Reverse yankee supply outlook to reach up to €80bn

We have revised our reverse yankee supply outlook from our original forecast of €65bn to €80bn, but it is unlikely to exceed last year’s record-breaking supply of €99bn. We also expect the supply to continue to target the longer end of the curve, where cost-savings are the most beneficial for US corporates

Driven by the maths

There are many reasons for a US corporate to consider issuing in EUR, such as diversification of investor base or funding its European operations.

But often the reason to target EUR is driven by mathematics, quite simply by issuing EUR and swapping it back to USD, the US corporate can make a significant cost saving of many basis points on often funding of billions of USD. There are many factors that influence whether or not issuing a reverse yankee bond is cheaper than issuing a plain vanilla USD bond.

There are many factors that influence whether or not issuing a reverse yankee bond is cheaper than issuing a plain vanilla USD bond

There are many factors that influence whether or not issuing a reverse yankee bond is cheaper than issuing a plain vanilla USD bond. Firstly, the cost of swapping the currency made up of the cross-currency basis swap and the 3m vs 6m Euribor to Libor swap, identified as the grey and orange area in Figure 1. If the cross-currency basis swap goes less negative and the 3m vs 6m swap tightens it becomes cheaper to swap, and therefore more attractive for reverse yankee issuance.

Additionally, the excess of USD EUR spread differential, blue line is an important factor. In asset swap terms, USD credit spreads (for similar ratings, sectors, names and maturities) are higher than for EUR credit. If the spread differential between USD and EUR trends wider, then issuing a reverse yankee becomes more attractive as it will be more expensive to issue in USD. Of course, the spread differential, i.e. the cost-saving of the reverse yankee issuance must be in excess of the cost of swapping.

Currently, looking at the 5-year maturity, the cross-currency basis swap is relatively less negative (and therefore attractive) versus previous years. However, we have seen it widen out on the back of the crisis compared to the low levels seen in 2019, where we also saw record-breaking reverse yankee supply.

Cross currency basis swap and EUR/USD spread differential

Naturally, the spread differential between USD and EUR can differ depending on maturities and thus steepness of the curves.

Currently, the Euro credit curves are a lot flatter and were even inverted back in March/April as spreads widened so significantly and the jump to default was being priced in. Whereas USD curves are substantially steep, due to the short-dated support limitations on the Fed’s corporate purchasing programmes. The primary purchasing facility is limited to maturities of four years or less and the secondary purchasing facility is limited to remaining maturities of 5 years or less.

Therefore, what we see in Figure 2, is there being a small spread differential between USD and EUR in the shorter end of the curve (5yr), whereas the longer end of the curve (10yr) identifies as a very attractive widespread differential.

USD/EUR spread differential at 5yr and 10yr

There are other factors that are at play that determine the attractiveness of the reverse yankee issuance.

For instance, in volatile times non-ECB eligible bonds like reverse yankees tend to underperform versus their European peers. Less well-known entities in combination with this ineligibility leads to spread underperformance in the foreign currency (EUR in this case). Naturally, all this is based on average levels, but what is important to note is that it is very dependent on a company by company basis.

