Hungary: Economic activity revised up

Hungary's growth rate has been revised up to 3.9% YoY in the third quarter of 2017, and that's a positive surprise

| 3.9% |

GDP growth in 3Q17 (YoY)Consensus (3.6%) / Previous (3.6%) |

| Better than expected | |

Domestic demand drives upward revision

The second 3Q17 GDP release caused a significant upside surprise, as the Hungarian Central Statistical Office revised the growth rate by +0.3ppt to 3.9% YoY. The details are also containing some surprises, but the big picture remains the same: the domestic demand was the main contributor. Net exports had a negative contribution not seen since 2003.

Though the performance in the third quarter was better than the EU-average (2.5% YoY), Hungary is lagging its regional peers.

GDP growth revised up to 3.9% YoY in 3Q17

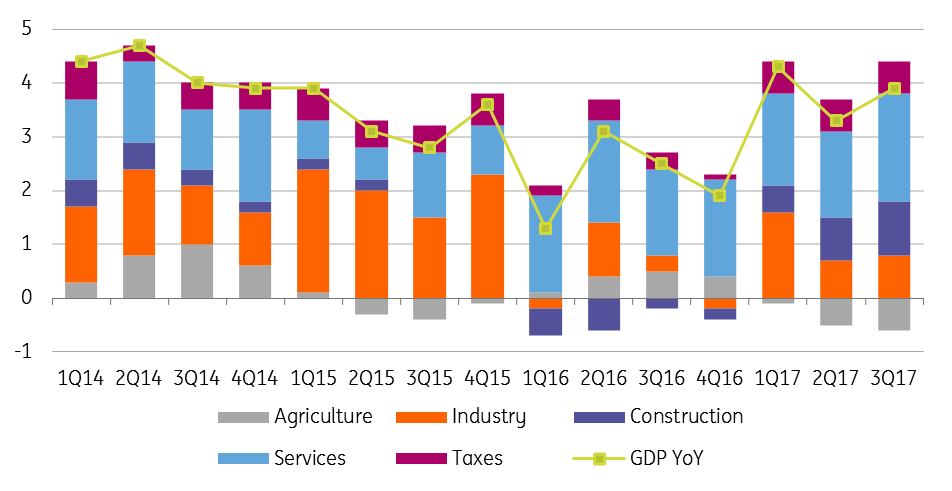

Production details revealed no big surprises. Reflecting the speeded up allocation of EU funds (pre-financed by the government), capacity enhancements in manufacturing, and a revival of the housing market, construction sector performance increased by 28.3% YoY in 3Q17, enhancing GDP growth by 1.0ppt. The added value of industry increased by 3.7% YoY, showing acceleration. Industry contributed to economic activity by 0.8ppt in 3Q17. Agriculture was a more significant drag on growth than in the previous quarters (- 0.6ppt), due to the base effect of the record year in 2016. The services sector has remained the main factor driving economic activity, with a contribution of 2.0ppt, showing a 3.8% YoY growth. The increase in real disposable income due to the strong labour market is fuelling the increase in consumption of services.

Production contributions to GDP growth production (% YoY)

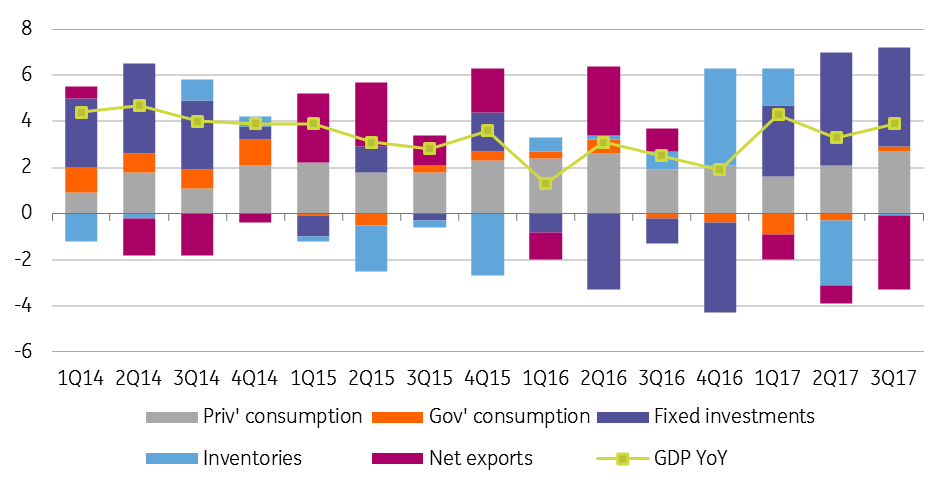

The structure of the expenditure side is roughly in line with that of production but contains some eye-popping developments. Firstly, the strong domestic demand which has a significant import ratio, and a weakening export activity (despite the acceleration in industry) translated into a significant negative contribution by net exports. Foreign trade dragged GDP growth by 3.2ppt, a scale not seen since 2003.

Signs are pointing towards an acceleration in economic activity

Actual final consumption reached a 2.7ppt contribution, 0.6ppt higher than in 2Q17 and a ratio not seen since 2006. This is mainly due to the remarkable increase of social transfers in kind. Government consumption rose by 2.5% YoY, in line with the new financing system of EU projects. In line with the flourishing construction sector, investments jumped by 20.3% YoY, translating into a 4.3ppt contribution to GDP growth. Domestic use as a whole added 7.1ppt to the 3Q17 GDP growth.

Expenditure contributions to GDP growth (% YoY)

Positive economic momentum proceeds in 4Q17

We expect economic activity to strengthen further in 4Q17, with GDP growth accelerating to 4.2% YoY. We do not expect any significant change in growth structure, thus domestic demand will remain the driver with net exports being a drag. We see upside risk surrounding our forecast as the 3Q17 data was much better than expected. As regards the high-frequency data and our LeadING HUBE indicator, we have seen encouraging signs too, so far.

Changing growth structure in 2018

After a 3.9% YoY growth in 2017 as a whole, we might see another year of near-4% YoY economic activity. The story, however, might be the shift in the structure of GDP growth. As the base effect won’t so favourable in 2018 when it comes to domestic demand (especially investment activity), we see its contribution to GDP growth shrinking. However, it will remain strong as real net wage growth is expected to be around 7-8% in a negative real interest rate environment. This should drive consumption. Investment activity will increase by around 8%, mainly fuelled by EU projects. Upside risks prevail in the private sector as the housing market is up and coming. On the external demand side, we see the stronger external activity to help the export sector, where the newly built capacities should provide enough room to increase production. Taking into consideration the high import ratio within domestic demand, we see import growth to keep pace with export growth in 2018, showing a slight but positive contribution from net exports.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more