India: August economic data round-up

Positive economic data for August released this week instilled some life in the Indian rupee (INR). But the worst isn’t over just yet. We expect the central bank to raise rates by another 50 basis points before the year-end, and wouldn’t be surprised if it hikes by more than that. But we aren’t changing our view of the USD/INR trading up to 73.50 by end-2018

Lower inflation and the external trade deficit data for August this week provided a break in the Indian rupee (INR) sell-off underway since early August, lifting the currency by 1.2% from an all-time low of 72.70 against the USD hit earlier in the week. The softer USD against G-10 currencies, and by extension against emerging market currencies, also deserves mention. We aren’t too excited though, as we consider the recent dip in inflation and trade balance reversible. So is the dip in the USD/INR rate. Despite some gain, the INR remains one of the Asian underperformers with depreciation on a week-on-week basis. We are sticking to our view of the USD/INR rising to 73.50 by end-2018.

| $17.4bn |

August trade deficit |

| As expected | |

Some good news on the trade deficit

The trade deficit fell in line with the consensus to US$17.4bn in August from US$18bn in the previous month. Additional good news is the fall came from faster export growth, not from higher imports. Exports grew by 19% year-on-year, up from 15% in July. Imports were up by 25%, slower than 28% growth in July. Judging by higher average oil prices in August, oil continued to be the main import driver. A separate report showed that daily volume of oil India imported jumped by 16% YoY in August.

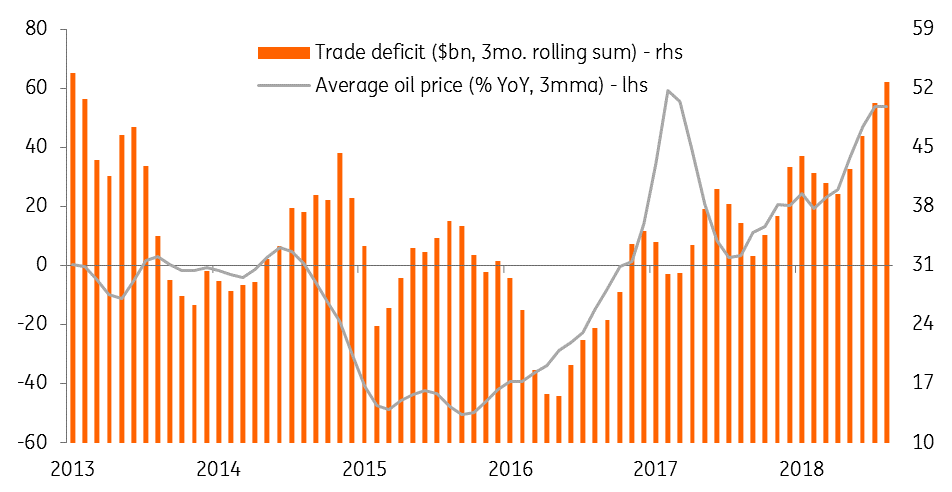

The lower trade deficit allows little room for the authorities to relax though. The three-month rolling total of the deficit is the highest since early 2013, as the chart below shows the deficit tracking oil price inflation. Strong domestic demand and high global oil prices are likely to sustain this trend in the months ahead.

The August trade report followed on the 1Q FY19 balance of payment data a week ago (late Friday, 7 September), showing a five-year high current account deficit of US$15.8bn. This intensified the INR selling pressure at the start of the trading week before the positive inflation report for August stemmed the currency weakness.

Oil drives trade deficit

And also good news on inflation

Consumer price inflation slowed to a 10-month low of 3.7% YoY in August from 4.2% in July. The slowdown was consistent with the consensus forecast, though this informs more about what happened a year ago than what happened this year – the high base-year effect due to new Goods and Services Tax implementation causing sharp spikes in CPI components across the board.

Housing, utilities and transport prices persisted as the main inflation driver, while food price inflation dipped to the lowest level in more than a year. Stripping out food and fuel prices from the total, Core CPI inflation also eased to 5.9% in August from 6.3% in July. And the wholesale price measure was down to 4.5% from 5.1% over the same months.

The favourable statistical base in the inflation index is unlikely to go away until early 2019, thus keeping inflation subdued, and under the Reserve Bank of India's (RBI) 4% medium-term target, through the end of the year. But this could as well be countered by high global oil price transmitting into domestic fuel prices, increase in imported inflation due to the weaker currency, and administrative measures such as a hike in minimum support prices for farm products. We maintain our 4.8% average inflation forecast for FY19.

Also released this week, industrial production growth eased to 6.6% YoY in July from 6.9% in June, yet signalling strong GDP growth in the current quarter.

Authorities are dragging their feet on FX measures

Headlines of the government and the RBI contemplating measures to stem currency weakness flooded the financial media this week, but there have been no announcements as yet. Among the widely talked-about measures are a central bank policy rate hike, exchange market intervention, tapping funds from overseas Indians, raising import tariffs, and swap window for oil companies.

The consensus is building up for more aggressive RBI rate hike either at the upcoming meeting in early October or even before that. According to Bloomberg, the odds of a 50 basis points (bp) hike in October and again in the December meetings far outweigh the odds of 25bp moves. The RBI targets inflation, not the exchange rate. However, we believe the currency weakness prompted two rate hikes in June and August this year when inflation wasn’t quite out of control. We aren’t completely discounting double-barrel rate hikes, while the latest print of 8.2% GDP growth in 1Q FY19 may as well underpin an aggressive policy tightening.

But the question is: will the central bank want to risk higher rates denting economic activity. We remain of the view that the RBI is accommodating the currency depreciation pressure from external contagion, whereas in-target domestic inflation and strong growth weaken the tightening argument. Although a weak currency is bad for inflation, it is good for exports in a global trade war environment and for reining in the external deficit. We have pencilled in a 25bp hike each in October and December, taking the policy rate to 7.0%. We maintain our view of the USD/INR rate trading towards 73.50 by end-2018.

India: Economic forecast summary

Download

Download article

17 September 2018

Good MornING Asia - 17 September 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).