Increasing headwinds for the Belgian construction industry

Activity in the Belgian construction sector is starting to slow. Although order books are still well filled, new orders are coming in more slowly. For this year, we forecast 2.5% growth for the Belgian construction sector, but next year growth will come to a halt

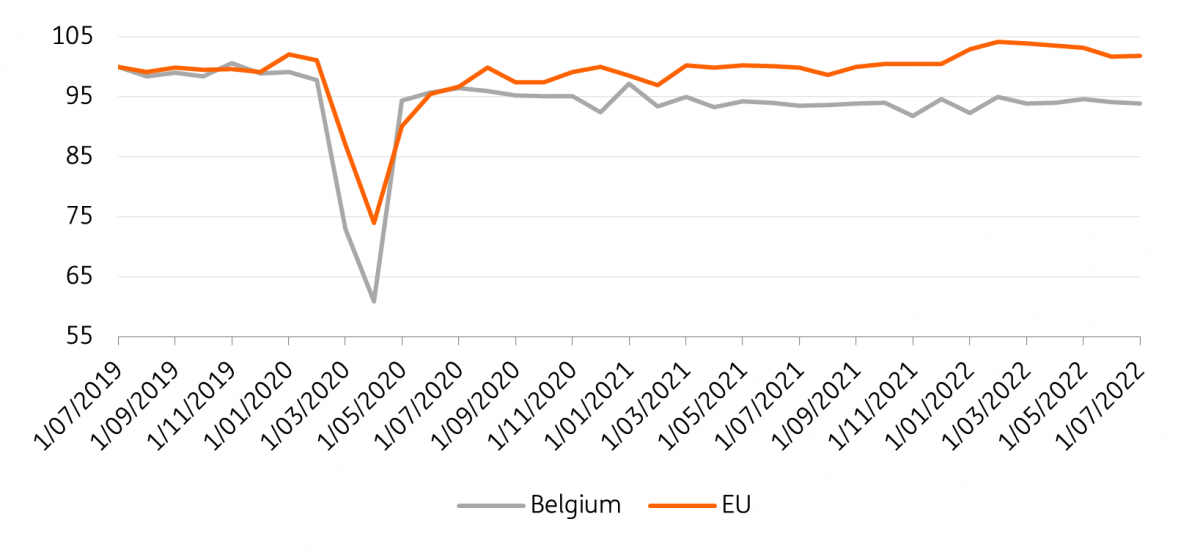

Belgian construction activity still 6.1% below its pre-pandemic level

Construction activity in Belgium in the first seven months of this year was 0.4% lower than during the same period last year. The war in Ukraine has put activity under pressure even more. In July, construction activity was 1.1% lower than in February before the outbreak of war in Ukraine. In the European Union, construction activity was still up 3.7% for the first seven months of this year, thanks to a strong start to the year. Yet the European average has also been under strong pressure since the war in Ukraine. Construction activity in the EU has declined by 2.2% since February.

Rising costs due to sharply increased energy and construction material prices, combined with growing uncertainty due to the war in Ukraine, are weighing on construction activity. As a result, it will take longer to fully recover from the Covid-19 hit. Construction activity in Belgium fell more sharply than the European average during the first lockdown. The recovery afterwards was also weaker. In July 2022, construction volume in Belgium was still 6.1% lower than in July 2019, the same month before the pandemic, while activity in the European Union was already 1.9% above its pre-pandemic level.

Fig. 1. Construction production index (July 2019 = 100)

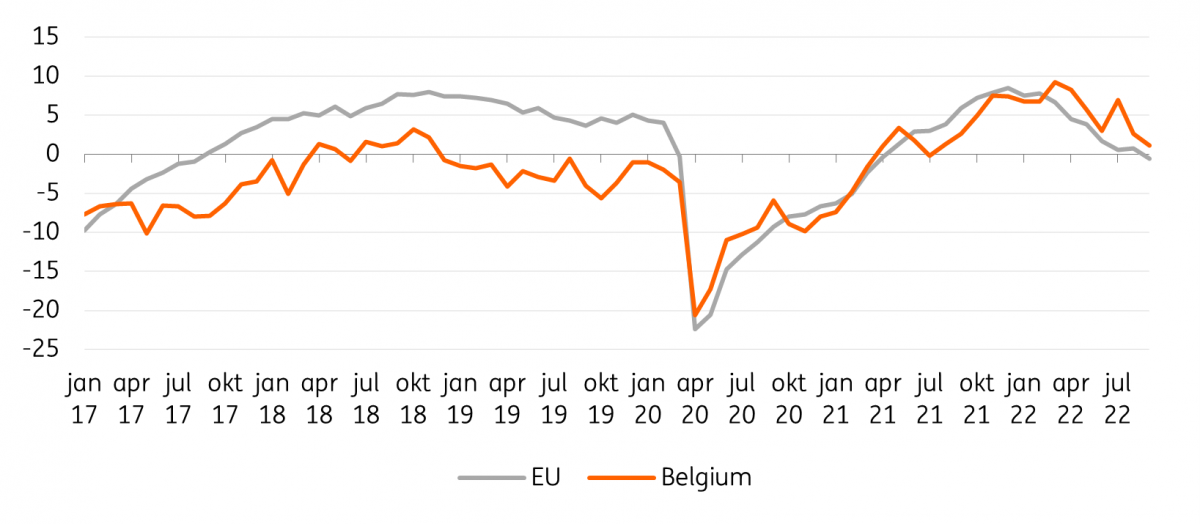

Construction business confidence down sharply since start of Ukraine war

According to the European Commission's confidence indicator, sentiment in the construction sector has fallen sharply since the start of the war. Rising costs and problems in global supply chains have weighed on profitability and caused a lot of construction sites to experience delays. Although pressure on supply chains is still high, it is beginning to normalise.

