IMF World Economic Outlook: A diverging growth path for emerging markets

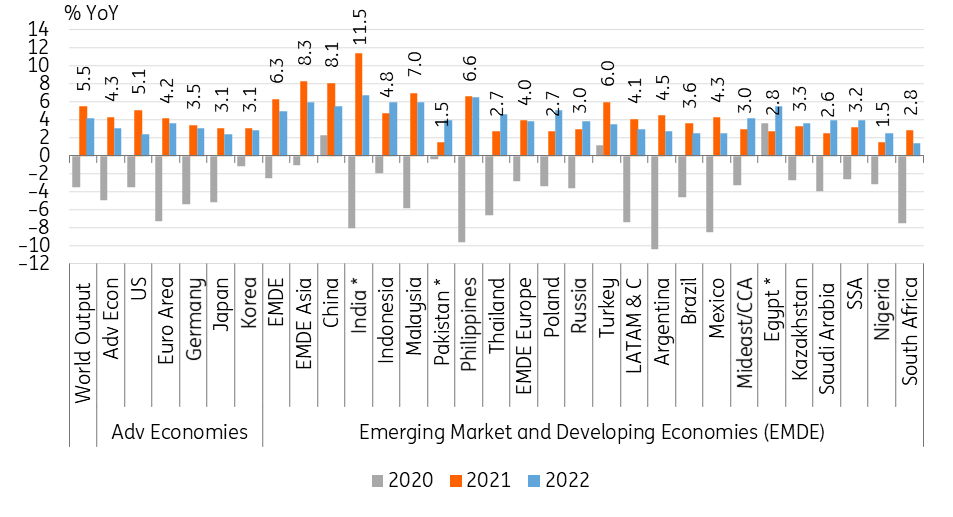

The IMF’s latest World Economic Outlook update provides a glimmer of hope. After the 3.5% contraction in 2020, global growth is set to rise by 5.5% in 2021 and 4.2% in 2022. In contrast to the October update, this marks a shallower contraction and an upward revision for 2021 growth thanks to vaccines and stimulus support

On an individual country level, there are substantial divergences, both in the growth outlook and in the revisions undertaken in the update.

IMF growth projections for 2020-22 across country groups and region (% YoY)

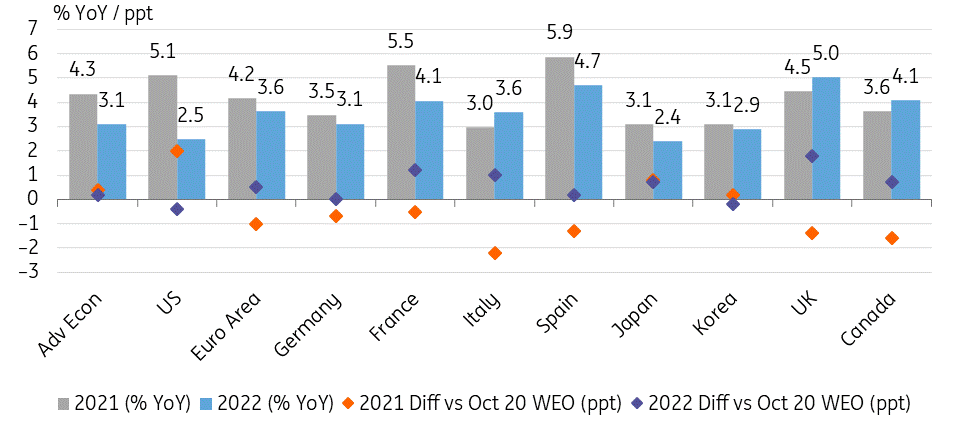

Fiscal stimulus and vaccine rollout give advanced economies a boost

The improved 2021 growth outlook is largely down to advanced economies which will grow by 4.3% (+0.4ppt vs October 2020 update), thanks to rapid vaccines rollout and supportive fiscal stimulus.

In particular, this has resulted in substantial upward revisions for the US (5.1% vs 3.1% in October 2020) and Japan (3.1% vs 2.3%), which make up for the lower projections for the Euro Area (4.2% vs 5.2%) and other advanced economies which are affected by rising infection cases and longer lockdowns.

Advanced Economies: Growth forecast for 2021 and 2022

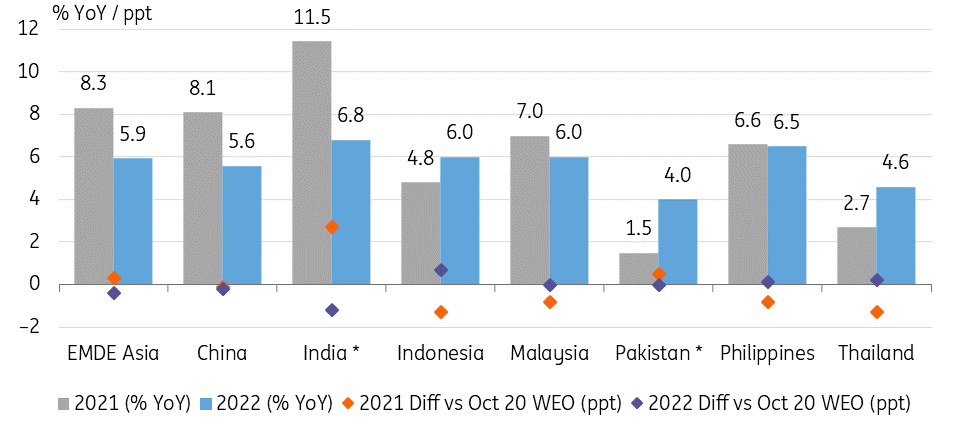

EM Asia runs ahead, Latin America recovery stands out

On aggregate, emerging market and developing economies (EMDE) have also seen upward revision to growth 6.3% (+0.3ppt), but the divergence in prospects remain. (regions sorted by growth levels in 2021):

- Emerging and Developing Asia (+8.3% in 2021; +5.9% in 2022) remains the growth locomotive of the emerging and developing world in 2021, led by India (which saw a 2.7ppt upward revision to a whopping 11.5% for the fiscal year ending March 2022) and China (+8.1%).

