India: Lower oil price a boon, politics a bane for the rupee

In yet another revision, we lower our USD/INR forecast for end-2018 to 71.5 from 74.0 and for end-2019 to 69.0 from 73.2. In the meantime, mounting political uncertainty in the run-up to general elections in May 2019 makes us think the rupee will weaken past the 73 level in the next three to six months

Lower oil price a boon for the rupee…

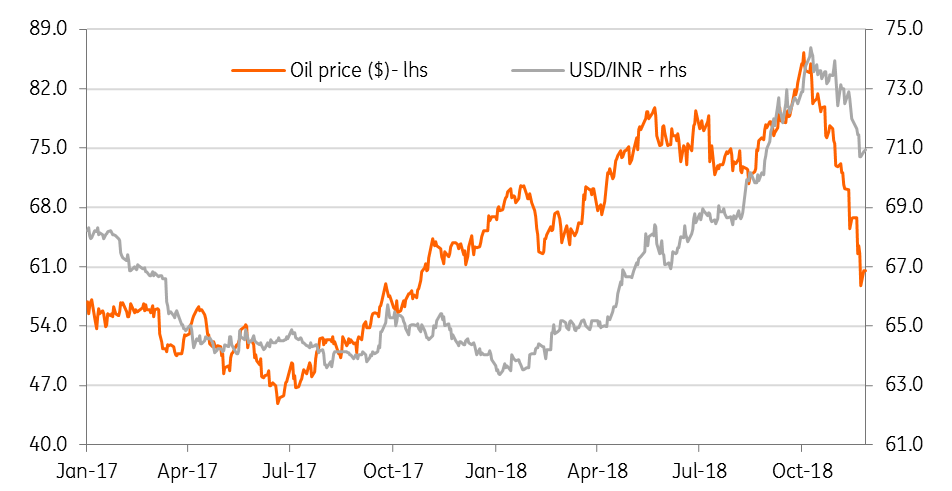

The Indian rupee’s (INR) 4.4% month-to-date appreciation against the USD has it on track to be an outstanding Asian currency this month. At 70.9 the USD/INR has retraced a chunk of the 15% depreciation that drove the pair above 74.0 in the first 10 months of the year. The more than 30% collapse in the crude oil price since October explains the reversal of fortune for the currency (see figure).

The expectation of slower global growth amid an intensifying US-China trade war and increased supply are depressing the oil price ahead of the OPEC meeting in early December at which US - Saudi Arabia diplomacy will weigh heavily on future supplies.

Longest INR appreciation streak in two years

… despite slowing growth, and

Aside from the falling oil price boon and the broader USD weakness, India’s economic dynamics have hardly changed in favour of the INR. The GDP data for 2Q FY2019 (July-September quarter of 2018) due later this week (30 November) is expected to reinforce the fact that growth has peaked and the slowdown has begun. While the high base effect from the post-denomination bounce in growth from 2Q FY2018 is at work in depressing annual increase, weakening exports and private consumption, and increasing drag from net trade are also contributing to the slowdown. In addition to this are the persistently tight banking system liquidity and tough lending guidelines for public sector banks dragging investment demand.

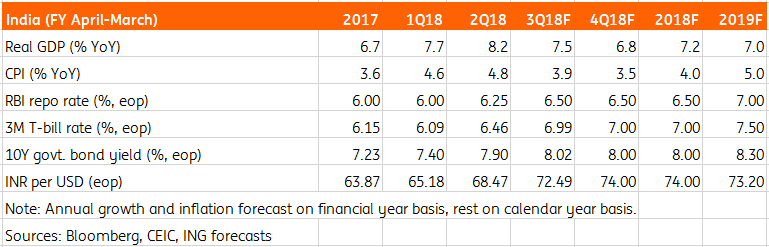

Our view of a slowdown in India’s GDP growth to 7.5% YoY in 2Q FY2019 from 8.2% in the previous quarter, which was the fastest rate of growth in two years, is consistent with the median consensus estimate of 7.4%. Anything weaker than consensus will be bearish for the local financial assets, including the INR.

… widening twin-deficits

The key economic resistance for the INR appreciation, the twin-deficits (current account and government budget) remains intact and could even get worse. The cumulative budget deficit in the first half of FY2019 was 19% higher than a year ago and was 95% of the full-year target deficit. The pressure on public finances was obvious from recent pressure by the government on the central bank for more funds. Yes, the thawing of tensions between the Reserve Bank of India (RBI) and the government is another positive for now, though recent tensions will continue to lurk in the background and are not positive for the currency. And on the external front, the financial year-to-date trade deficit of $111bn is 26% wider on the year, with more than half of the widening coming from oil trade.

The benign inflation backdrop, which is puzzling in view of INR’s dismal performance, has allowed the RBI to hold the line on policy interest rates. But the wide fiscal deficit will eventually be inflationary while crowding out of private sector investment will also weigh on GDP growth. That said, we have recently scaled back our RBI view from a rate hike at the last meeting of the year in December to no more hikes this year. We do, however, expect the RBI to resume tightening once the elections are out of the way by mid-2019.

Resurgent twin-deficit problem

Politics the key headwind to INR in 2019

Above all, politics is likely to decide the course for the INR in 2019. The political heat is already rising as the elections being held in five states currently will set the tone for the national elections scheduled in May 2019. Considering the public wrath following chaotic demonetisation in late 2016 and GST implementation in mid-2017, it will be a tough task for the incumbent Modi government to retain power for another term. We expect it to be a too close-to-call poll.

Snapping the longest appreciation streak in two years the USD/INR started trading this week on the weaker side. We aren’t seeing the pair drifting far from the current level as the year draws to close, though the bias will be more on the weaker than stronger side depending on the outcomes of the state elections.

We revise our USD/INR forecast for end-2018 to 71.5 from 74.0 and that for end-2019 to 69.0 from 73.2. In the meantime, the mounting political uncertainty in the run-up to general elections leads us to a view of the INR weakening past the 73 level in the next three to six months. Once the political overhang lifts we anticipate a steady consolidation below the 70 level by the end of next year.

India: Economic forecast summary

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 November 2018

Good MornING Asia - 28 November 2018 This bundle contains 3 Articles