How will China’s new central bank governor run the new central bank?

With more responsibilities to regulate the banking and insurance sectors, how will Yi Gang - the new central bank governor run the People’s Bank of China?

Yi Gang, the newly appointed governor of the People Bank of China has been part of the bank for a considerably long time and is likely to continue the ongoing reforms laid out by governor Zhou Xiaochuan which should help smooth the takeover and minimise any uncertainties on interest and exchange rate markets.

Currently, there are three policies governed by the PBoC, namely, the monetary and exchange rate policies along with capital controls and the first two are under reforms.

Interest rate liberalisation

In the recent months, the central bank increased five basis points on the PBoC 7D reverse repo (2.5%), the medium lending facility (1Y 3.25%), the standby lending facilities (1M 3.35%) when the Federal Reserve raised interest rates last year. And since 2015, the PBoc hasn't changed its benchmark deposit and lending rates which sent a strong signal that not only is it liberalising deposit and lending rates, which should invite competition among banks but also changing policy rate tools to short-term interest rates.

We believe Mr Yi is likely to continue this interest rate liberalisation, and will finally name a single short-term interest rate as the policy interest rate. In the meantime, we believe the 7D reverse repo is the key policy interest rate to watch.

Exchange rate liberalisation

Another ongoing reform is the liberalisation of the exchange rate mechanism. The recent policy of resetting the counter-cyclical factor in the yuan fixing formula is a step towards exchange rate liberalisation, but this is still a very long road ahead for Mr Yi.

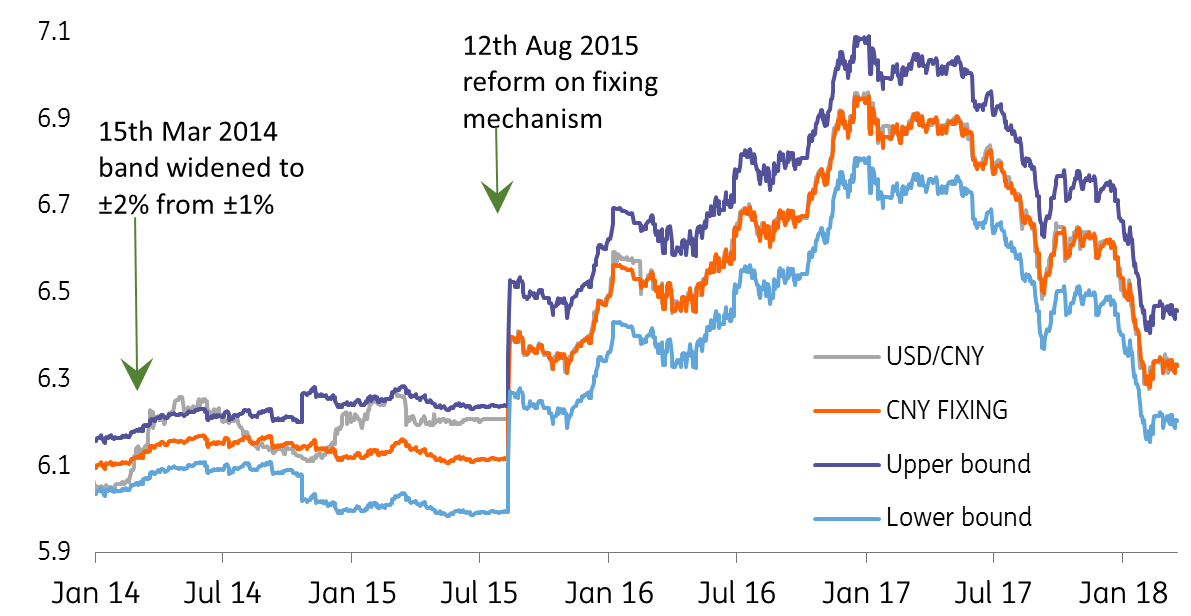

The central bank has claimed that the market is taking charge of the intraday momentum of USD/CNY, which should increase the volatility of the exchange rate. If this is true, it is still to be tested by major market movements. Since the depreciation of the yuan on 11th August 2015, the exchange rate liberalisation has moved backwards. The spot rate has stuck with the fixing, which means it does not touch the daily trading bands.

Yi Gang faces a tough job to allow the spot rate to move away from the fixing after the 11th August 2015 incident. If the spot doesn't show volatility, then there is no point to further widen the daily trading band.

USD/CNY has yet to experience genuine volatilities

Capital controls

The PBoC, it is not independent of the government and this is crucial to understanding how the central bank tune the tightness when it implements capital controls.

When Xi Jinping would have had a very long tenure, and Wang Qishan becomes the vice president of China, the anti-corruption campaign might become at least as fierce as in 2017. But for now, it's possible we see a fresh round of capital flight from the new political environment, which means we might see a tighter implementation of capital controls. The expected appreciation of the yuan (forecast USDCNY at 6.1 by the end of 2018) should attract inflows, which should counter-balance the outflows.

Still, it is Mr Yi's job to skillfully manage the value of capital controls so that foreign companies don't complain they couldn't make outward remittances when required and given that Mr Yi was previously the head of SAFE, the body to control capital flows, he is well placed to do so.

Impact on financial markets now that the central bank is a financial market regulator

The central bank now has to take care of banking and insurance regulations - two new functions that will prevent Mr Yi from simply following the footsteps of Zhou Xiaochuan.

When financial products offered by banks and insurance companies could create credit risk, liquidity risk and market risk in the interbank it is reasonable to assume that the central bank to have better say on the regulations of banks and insurance companies.

The apparent impact is that there would be more controls on shadow banking, e.g. regulating issuance and underlying assets of wealth management products and insurance products. This would extend to capital and liquidity requirements of banks and insurance companies. We can think of a few results. 1) With decreasing number of wealth management products in the market banks may start to raise deposit rates. 2) PBoC would continue to tighten liquidity in the interbank to drive out poor credits as underlyings of wealth management products, which would directly push up short-term interest rates. 3) For banks, fewer product sales could mean lower fee income, and banks would turn to look for increase interest income to stabilise bottom line, but deposit costs are on the rise. The central bank might need to react to the dynamic changes because that could incur higher credit risks.

This is positive for the long-term growth of China's financial system as we see this as part of the financial deleveraging reform. But these functions are not only new to the central bank but also brand new to Yi Gang. We expect the central bank to be on the cautious side, i.e. to minimise the risks we mentioned when it comes to regulating banks and insurance companies. However, over-regulating the two sectors would create slow growth and innovation in financial products and the financial market.

We stick to our forecast that the PBoC is likely to follow the Fed's footsteps to hike four times but each at five basis points to keep the interest rate spread between China and US stable. We also believe that the yuan will continue to appreciate to attract inflows counterbalancing outflows. We hold our USD/CNY forecast at 6.10 by the end of 2018.

We believe Mr Yi will continue the reforms laid out by Zhou. But the new functions mean he has new challenges, and we think he will start with caution to minimise the risks.

Download

Download article

21 March 2018

In Case You Missed it: This is just the beginning This bundle contains 7 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).