Hungary: All sectors take a hit

The Statistical Office left the advance GDP growth estimate unchanged at 2.2% year-on-year in 1Q20. The details show that no sector has remained unscathed by Covid-19

| 2.2% |

GDP growth (YoY)Consensus 2.2% / Previous 4.5% |

| As expected | |

Services help on the production side

The first estimate made by the Hungarian Central Statistical Office (HCSO) remained unchanged at 2.2% YoY. The first quarter performance was solid thanks to a strong start before the Covid-19 related lockdown measures kicked in.

On the production side, the value added of services increased by 2.4% YoY, showing a significant deceleration from previous years. Full employment and strong wage growth fuelled demand for services through the first 10-11 weeks in the quarter before lockdown measures took effect. The 1.2ppt contribution to GDP growth was the single most important contributor. However, we can’t say that industry and construction was weak. Value added growth in industry slowed, but the 1.7% YoY performance is still good given that supply side constraints hit the sector earlier than the local curfew measures.

Construction was at a disadvantage given the outstanding performance in the same period of the previous year (44.5% YoY), so the 3% year-on-year increase in value added in 1Q20 is still remarkable. All in all, industry and construction helped GDP growth by 0.4 and 0.1ppt, respectively. The balance of taxes and subsidies helped growth (0.5ppt) due to the positive carry-over from economic activity of the previous quarter. The only sector without a positive contribution in 1Q was agriculture.

Contributions to GDP growth – production side (% YoY)

Expenditure side is a tale of two cities

On the expenditure side, the main driver behind GDP growth remained domestic use (actual final consumption and gross capital formation), which added 3.8ppt to economic activity. At first glance, there is nothing strange about it, but the details show a major shift. For the first time since 2016, gross fixed capital formation decreased on a yearly basis, shaving off 0.6ppt from economic activity. The high base effect, large infrastructure projects largely coming to an end and delayed corporate investments due to Covid-19 all took a toll.

On the other hand, final consumption of households held up pretty well, showing a 4.3% YoY increase in the first three months of the year. Actual final consumption of the government also increased by 2.4% YoY, a mild downward surprise. We expected a slightly stronger contribution due to an increase in spending to defend against the coronavirus. The contribution of actual final consumption (including private and government) added a 2.8ppt impetus to GDP growth in 1Q20.

Inventories boosted economic activity by 1.5ppt. This is a result of the Covid-19 preparations, as demand started to fall and companies built inventories to be able to remain in business. Such a jump in inventories used to mean that a drop was in the making in forthcoming quarters, shaving off significant percentage-points from GDP growth.

Still, strong consumption and the increase in inventories pushed imports higher. On the other hand, export activity was disrupted by the global lockdown measures. The import and export of services dropped around 5% YoY, an effect of the standstill in tourism. Against this backdrop, the difference in the trade balance was remarkable, translating into a 1.6ppt drag from net exports in 1Q20.

Contributions to GDP growth – expenditure side (% YoY)

Recession is ahead

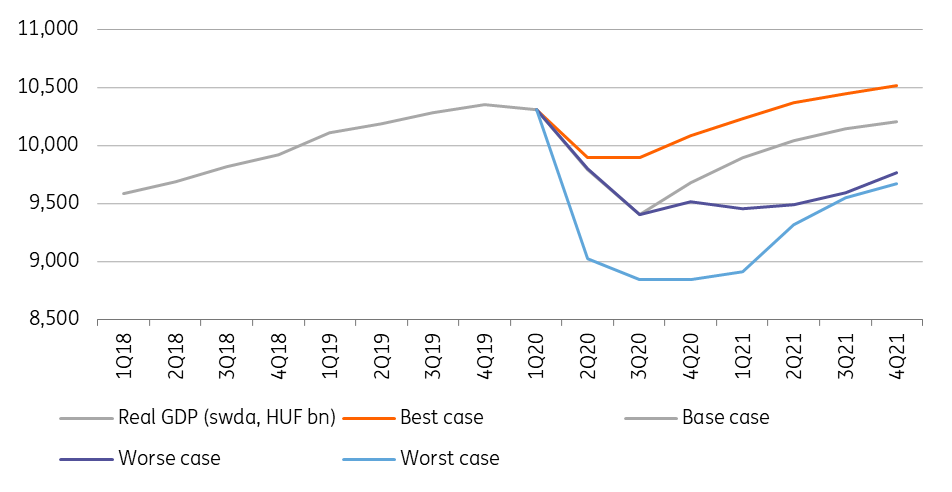

It was good to see that the Hungarian economy held up quite well in 1Q20, but the economic reality of Covid-19 will be revealed in the next quarter. We have several scenarios, based on how lockdowns, vaccination, social distancing etc, play out locally and globally. Our base case expects that the worst will be behind us by the second quarter and a mild rebound comes in the second half of the year. That would mean a 4.2% recession in 2020, followed by a 3% rebound in 2021. Should the winter fuel the spread of the coronavirus, worsening the outlook, we could face two years of GDP decline (-4.5% & -1.7%). In a worst case, this “crisis of confidence” could still morph into a deeper financial and economic depression, shaving off 9.4% from GDP in 2020 followed by -1.7% in 2021. Even in our base case scenario, we don't expect GDP to reach its pre-crisis level until late-2022.

The path of the Hungarian real GDP in our four scenarios

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article