India: First test of RBI’s latest policy inaction

September inflation data today comes as the first test of the RBI's decision a week ago to leave monetary policy on hold. Besides the central bank's inaction, nothing from the government side has worked so far to prop up the rupee, prompting yet another upward revision to our end-year USD/INR forecast to 76.5 from 75.0

| 4.1% |

ING inflation forecast for September |

Inflation to bounce back above 4% in September

Today's release of Indian consumer price inflation data for September will be the first test of the central bank’s (RBI) decision a week ago to leave its interest rate policy on hold. Even though inflation slowed sharply in July and August, that was more of a function of base effects than any underlying price weakness.

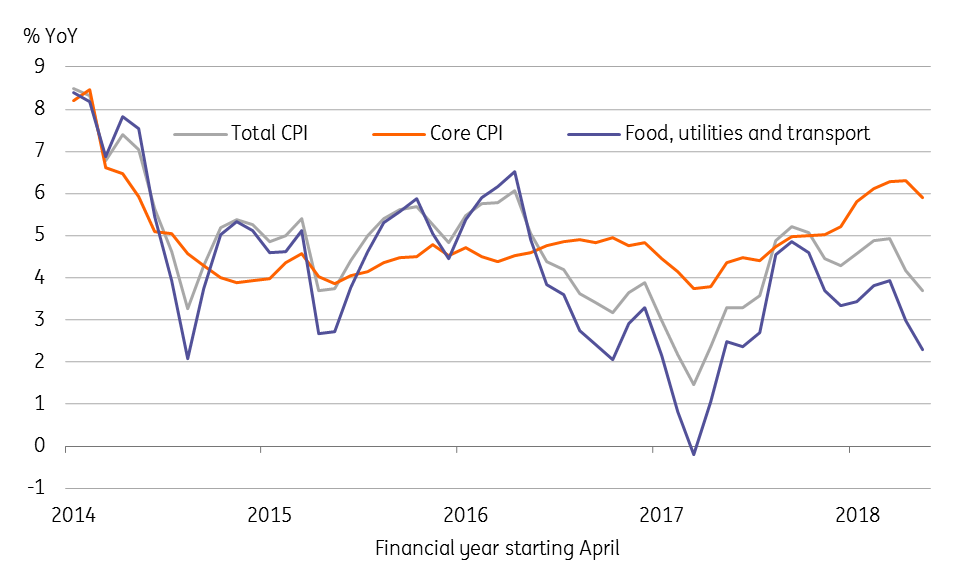

Food, utilities, and transport have been standout drivers of lower CPI inflation in recent months (see figure). But month-on-month increases in these components have been positive since April and likely have been sustained in September, boosting the headline back above 4% from 3.7% in August. The August print was the lowest point in 10 months. Core inflation has been running at around 6%, which is where we expect it to stay.

Consumer price inflation

A reactive rather than proactive central bank

Even as the RBI shifted its policy stance from ‘neutral’ to ‘calibrated tightening’, we believe it grossly underestimated the potential inflationary pressure from higher global crude oil prices, which undoubtedly will be compounded by a historically worse INR exchange rate. Not a proactive policy by a central bank.

And given an underlying policy lag, even if the RBI responds to high inflation in the future with rate hikes (we continue to forecast a 50 basis point rate hike at the December meeting), that’s not going to be timely medicine, while growth will also come under pressure from the global trade war, weak private consumption due to high inflation, and crowding out of private investment from a widening fiscal gap. Also due today, industrial production data for August will provide a sense of GDP growth in 2Q FY2018-19.

And lack of government policy support for rupee

As we noted earlier, the RBI inaction on the rupee has put the ball in the government's court. Yesterday Bloomberg quoted India’s Economic Affairs Secretary Subhash Garg as saying that the economy was strong on most counts – fiscal deficit, inflation in control, reserves fine, exports good -, and that the government has tried to deal with the current account gap with measures on imports. Alas, nothing has worked so far, prompting a further upward revision to our end-year USD/INR forecast to 76.5 from 75.0 (spot 74.1).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 October 2018

Good MornING Asia - 12 October 2018 This bundle contains 5 Articles