While the pressure on building material prices seemed to ease somewhat during the summer, the prices of energy-intensive building materials rose sharply again in September. Unlike the situation in the spring, this further increase in building material prices is no longer due to higher commodity prices on international markets, but due to higher energy costs, which make the production process of building materials more expensive. From a survey by Embuild, eight in 10 respondents expect further price increases for these materials over the next three months. A number of Belgian producers have already reduced or halted production, which in turn could affect the availability and delivery time of these materials. Falling demand will also make it more difficult to pass on price increases, putting pressure on the industry's profitability.

Fig. 2. Evolution of confidence in the construction industry

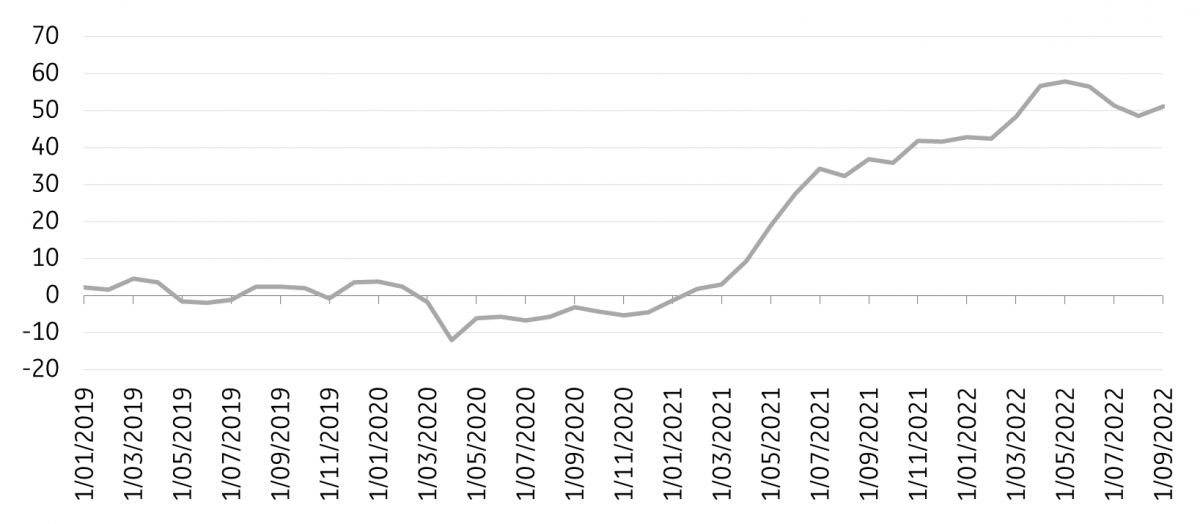

More companies planning to raise prices again

These cost hikes are again increasing sales prices. The European Commission's business survey shows that the net balance of construction companies planning to increase their selling prices rose again in September. Price pressure seemed to have eased somewhat recently, but once again more contractors feel compelled to raise their prices further.

However, as demand begins to decline, it is becoming increasingly difficult to pass on these higher costs to the end customer which is putting pressure on profitability. In a survey by Embuild, half of the construction companies already said they were having trouble paying their invoices in the short term. For now, the volume of work is still decent, but the industry is concerned about shrinking order books.

Fig. 3. Sales price expectations in the Belgian construction sector

Alongside increased material costs, the sector faces other headwinds

In addition to the sharply increased cost of building materials, the construction industry is also struggling with a number of other problems, including shortages of labour and building materials. Although pressure on global supply chains has improved somewhat since early summer, there are still many delays and difficulties in obtaining certain materials. The number of contractors reporting that a lack of materials is hindering production is still quite a bit higher than before the Covid-19 pandemic. In addition, the industry is also struggling to find suitable labour which is holding back activity. Although this figure has come down somewhat recently due to declining demand, this continues to hamper the sector.

Fig. 4. Factors hindering activity

Higher mortgage rates weigh on residential market

Higher interest rates on a mortgage loan will dampen demand for new residential projects. Mortgage rates on a 20-year term have already doubled this year from 1.4% at the beginning of the year to nearly 3% by the end of September. This translates into a declining number of applications for new mortgage credit for new construction projects. The number of mortgage loans registered in August was 24% lower than in the same month last year. Although it's important to say that the number was exceptionally high last year, partly because many homeowners took advantage of low interest rates to refinance their mortgage loans. We expect these mortgage rates to continue to hover at these higher levels. On top of that, the ongoing war in Ukraine is creating additional uncertainty that may cause people to postpone new construction and renovation projects.

