How will the automotive industry recover from Covid-19?

How will the global auto industry recover from Covid-19? Already under pressure before the crisis, the future looks bleak. Major structural changes within the industry could come which will affect everything from production, demand for electric vehicles and supply chains. Download our full report here.

An industry already facing tough times

The global automotive industry was already in trouble before Covid-19 swept across the world. The trade war, environmental concerns and the search for future motoring among any other things were already weighing on sales. China, where the outbreak of Covid-19 began at the end of December, was the first country to go into lockdown, restricting travel, cancelling plans for Chinese New Year and shutting factories. While light vehicle sales had fallen by 18.6% YoY in January, February saw the biggest fall ever recorded in the time series, with sales contracting by 79.1%. Nevertheless, April sales recovered with light vehicle sales crossing the 2 million vehicle mark compared with sales of only 1.4 vehicles the month before, increasing by 4.4% YoY thanks to an uptick in commercial vehicles.

In Europe, demand for vehicles fell sharply in March with the EU light vehicle market contracting by 44% YoY as lockdown measures, closed dealerships and consumer uncertainty caused a drag, while in the US new passenger car and light truck sales plummeted by 47.9% YoY in April. These monthly declines resemble the industry downturn in 2008 and 2009 or are even worse. However, back then, production and public life did not largely come to a halt. So how will the automotive industry get out of this unprecedented crisis and will there be major structural changes?

Could there be a 'renaissance' of individual transportation?

Our full report, Covid-19's long term effects on the automotive industry, has all the details on each of these sections. First we ask whether Covid-19 could trigger a (temporary) reversal of trends such as car sharing due to social distancing? Not only have car sales already seen a large drop, demand for urban mobility concepts such as car sharing, ride-hailing or electric scooters has also been impacted. So while the cyclical slump does not really come as a surprise, the question is whether Covid-19 could lead to structural changes in shared transportation choices. Will there be a return of the car for personal use or will an increase in working from home post coronavirus reduce commuting of any kind, including with your own vehicle?

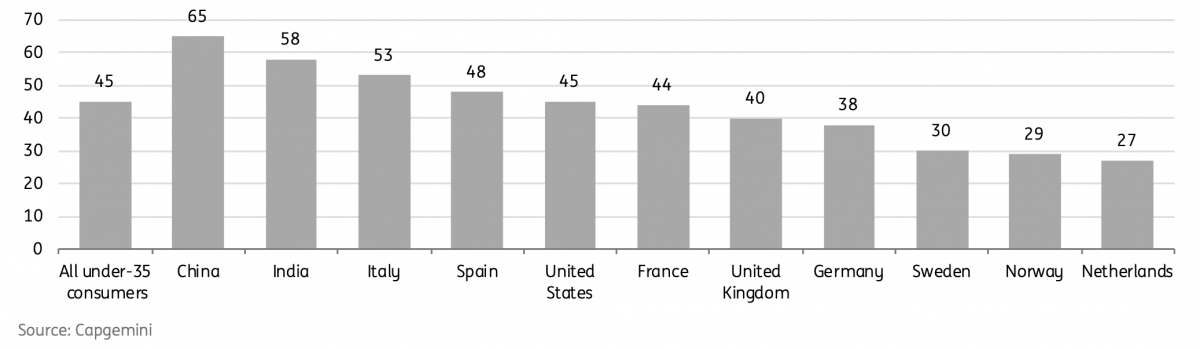

Percentage of potential car buyers under 35 years of age who are considering buying a car in 2020

The cyclical impact from higher unemployment and reduced income on the automotive industry

Due to lockdown measures in response to Covid-19, unemployment rates have increased exponentially worldwide. The effects of the crisis on the labour market are particularly evident in the US, where the number of jobless claims filed climbed to more than 35 million people since mid-March, while in Europe, the impact of the crisis can clearly be seen in the short-time work applications.

