India: Banking on the budget

India is complicated. But you can get a long way to understanding its issues by stress-testing the budget deficit projection of 6.4% outlined in the 2022/23 Union Budget. Despite surging inflation and growth assumptions that now look ambitious, we still think this deficit target is achievable

Why the budget deficit?

The reason we start our analysis with the budget deficit is that although India’s credit rating is BBB- Stable for S&P, Moody’s, and Fitch, it is only one step away from a non-investment grade rating. So about the only metric that now becomes important for the safeguarding of the current rating is progress on fiscal retrenchment.

The 2022/23 Union budget sets out the Indian government’s estimate for the deficit in 2021/22 at 6.8% of GDP and projects the deficit falling to 6.4% in 2022/23.

Digging into the numbers further, the forecast of 6.4% is based on an assumption of GDP growth of 8.0-8.5% for real GDP, and an assumption of 11.1% nominal GDP growth, which implies an inflation rate of something like 3.1% in this period based on oil prices at $70-75/bbl.

Almost immediately, it looks like the assumptions that these deficit forecasts are based on are completely off course. So, what does this imply for the budget deficit, and for India’s rating outlook?

The outlook for GDP: real vs nominal

Let’s start with the GDP forecast. On the one hand, the re-opening of the economy after the Covid-19 pandemic-related lockdowns is undoubtedly supportive. India’s economy re-attained pre-GDP levels of economic activity by the first quarter of the year, but it still has quite some way to go to make up for the lost output it would have achieved assuming no pandemic. And while that remains the case, growth should be buoyed by “catch-up” minus any loss of potential output due to economic “scarring”.

Indian GDP still making up for lost time

Inflation is likely to undermine spending power

So far, so good. But the rest of the news isn’t quite so helpful. India is quite a closed economy, so the bulk of its growth is going to be determined domestically. Of the principal expenditure components of GDP, consumer spending is the largest.

Real income growth, on which spending is dependent, is vulnerable to purchasing power-sapping increases in inflation. There will be some offset to this from rising salaries, but these will probably lag behind. Rising interest rates to curb current high levels of inflation also raise debt service costs as well as raise savings rates. On both counts, the outlook for real consumer spending is looking troubled.

Current inflation is 7.0%, well above the RBI’s 4+/- 2% target range, and then only thanks to a recent cut in excise duties on fuel that has trimmed the inflation rate from 7.8%.

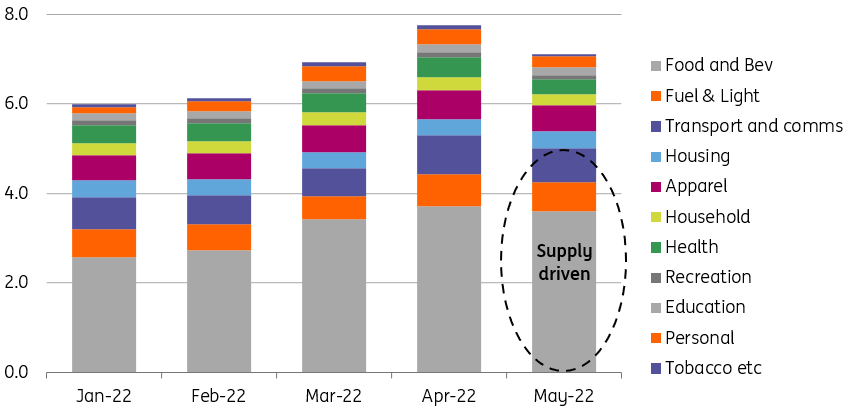

It is clear that keeping inflation low is already having a direct budgetary impact, although high oil prices have also facilitated a recent increase in excise duties on Indian crude oil production, so it isn't all one way. Admittedly, most of India’s inflation is supply-side generated. The combined total of food and beverage and fuel and light components of CPI make up about 4.2pp of the current 7.0% inflation rate. A portion of the 0.8pp contribution to the total from transport and communications should also be chalked up to fuel costs making about two-thirds of the total supply-driven.

Indian inflation – contributions to YoY% growth

Some good news around the corner on inflation

The importance of agriculture for India's inflation can't be overstated, and there is perhaps some good news lurking around the corner. Since the end of May, global agricultural commodity prices have come off quite sharply. There doesn't seem to be much fundamental going on here. Our head of commodities strategy describes this as an "evaporation of risk premium," coupled with supply looking a bit better than had perhaps been feared around the time of the Russia-Ukraine war, and a downgrade of global demand on recession fears.

The result has been a sharp drop in the prices of palm oil (Indonesia's resumption of exports has helped), wheat, sugar, and rice. There is a slight concern that with no strong fundamental driver, risk premia may return. But at least in the short-term, we may be due a few months of surprisingly low food price inflation which will help to reduce price pressures elsewhere. And this is the principal reason we have nudged down our near-term inflation forecasts, though we concede that there won't be much of a decline until 2023.

Agricultural prices have come off a lot

Investment spending looks well supported

So if consumer spending is looking challenged, what about the other elements of domestic demand? The main sources of these are private business investment and government spending.

As far as private investment goes, credit growth from scheduled commercial banks is running at a double-digit pace, and 1Q22 real gross fixed capital formation growth moved up from the low growth pace in 4Q21 to around 5% in 1Q22.

But the increase in policy rates is likely to push lending rates higher, and rapid WPI inflation is also likely to undermine real investment in plant and machinery. Second-quarter gross fixed capital formation will probably continue to show upward momentum, but this is likely to moderate in the second half of the year.

