Hungary: Still room for more in GDP growth

The Statistical Office confirmed GDP growth at its second highest ever in 1Q19 - 5.3% year-on-year . The structure of economic activity is becoming more balanced, with evidence of more room for growth

| 5.3% |

1Q19 GDP growthConsensus (5.3%) / Previous (5.1%) |

| As expected | |

Production more balanced

The detailed 1Q19 GDP release contains some surprises on production and on expenditure, with the Hungarian Central Statistical Office (HCSO) first estimate unchanged at 5.3% YoY. This is the second highest growth rate ever in Hungary, and the strongest of all EU member states in 1Q19.

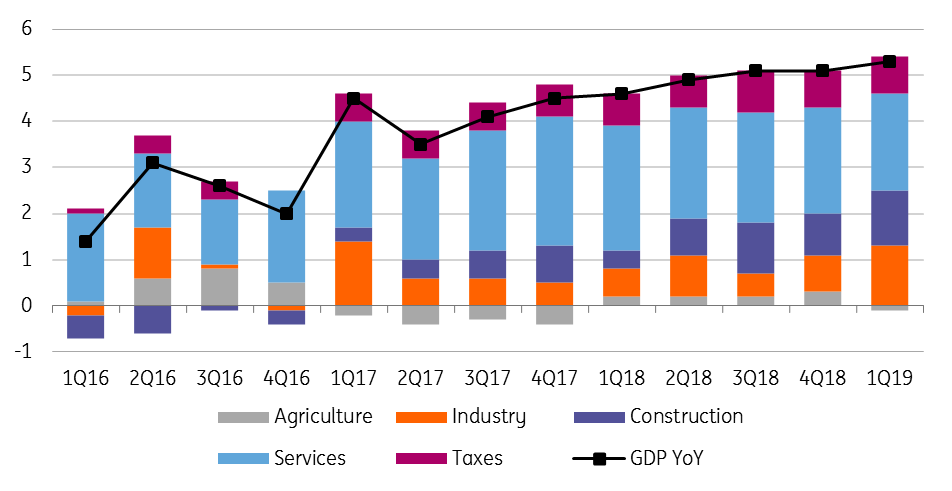

On the production side, services value-added increased at a slightly slower pace (3.8% YoY) in the first quarter, a mild surprise. In line with this deceleration, services provided a lower contribution to GDP growth in Q1 (2.1ppt), the lowest since 2016. Value-added in industry rebounded, with a strong performance mainly in the auto industry, here posting an expansion of 5.9% YoY and the best figure in almost four years. So the slowdown in services was counterbalanced by industry. Construction was expected to be a strong contributor and did not disappoint. The 47% YoY increase here translated into a record high 1.2ppt contribution. The balance of taxes and subsidies remained positive due to the strong increase in government revenue linked to economic activity and to the retreat of the shadow economy. The only drag on growth was agriculture, hit by adverse weather.

Contributions to GDP growth – production side (% YoY)

Change in inventories a huge drag on growth

On the expenditure side, the main drivers behind GDP growth are still domestic. Domestic use (actual final consumption and gross capital formation) added 4.0ppt to economic activity. This is a significant drop from the quarter before, where the contribution was 6.8ppt. So what happened? Actual final household consumption increased at a faster pace, while gross fixed capital formation was also a huge contributor to growth. The dampener comes from the change in inventories, which cut 3.4ppt from 1Q19 GDP growth. This can be linked to missing type approvals on cars produced - stocked in 2018 and finally sold from stock in 1Q19. We do not expect such a negative contribution to continue, suggesting that there is still room for growth in the Hungarian economy. Another surprise is in the performance of net exports, with a 1.3ppt contribution to the GDP growth. This is the first time since 2016 that the change in external balance is supporting the economic activity.

Contributions to GDP growth – expenditure side (% YoY)

The short-term outlook is still rosy

With the first set of hard data still not released, it is hard to estimate what’s next for Hungary. Soft business and consumer indicators are pointing towards optimism. Moreover, the change in inventories provides a growth cushion going forward as we don’t expect the huge run-down in inventories to continue. Export activities are strengthening on new capacities in manufacturing and can support growth further. On the other hand, our LeadING HUBE indicators suggest a loss in economic momentum going forward mainly due to the external environment. Against this backdrop, we see a minor slowdown in 2Q19 to 4.8% YoY, while we see GDP growth at around 4% on average in the second half of this year. This would translate into a 4.5% YoY growth in economic activity for 2019 as a whole, 0.2ppt higher than our previous forecast.

Regarding risks, we see these as balanced. On the upside, there is the government’s newly announced ‘economic protection action plan’, which can provide a short-term boost via payroll tax reduction. On the downside, the even gloomier external outlook with an escalation in trade wars counterbalances the positives.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more