Supply & Outlook

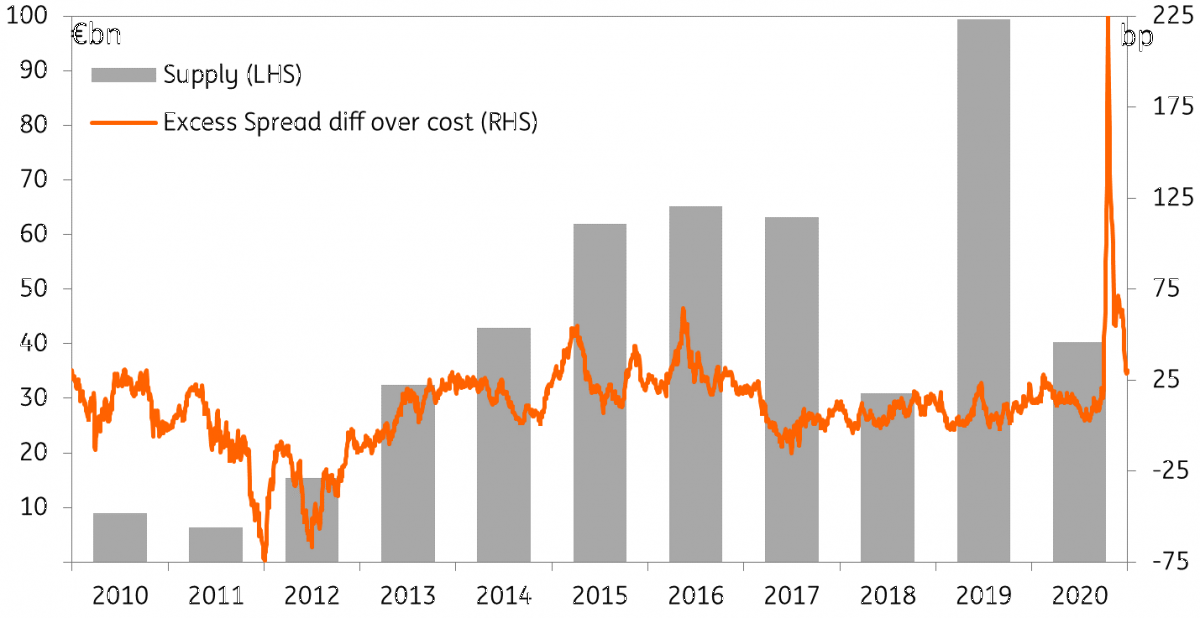

Figure 3 illustrates reverse yankee supply and excess net spread differential (over the cost of swapping), as seen reverse yankee issuance has increased over the years, mainly due to the improving attractiveness of issuing in Euro for US corporates. Reverse yankee supply in 2019 hit a record-breaking €99bn, and the excess spread or mathematics was not the main driver, as it also seems the Euro credit market is becoming more mature and thus increasingly receptive to these trades.

Reverse yankee supply & excess spread differential over cost of swapping

Now that there is little USD/EUR spread differential on the short end, attractiveness is being reserved only for the long end of the curve. Furthermore, the substantial support needed and being offered by both the ECB and the Fed, pushing corporates to stay within their own currency. All of which has resulted in our initial expectations of slower reverse yankee issuance and supply to pencil in less than 2019.

However, thus far in 2020 reverse yankee supply has totalled €45bn. Which is level with the 2019 year-to-date figure of €48bn. Be that as it may, February pencilled in a substantial €15bn in reverse yankee despite unattractive conditions, accumulated by large deals from AT&T, VF and Dow, whom for the most part used the proceeds for European operations.