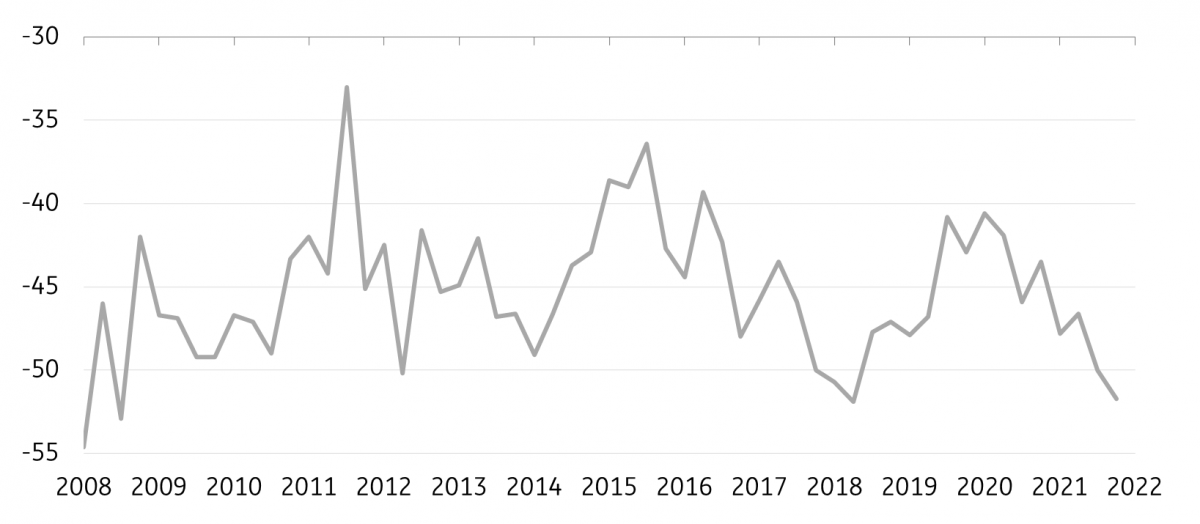

All of these factors are translating into declining demand for new projects. Thus, there are fewer new construction projects in the pipeline. The number of licensed new residential buildings decreased by 3.4% in the first five months of 2022 compared to the same period in 2021. Moreover, economic uncertainty is making more households postpone their renovation projects. The European Commission's latest consumer survey shows that the intentions of Belgians to carry out improvement works on their own homes in the next 12 months fell to the lowest level in 12 years in the third quarter.

Fig. 5. Belgian's intention to carry out improvement works on own home in the next 12 months

Belgium's residential construction sector likely to hold up better than other countries'

On the other hand, purchasing power in Belgium is holding up much better than the European average. According to the Federal Planning Bureau, purchasing power will decline only 0.1% this year thanks to automatic wage indexation and strong job creation. For next year, it predicts a 0.7% increase in purchasing power. As a result, the Belgian residential real estate market, and thus the residential construction sector, is likely to hold up better than in neighbouring countries.

In addition, uncertainty due to the ongoing war in Ukraine combined with sharply increased prices for energy and building materials will cause many households to postpone non-urgent beautification and renovation projects. As we expect the Belgian economy to head towards a recession in the winter months, residential construction activity will also weaken further in the second half of the year. The start of 2023 will be difficult. It is likely that the residential construction market will only recover from the second quarter of next year.

Negative business sentiment will further dampen the non-residential sector

The outlook for the non-residential sector is strongly dependent on the economic context of the companies that need these types of properties. There is little optimism on their part. In September, business confidence fell for the sixth consecutive month. The decline was strongest in manufacturing, but confidence also crumbled further in the service sector. Energy-intensive companies are particularly hard hit by high energy prices. Given the likelihood of the economy slipping further into recession, we expect business confidence to weaken further. The negative sentiment will encourage companies to invest less in non-residential real estate. In September, the component measuring confidence in the construction sector for non-residential buildings (such as commercial spaces, job stores, bank offices, sports complexes, office buildings, etc.) improved slightly but is still strongly negative.

Sentiment also fell sharply for government projects in September

Public construction projects held up a little better, but confidence also fell sharply in September. Many public clients have had to postpone plans in recent months due to the sharp increase in the cost of building materials and increased operating costs due to high inflation. Notwithstanding, public investments are usually less cyclical and the need for more investment in public infrastructure is still very high. We expect this branch to suffer less from the upcoming recession.

Rising headwinds will put brakes on growth in 2023

Although the construction industry started the year well, the sector is facing increasing headwinds. Supply problems have improved but are not yet completely gone. Higher mortgage rates and declining consumer confidence are making builders hesitant about new projects. On top of that, the industry is facing new price increases for energy-intensive building materials. For now, contractors still have plenty of work as they are still catching up due to the supply problems caused by the Covid crisis. Therefore, we still expect the sector to grow by 2.5% this year. For 2023, we expect stagnation, or possibly even a slight contraction in activity.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article