- In contrast, most larger ASEAN economies are expected to see a delayed recovery, with downward revisions in the 0.8-1.3ppt area for Indonesia (+4.8% in 2021), Malaysia (+7.0%), the Philippines (+6.6%) and Thailand (+2.7%).

Emerging market and developing economies Asia: Growth forecast for 2021 and 2022

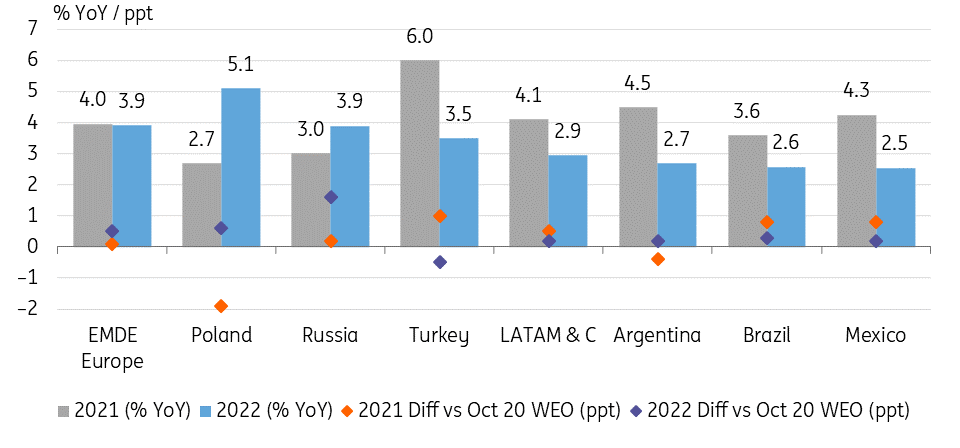

- Latin America and the Caribbean (+4.1%; +2.9%) were hit by the deepest recession in 2020 across all regions (-7.4% vs -2.4% for EMDE on aggregate) but the IMF looks more optimistic for 2021, reflected by the 0.5ppt growth upward revision which is driven by Brazil (0.8ppt upward revision to +3.6%) and Mexico (0.8ppt upward revision to 4.3%). Both economies are also expected to fare a tad better in 2022 than previously assumed.

- In Emerging and Developing Europe (+4.0%; +3.9%), Turkey is seen growing by 6.0% (+1.0ppt vs October) after having already avoided a contraction in 2020 (+1.2%). However, Poland is only expected to grow by 2.7%, a 1.9ppt cut in comparison to the October 2020 forecasts.

EMDE Europe / Latin America and the Caribbean: Growth forecast for 2021 and 2022

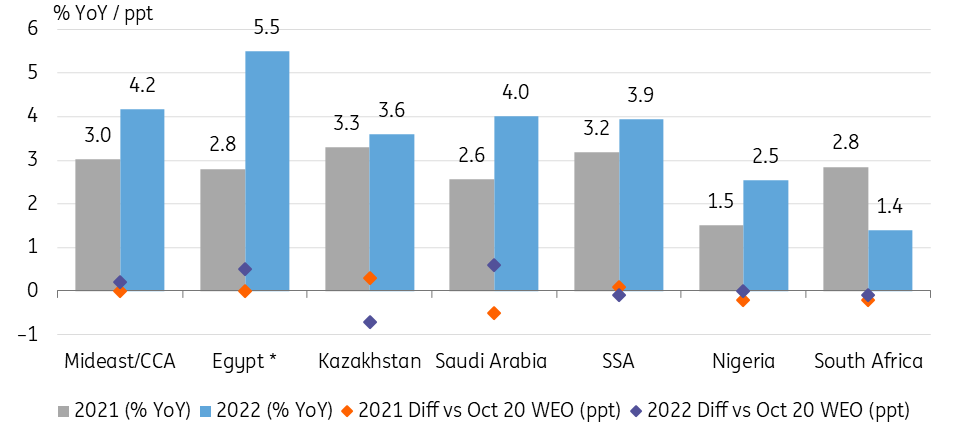

- Sub-Saharan Africa (+3.2%; +3.9%) and Middle East and Central Asia (+3.0%; +4.2%) both see a muted recovery in 2021, with some of the lowlights found here: Saudi Arabia’s growth forecast has been trimmed to 2.6% (-0.5ppt) while Nigeria (-0.2ppt to 1.5%) and South Africa (-0.2ppt to 2.8%) will also remain in low gear. South Africa also screens as the country with the lowest growth rate in 2022 (only +1.4%).

Middle East and Central Asia / Sub-Saharan Africa: Growth forecast for 2021 and 2022

The IMF strikes a somewhat more optimistic tone thanks to vaccines and stimulus support which offset the weak near-term outlook in some parts of the world. Downside risks largely come from the pandemic (renewed virus surge possibly driven by new variants, extended lockdowns, vaccine rollout delays, unequal access to vaccines leading to inequality and unrest) and the risk of premature policy support withdrawal.

However, there are also upside risks thanks to vaccine prospects and spillover effects from supportive fiscal policies.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 January 2021

Hopes fade for a synchronised global recovery This bundle contains 10 Articles