India: Never underestimate central banks

The key question for markets ahead of the central bank meeting this Friday is whether it will overlook the rupee's weakness? We won’t be surprised by more than a 25 basis point hike, but still, we revise our end-year forecast for USD/INR to 75 from 73.5

A confounding consensus on RBI policy

The recent media headline about the Reserve Bank of India possibly abandoning the rupee was eye-catching but was based on the increased stress in India’s financial system due to a beleaguered non-bank finance company going bust and the resulting tighter liquidity conditions.

The fact that higher interest rates will compound the liquidity problem was a setback for the consensus view on the RBI policy. Until the troubles surfaced to batter local markets around two weeks ago, the consensus was biased towards a 25 basis point hike at the next meeting. However, since then, things have become pretty indecisive with almost half of the analysts expecting a 25bp hike and the remaining expecting no hike at all.

We have been in the rate hike camp all along.

| 6.75% |

ING forecastRBI repurchase rate |

Will the RBI overlook the weak rupee?

The usual central bank response to a weak currency is aggressive policy tightening, like Indonesia and the Philippines, who have had 150 bp rate hikes recently. But the odds of the RBI following their footsteps seems to be constrained by the central bank’s 4% (+/- 2%) inflation mandate, a potential slowdown in growth due to the ongoing trade war, and troubles in the financial system.

We won't be surprised if the central bank hikes more than 25bp, though for now, our base case remains only a 25bp hike and another move in December

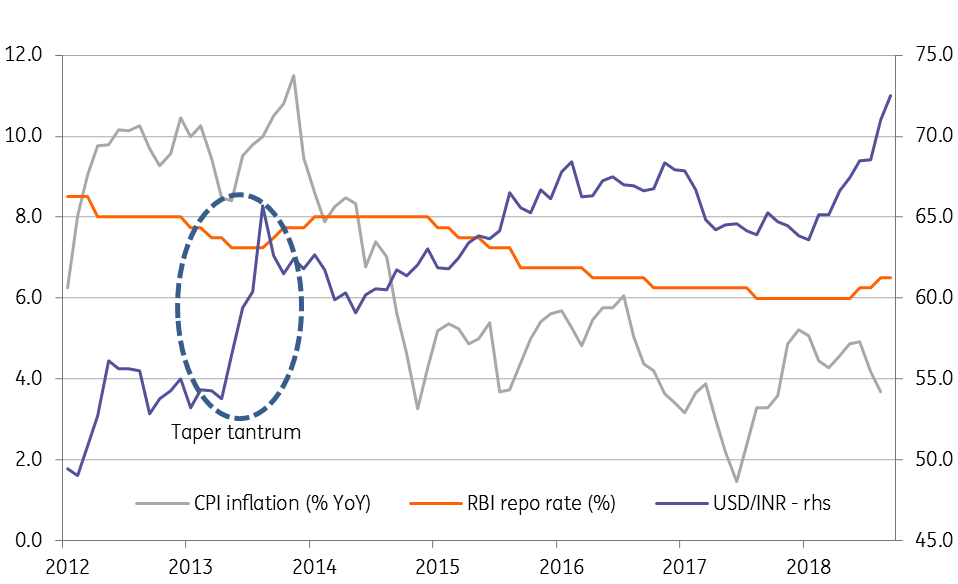

The latest rupee sell-off is a mirror image of the sell-off in 2013 and the RBI’s response back then was just as lacklustre as it is today. Despite domestic inflation running in double-digits in 2013, they only lifted the policy rate twice by 25bp in September and October 2013.

If history is any guide, then the RBI upping its ante on tightening measures may be a remote possibility, just as the consensus view for the upcoming policy meeting stands.

A lacklustre response to currency turmoils

As other support measures have been failing

Other currency support measures, including import tariffs, relaxation of foreign borrowing limits for manufacturing companies, removal of withholdings on masala bonds have all failed to do much.

The RBI has allowed commercial banks to dig into their statutory reserves to ease the liquidity crunch. There have been some traces of the central bank intervening in the foreign exchange market to support the currency, but not a lot. The $22.6bn fall in the country’s foreign reserves since the onset of currency market turmoil in April represents the largest capital flight from any Asian economy.

Even as the government has moved to bail the troubled infrastructure finance company out, the uncertainty surrounding restructuring of the company continues to be an overhang on financial markets.

Never underestimate central banks

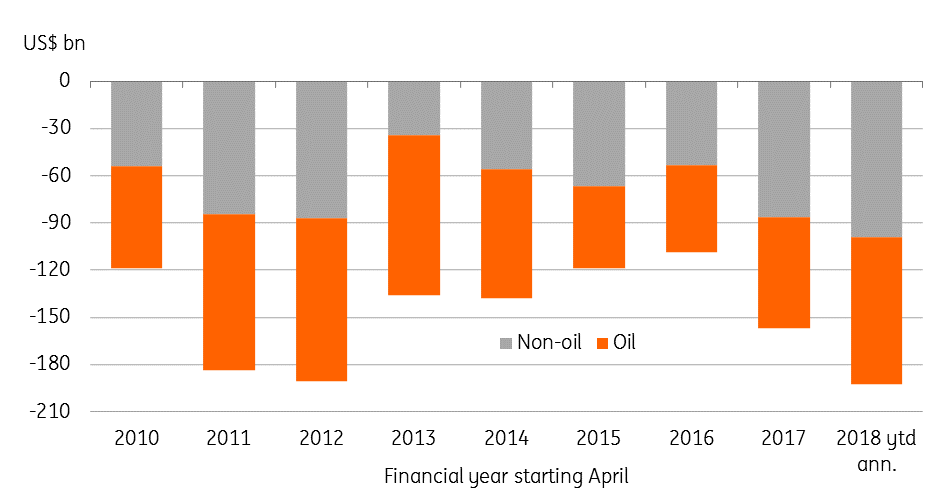

However, we also find it hard to believe that the central bank will turn a blind eye to the currency problem. Although inflation has been anchored within the RBI’s target, it certainly is more of a transitory phase, especially when global oil price are rising and the hit from this on the country’s current account deficit is already being compounded by depreciating the currency.

The USD/INR rate has almost hit our 73.50 end-year forecast, which is why we now revise our forecast upward to 75.0 (spot 73.3)

Any central bank in the world will want to be pre-emptive rather than reactive to future inflation expectations and in India’s case expectations remain elevated.

Never underestimate central banks, when it comes to preventing a crisis from eroding investor confidence in the economy and the currency. Indeed the currency and the financial sector troubles will top the agenda for the RBI policy committee this week and an extra policy thrust can’t be completely ruled out. This is why we won't be surprised if the RBI does hike more than 25bp this Friday, though our baseline remains only a 25bp now and another like move in the next meeting in December.

Another downgrade of INR forecast

Whether the aggressive policy move (if we get one at all) will eventually keep the rupee from losing further ground remains a perennial question given the lingering risks of a wider trade deficit from high oil imports and elevated inflation expectations. Add to this the political risks becoming a more prominent sentiment driver for markets going into the election year and any additional policy thrust may still prove to be inadequate in an environment of a strong US dollar.

The USD/INR rate has almost hit our 73.50 end-year forecast, which is why we now revise our forecast upward to 75.0 (spot 73.3).

Oil is swelling the trade deficit

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 October 2018

Good MornING Asia - 4 October 2018 This bundle contains 3 Articles