India: Have things really turned around in favour of the rupee?

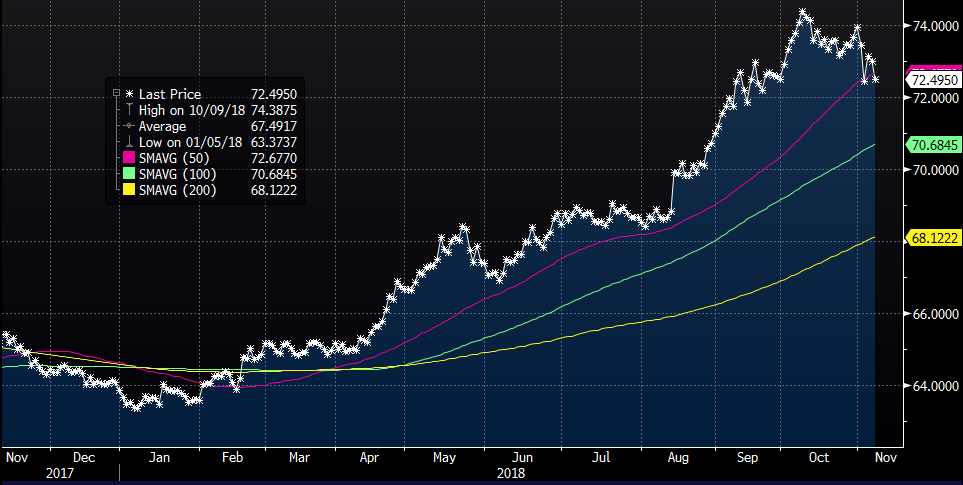

The Indian rupee (INR) isn't left out of the recent emerging markets currency rally. However, based on just a couple of weeks of appreciation it's premature to judge that the worst is over. That said, we revise our end-2018 view on the INR to a slower depreciation to 74.0 against the USD than 76.5 in our previous forecast

Calm after the storm

For now, calm has returned. The INR has joined the latest emerging market currency rally. The combination of a softer USD (following bouts of sell-offs in US stocks dampening expectations of the Fed tightening), a softer US stance on sanctions on Iranian oil sales to its main buyers including India, and the status-quo between the central bank and the government over the liquidity issue have put some life back in Asia's most-stressed currency this year. With a 1.3% month-to-date appreciation against the USD, November looks to be shaping up as the best month for INR since March 2017.

INR per USD

Has anything really changed?

Domestic economic fundamentals haven't changed drastically in the last two weeks to warrant a sudden reversal of fortune for the currency after an over 14% depreciation in the first 10 months of the year, the worst in Asia. The prevailing tightness in financial sector liquidity is the main trouble. Notwithstanding the government apparently succumbing to the central bank's (Reserve Bank of India) independence, the rift between two bodies continues to resonate in the financial press.

The government is pressuring the Reserve Bank of India (RBI) to relax tight lending rules on over a dozen public sector banks and stimulate lending, investment, and GDP growth ahead of the general elections. Two years after the denomination (cancellation of high-denomination currency notes in November 2016) the liquidity problem persists. It's recently been exacerbated by the insolvency of a non-bank finance company, Infrastructure Leasing and Financial Services (IL&FS), a month ago. In addition to this, there are already stretched public finances, with election spending possibly making it difficult for the government to contain the fiscal deficit at a projected 3.3% of GDP in FY2019, that is squeezing market liquidity.

The Bloomberg reports of the government now commanding the RBI to part with its excess reserves, the issue likely to dominate the agenda of the RBI board meeting on 19 November, suggests the tensions are far from over. Will the RBI budge to the government pressure?

What's the economic data say?

A slew of the Indian economic data on inflation, trade, and industrial production will add to the local market volatility this week, after a holiday-related respite in the last week.

Inflation data matters the most for the central bank's (RBI) policy. The RBI resisted pressure to support the INR during stormy periods of emerging market contagion earlier in the year, and again in October when a row between the RBI and the government intensified. The RBI's rationale for keeping policy stable has been well-behaved consumer price inflation, within the 2-6% policy target, and increased downside growth risks. We don’t expect the data this week to depart from the recent trend of stable inflation of around 4%. The good news here is a conditional waiver from the US sanctions on oil imports from Iran, at least for six months.

With lower oil prices offsetting administrative measures (a hike in minimum support prices for farm products and higher civil servant salaries) inflation should remain in the middle of the RBI’s target range through the end of the current financial year in March 2019.

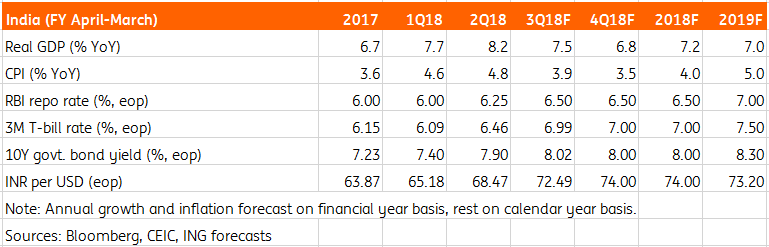

However, with tight liquidity depressing investment and the drag from net exports continuing to widen, GDP growth is poised to slow. The industrial production data for September is expected to testify to this view after a dismal export growth in that month. The year-on-year export growth likely has rebounded in October, thanks mainly to a favourable base effect, and yet the trade deficit looks set to swell, despite lower oil prices, making net exports a greater drag on GDP growth coming into the third quarter of the financial year. On our forecast, GDP growth decelerated to 7.5% in the second quarter of FY2019 (July-September 2018) from an outstanding 8.2% pace in the first quarter (data due on 30 November).

Revision to RBI policy and INR forecasts

Such a growth-inflation dynamic reduces the odds of the RBI changing its monetary policy at the forthcoming bi-monthly meeting on 5 December.

The RBI shifted the policy stance from 'neutral' to 'calibrated tightening' at the previous meeting in October, though it stopped short of raising the policy interest rate as was required at the time to curb the INR depreciation pressure. Now with a firmer rupee, stable inflation, and, more importantly, the ongoing tussle with the government, the RBI has strong grounds to leave the policy on hold in December.

As such, we have revised our policy forecast from a 50bp rate hike in December, which hinged on expectations of the non-ending currency plight and high oil price adding to inflation pressure, to no hike. We don't think the inflation risk is over though and maintain our view of a 50bp rate hike in 2019.

Likewise, we don't think the INR depreciation pressure is over either. But for now, on the expectation of no further escalation of tensions between the RBI and the government, we do anticipate a reduced depreciation pressure on the currency. Accordingly, we have revised our end-2018 forecast for USD/INR from 76.5 to 74.0. However, the potential escalation in the political uncertainty amid legislative assembly elections in five states this month, and in the run-up to the national elections in May 2019, will sustain the weakening bias on the INR. We continue to see the USD/INR rising past the 75 level against the USD in the next three-to-six months.

India: Key economic forecasts

Download

Download article

12 November 2018

Good MornING Asia - 12 November 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).