the budget a week ago represents an over 30% increase from the revised INR 5.35 trillion borrowing in the current year. This will not only pressure borrowing costs higher but also will cause a significant crowding out of private investment, thereby weighing on GDP growth.

The INR has been the worst performing Asian currency since last year. Despite persistent wide relative interest rate differentials, the lower domestic rates will sustain the INR's underperformance throughout 2019. We maintain our view of the USD/INR rate re-testing 73 in the near-term.

ING's key economic forecasts for India

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 February 2019

In case you missed it: Trade truce withering away This bundle contains 8 Articles