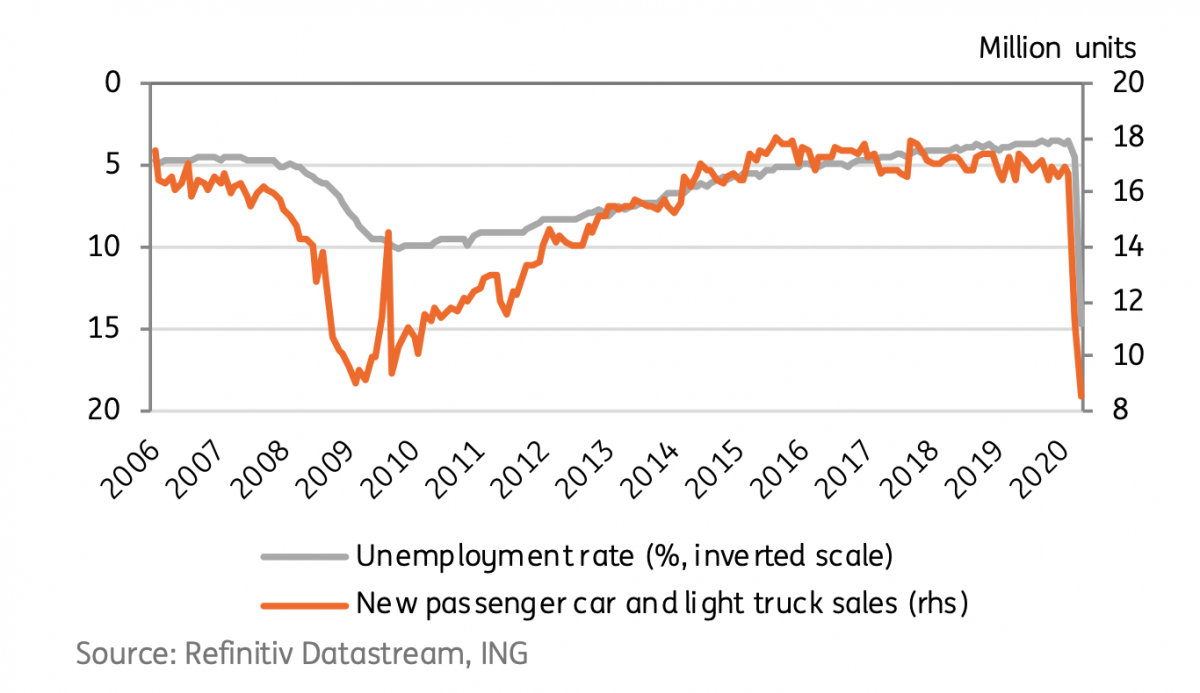

Higher unemployment clearly weighs on automotive sales. The damage induced by Covid-19 is already worse than that caused by the financial crisis which began in 2008. In March this year, consumer spending in the US dropped by 7.5 percent with the leading contributor to the decrease being spending on motor vehicles and parts. Sales of new passenger and light truck sales plummeted by 34 percent in March and a further 48 percent in April, while the unemployment rate shot up to 14.7 percent, the highest level since 1940. A similar picture is expected in Europe.

US: Unemployment rate and car sales, 2006-2020

Will demand for electric vehicles fall due to low oil price environment?

Oil prices have tumbled following ongoing supply and falling demand as a result of Covid-19. With continued low energy prices, the question arises whether electric vehicles (EVs) could suffer even more in what will be a sharp drop in global light vehicle car sales. While sales of EVs will suffer, the trend remains.

Last year, the share of EVs in total car sales across the EU amounted to 2% of total new car sales (from 1% in 2018). In Norway, the share of new sales is highest at 41% and the Netherlands follows with a share of 14%. Eastern European countries lag behind. The transition to EVs has begun to gain traction and various European countries have shown their ambition by mentioning future 100% electric sales targets.

We were expecting European new car sales to move in the direction of 100% electric by 2035. The price of oil is a cost factor for drivers and might influence choices when ordering a new vehicle. However, we do not believe there will be a deviation from the current electrification path, as we only expect it to experience a temporary slowdown. Despite low oil prices, we see three main reasons why the trend will not be affected.

Will supply chains be adjusted due to Covid-19?

Supply chains in the automotive industry are clustered in regional hubs, with the lion’s share of value added (ie, the production of vehicles from component parts) happening close to market. Even though inter-regional linkages contribute a smaller amount of value added than those within regions, their disruption has been enough to cause major issues across the industry. The outages in Hubei province forced some factories elsewhere in the world to stop work weeks before those in other countries as China began lockdown measures to stop the community spread of the virus.

The complexity of automotive supply chains makes it difficult as well as costly to make them more resilient to shocks. It is difficult to define how to mitigate the risks posed by future shocks that could happen within a country, region or, as with Covid-19, globally. With upwards of 10,000 suppliers in a vehicle’s value chain, organised across several tiers, there are further challenges in incentivising and enforcing de-risking comprehensively enough to cover all components.

Suppliers’ margins were being squeezed during the downturn in global economic activity before Covid-19

Suppliers’ margins were being squeezed during the downturn in global economic activity before Covid-19, making the higher costs of increasing resilience unaffordable without raising prices. There is considerable work and expense involved in finding and retaining suppliers, that need to be able to produce to detailed specifications and meet quality and safety standards. Holding larger inventories is another way of increasing resilience by helping production to continue amid disruptions upstream in the supply chain, but involves higher storage and working capital costs. Read more about this in our main report here.

The impact of Covid-19 on OEMs and auto part suppliers in a period of transformation?

With production stoppages, lockdowns and the sharp rise in unemployment, both car producers are burning cash supply and demand for Original Equipment Manufacturers and auto part suppliers has been heavily disrupted. In this environment, car producers are burning significant amounts of cash, as fixed costs and working capital need to be financed. Management teams have taken measures to preserve cash, including cutting costs and delaying non-essential Capex and R&D. Furthermore, car producers have been negotiating new credit facilities to shore up liquidity during these testing times.

Download our main report

The above is just a short summary of the main points in our major new report on the Automotive Industry and the effects Covid-19 are having on its full supply chain. Click here to download the complete analysis.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article