Government spending in the 2022/23 budget included a substantial pick-up in spending on infrastructure. Effective capital expenditure is budgeted at 27% above the revised 2021/22 estimates. Even allowing for some reduction in this in real terms due to inflation, this element of domestic demand should show strong growth in 2022.

Scheduled commercial bank credit growth YoY%

GDP for 2022 of 7.4%

Adding in a fairly neutral assumption for net exports gives us a forecast for GDP in the calendar year 2022 of 7.4% (FY22/23 7.3%) and in the calendar year 2023 of 7.5% (FY23/24 8.5%).

That puts our real GDP forecasts in real terms about a full percent below the growth rates assumed in the 22/23 budget. That said, taxation is on nominal not real incomes, so we need to calculate nominal values for GDP, consumer spending and corporate profits to come up with estimates for revenues in the coming fiscal year from GST, income and corporate taxes.

Where does tax revenue come from?

Inflation can be helpful in revenue collection

When you plot nominal, inflation-affected series such as GDP or consumption against the various tax revenue sources, it is clear that inflation should have a positive impact on tax revenues, pushing up GST receipts as nominal consumer spending rises even as real spending is undermined by high prices. Higher prices could also lift corporate tax receipts, though that is less clear as costs of goods sold rise as well as sales prices.

Higher wages will also feed through to higher income tax receipts. There is also a revenue windfall from higher energy prices in terms of excise duty receipts, though this will be largely offset by higher expenditure on subsidies, and the recent cut in excise duties will also limit any upside in net terms. Higher global prices could also lift customs receipts, though again, weakening domestic demand may cap this.

Income tax and nominal GDP

Inflation less helpful for expenditure

It is not such a helpful story on the expenditure front, however. We’re taking at face value many of the budget claims for spending. But the rise in interest rates means that debt service costs will come in higher than predicted.

The Reserve Bank of India has been slow to react to higher inflation. Until April, when it hinted at a shift in policy stance, it still kept a bias towards supporting growth. That changed with its unscheduled 40bp hike in the repo rate to 4.4% in May and a further 50bp hike to 4.9% in June. Inflation may be largely supply-driven, and hiking rates will not lower oil prices or those of tomatoes, but it’s the only way to bring demand low enough to reduce inflation through the other demand-sensitive components.

...hiking rates will not lower oil prices or those of tomatoes, but it’s the only way to bring demand low enough to reduce inflation through the other demand-sensitive components.

It looks likely that we will continue to see the RBI tightening policy rates over the rest of the year. The next rate-setting meeting is 8 August, and then 30 September. There could be some easing of inflation from lower global agricultural prices, but with policy rates in real terms remaining sharply negative, the RBI will probably still choose to hike by 50bp at each of these meetings. That should take rates to 5.9%, but by December, the final policy meeting of the year, this should be roughly where core inflation is and could provide an excuse for at least a smaller hike, if not an actual pause.

Bond yields are already about 150bp higher than their trough in 2021. It isn’t totally clear that they will rise much further though, even if the RBI hikes as we expect. Indeed, more credible tightening could head off much higher bond yields and cap the amount that debt service costs rise. We are actually forecasting bond yields to decline slowly over the second half of this year as global recession fears gain traction.

The Union Budget implicitly assumes a slight increase in the effective interest rate on debt of 6.2%, up from 6.0% in 2021/22. We estimate that with rates almost a full percentage point higher now than they were in 2021, this should push up the effective rate by a little more than this. But that should hopefully be all.

Our forecasts also assume greater public sector spending on salaries. Public sector wages typically get compensated for inflation increases with a bi-annual "dearness allowance" or DA. This should see salary expenditures rise by roughly the rate of inflation. Pensions payments will also likely increase.

Policy repo rates and bond yields

Revenues higher, expenditures higher, deficit lower?

Putting our estimates for revenues and expenditures together, we get what we think is perhaps a more realistic picture for this year’s deficit than we previously had. The Union Budget estimates a deficit of INR 11,61,196 crore. We estimate the deficit at more like INR 17,00,000 crore.

...a deficit of 6.3% should be achievable. Lower than the 6.4% budget assumption.

But we also expect nominal GDP to be higher. The budget estimate for nominal GDP in 2022/23 is INR 2,58,00,000 crore, up from an estimated INR 2,32,14,703 crore in 2020/21. Since the budget, revisions to GDP show 2021/22 GDP to have come in at INR2,36,64,637 crore, and adjusting for a higher nominal GDP growth rate than the 11.1% assumed in the budget (lower real GDP, but higher GDP deflator), our higher deficit projection is more than compensated for with a higher nominal GDP, and we believe on current spending plans, a deficit of 6.3% should be achievable. Lower than the 6.4% budget assumption.

Fiscal deficit and projections

Fiscal run rate is on track, almost

The fiscal year is only just starting. The April deficit print was well within its tolerance limits for meeting the 6.4% target, though the May figure, perhaps reflecting higher pressure on subsidies and excise duties foregone, was substantially higher, Still, the real story will only emerge later in the year, with most of the cumulative deficit coming in the second half of the year. If our projections for GDP, inflation, rates and bond yields pan out, and revenues and expenditures evolve accordingly, then we may even see the deficit coming in lower than 6.3%.

With the simplified debt dynamic arithmetic of R, India looks on course to see the debt to GDP ratio come down from 86.9% GDP in 2022 to 82.1% in 2023.

If the debt-to-GDP ratio falls as we expect, albeit fairly slowly, this should still be sufficient for Fitch to leave its rating at BBB-, and potentially even to lift the negative watch it has in place in due course. With India still considered a likely candidate for inclusion in global bond incises in the future, it is important that it keeps its investment-grade rating.

Fiscal deficit run rate

Tax revenues 2021/22, 22/23

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article