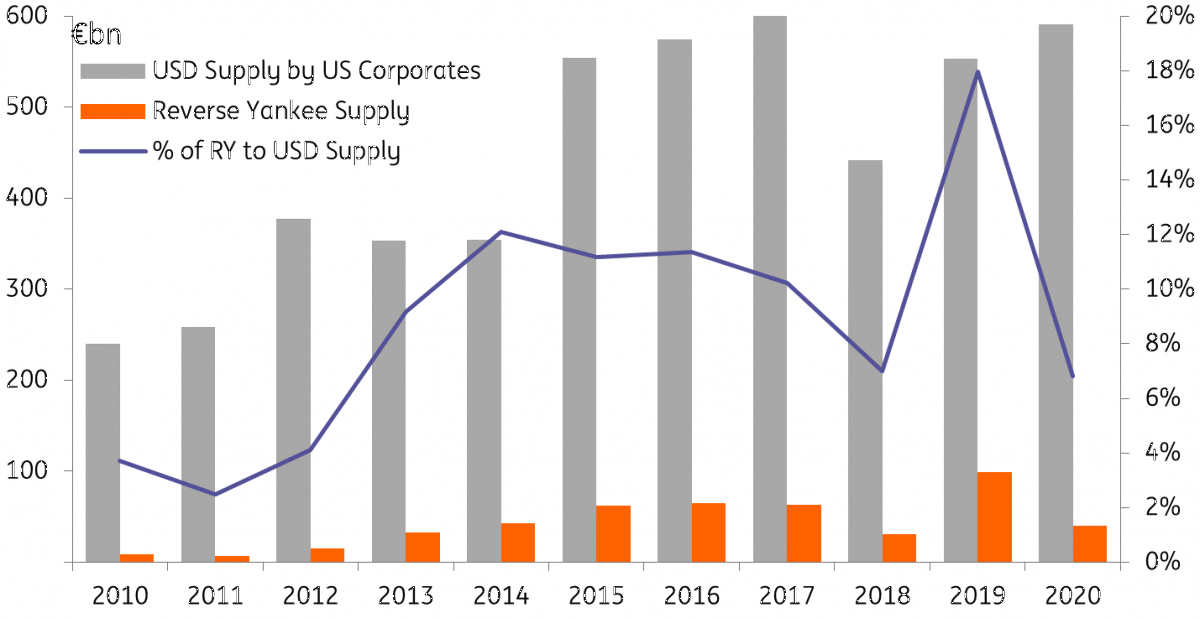

Furthermore, USD bond supply by US corporates has soared substantially thus far in 2020 pencilling in a considerable $775bn, which has already surpassed previous full years and has even surpassed the record-breaking FY 2017 figure of $696bn. Therefore, it is not surprising to see reverse yankee issuance increasing.

However, the slightly higher than expected reverse yankee issuance is as a consequence of the higher total issuance by US corporates as issuers stack up on liquidity to buffer Covid 19 consequences. This is proven by the fact that the percentage of reverse yankee supply to USD issuance by US corporates, where we identify the substantial relative fall in reverse yankee issuance. This is illustrated in Figure 4, where we see reverse yankee supply running at 7% of USD supply by US corporates, compared to the 18% in 2019.

Similarly, reverse yankee normally accounted for around 20-25% of Euro supply, last year pencilling in the higher end of that range. However, this year is only running at just shy of 16%. This is due to the substantial Euro supply seen thus far in 2020. Much like in USD, EUR supply is well and truly on route for a record-breaking year for supply.

Reverse yankee & USD supply

At this rate, we may still see slightly more reverse yankee supply than previously expected, but remains unlikely it will exceed last year's figure of €99bn. We originally pencilled in a forecast of around €65bn in reverse yankee issuance for 2020, we now expect that it may exceed this slightly and reach up to €80bn. What is also noteworthy, is the reverse yankee supply thus far has and will continue to be around the long end of the curve.

As the Fed is only supporting the short end of the USD curve, current long end attractive levels for reverse yankee offer US corporates an opportunity to issue longer-dated bonds.

To conclude, we forecast an increase in reverse yankee supply from our original outlook, now expected to reach up to €80bn.

As things stand at €45bn year-to-date right now, the slightly slower second half of the year is in line with our overall view of slower supply across the board for the second half of the year, as many corporates have undertaken considerable financing in an attempt to shore liquidity.

Of course our view on less reverse yankee supply still stands in relation to percentage of total USD supply. Now we stand at reverse yankee running at 7% of USD supply.

What are reverse yankee bonds?

A reverse yankee is a bond issued in EUR currency by a US corporate.

In most cases, this is utilised by US financial and non-financial corporates and swapped back into US dollars to finance US operations. Of course, there are some cases that the funds will remain in EUR and are used for European operations. US corporates can, therefore, issue in EUR to fund European operations or to take mathematical advantage as at times it could be a cheaper source of funding than to issue a USD bond.

Download

Download article26 June 2020

What you need to know about the slow Covid-19 recovery This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more