India: A look at the Union Budget for 2023-24

India's Finance Minister Nirmala Sitharaman has announced an ambitious budget, with big increases in infrastructure spending and a reduction in the deficit below 6%

| 5.9% |

% GDPDeficit target 23/24 |

Deficit adherence in 2022/23 has been good

A few days leading up to today's Union Budget speech, Finance Minister Nirmala Sitharaman received some good news as the December 2022 fiscal deficit numbers came in sharply down from the December 2021 total, giving her more wiggle room for a budget centred on growth for the year ahead.

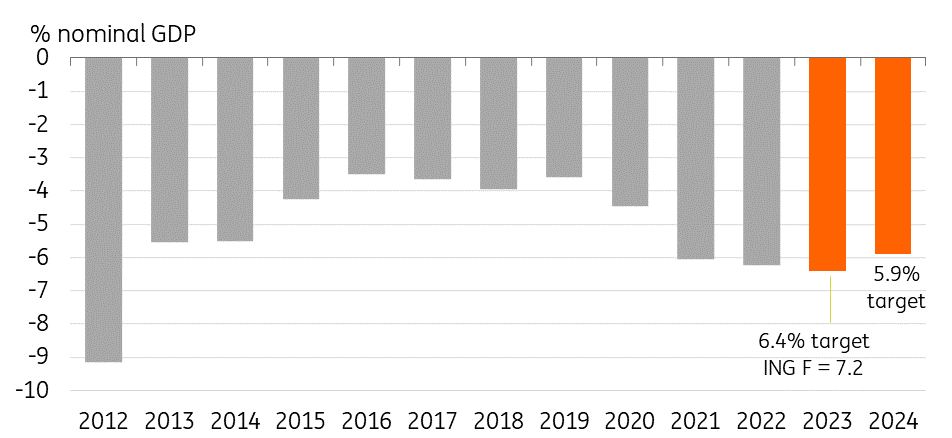

In her latest budget, the deficit target for this fiscal year was left unchanged at 6.4% of nominal GDP with three months left in the fiscal year to run. Currently, the numbers are running below (i.e. a smaller deficit) what we calculate the government needs to achieve in order to come in on target for the year at 6.4%. However, the last three months of the fiscal year have a nasty habit of springing some unwelcome surprises, and we think there is still some scope for a little overshoot by the end of the fiscal year, which would leave the deficit closer to 7.0% of GDP, a slight increase of the 6.7% outcome for 2021/22.

Fiscal 2022/23 deficit evolution and target

New deficit target reduced to 5.9%

The Union Budget for the fiscal year 2023/24 sets a deficit target of only 5.9% (on a primary deficit of only 2.3% GDP – interest payments make up 24% of all budget expenditure). This is ambitious, coupled with a sizeable increase in capital expenditure that is 37.4% more than the prior year's total.

Underlying these estimates is a forecast for nominal GDP growth of 10.5% over 2022/23. This also seems about right to us, as inflation falls closer to the mid-point of the Reserve Bank of India's 4+/- 2% inflation target, and real GDP growth comes in around 6% for the year, a bit down on this year, but still one of the highest rates of growth in Asia.

For a bit of balance, we do note that in the last fiscal year, the budgeted capital expenditure fell short of achieving some of the physical targets for home building, road building and water connectivity that it was supposed to deliver. Making sure that the extra expenditure this year delivers what it is supposed to on the ground will ultimately be as important to India's long-term growth potential as meeting arbitrary deficit targets.

Helping India to achieve these underlying growth assumptions, and hence the budget projections, India's large and not particularly open economy shields it to some extent from the slowdowns we are expecting in the US and Europe. India is also not particularly exposed to the downturn in the semiconductor industry that is weighing on the exports and production outlooks for many other Asian economies, and which will likely weigh on growth at least until the middle of this year.

India is also benefitting from a more imaginative approach to foreign direct investment from many multinational corporations looking for an alternative to China following trade and tech wars. And this is resulting in increased foreign direct investment inflows that will not only provide employment but typically also boost domestic productivity and raise the potential growth rate.

Budget deficits as % nominal GDP (fiscal years)

Financial markets give the 'thumbs up' to the budget

Our relatively favourable perspective on this budget seems to be shared by financial markets. The Indian rupee (INR) opened trading a little stronger on the day and is about 81.80 as of writing. We think the INR should appreciate a little further over the coming quarters as the US dollar (USD) backtracks and we look for the rupee to reach USD/INR 80.0 by mid-year. The bond market also seems to share our relative optimism. 10Y Indian government bond yields are down about 4bp to 7.30%, which represents a cautious "thumbs up" from investors.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article