Hungary: Consumption drives GDP growth

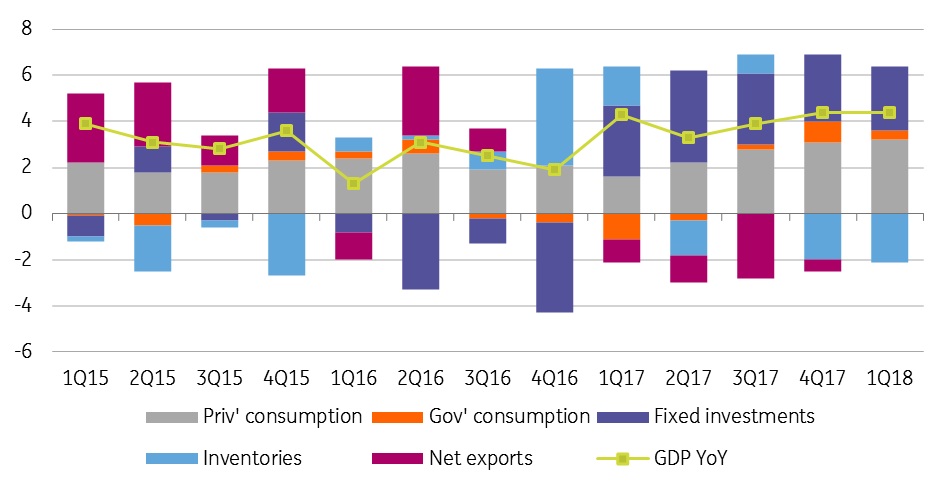

The economy started 2018 exactly where it left it last year but the growth structure is becoming slightly imbalanced as consumption is responsible for an increasing slice of the growth

| 4.4% |

GDP growth (YoY)Previous (4.4%) |

| As expected | |

Services in the focus

The second 1Q18 GDP release caused no surprise as the Hungarian Central Statistical Office (HCSO) left the 4.4% year on year advance reading unchanged. The details are also roughly in line with expectations, as domestic demand remains the main driver.

Services sector provides the majority of economic activity

On the production side, we would like to highlight the significant and increasing contribution of services, making the growth structure more and more imbalanced. Services provided a 2.6ppt contribution to GDP growth - the strongest figure since 4Q13.

Information and communication, trade and accommodation as well as food service activities played a leading role. The former sector could benefit from digitalisation led by labour shortage, while the latter is thriving on the improvement of households’ income position.

Contribution to GDP growth - production side (% YoY)

Construction slowed down to 22.5% YoY in 1Q18 due to the high base but was still mainly driven by the drawdown of EU funds, thus infrastructural projects.

The increase of value added in industry underperformed the average growth of 2017, marking a 2.0% YoY activity, one of the weakest starts in the last few years. The contribution of the industry and construction to the GDP growth was only 1.0ppt, in a fifty-fifty proportion between the two sectors. Agriculture has started this year in relatively good shape, posting a 0.6% YoY decrease in added value.

Due to the small weight, the effect of the sector remained neutral. The contribution of net taxes on products reached a remarkable 0.7ppt. As this is the income of the government, we see this as a sign of the increasing extra revenue due to the combination of two things: (1) strong economic performance and (2) the retreat of the shadow economy.

One-sided economy

Taking into consideration the expenditure side, the main drivers behind the GDP growth have remained domestic factors. Private consumption reached 3.2ppt contribution, the highest since 2006. This is due to the significant pickup in the labour market and the constantly increasing wage bill combined with a high level of propensity to consume.

The expansion of government consumption also helped the economy with its 4.6% YoY growth, translating into a 0.4ppt contribution to economic activity. The strong spending before a general election is a well-known pattern in Hungary.

Contributions to GDP growth – expenditure side (% YoY)

In line with the strong performance by the construction sector, investments rose by 17.1% YoY, causing a positive surprise. Fixed investments had a 2.8ppt contribution to GDP growth. The domestic use added 4.4ppt to the 1Q18 GDP growth, as net export had a neutral effect.

Both export and import activity slowed down remarkably, posting one of the weakest quarter in the recent history of foreign trade. This is however in line with the disappointing performance by industry.

Changing growth structure in 2H18

After the strong, 4.4% YoY GDP growth in 1Q18, we could see another year of 4% or even better economic activity. The outlook is still rosy as we see the wage bill to increase further mainly on the back of wage growth and partially due to more improvement in employment.

We see GDP growth at 4.2% YoY in 2018

Regarding the strong base effect in fixed investments, we expect contributions to weaken somewhat. Investment activity will increase by around 13% YoY after the 17% jump in 2017, mainly on infrastructural projects. Upside risks prevail mainly due to the soaring housing market. On the external demand side, we expect new manufacturing capacities to enhance export production gradually through the year.

We see a high probability of net export being a slight positive contributor to the GDP growth in 2018.

Growth to remain in the 4% territory in 2Q18

We expect economic activity to slow down to 4.0% YoY growth in 2Q18 but don't expect significant changes in the structure as domestic demand will continue to be the main driver.

We see upside risks surrounding our forecast as the 1Q18 data was better than expected. Net export might surprise on the upside if new capacities started producing earlier than expected.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more