How the manufacturing industry can tackle circular challenges

Circular innovations in manufacturing are often complex and costly, while customers are unwilling to pay extra for more circular products. There are opportunities for circular acceleration, but these require strategic choices and tangible steps toward value retention

For manufacturing companies, a different perspective on the value proposition offered – the package of 'benefits' that a company offers its customers – can increase both value creation and value retention and thus the degree of circularity. A shift in focus from maximum product sales to more sustainable customer solutions, and from a production-oriented approach to a more service-oriented approach can achieve a great deal – not only greater circularity, but also improved revenue, customer relations, and a more stable cash flow. In addition, it is important to take more low threshold steps and to tackle avoidable loss of product value already in the design phase by means of circular design strategies.

Circularity: How the manufacturing industry is performing

In a 2021 publication, we argued that, despite ambitious policy goals, the EU and UK are making slow progress towards a circular economy. Circularity is a crucial part of the strategy to achieve a climate-neutral society by 2050. But so far, reducing material consumption has lagged behind reducing and greening energy consumption. Judging by the circularity rate – or used materials rate – most European economies are steadily increasing their circularity. However, on average, this has only led to a limited reduction in material consumption within the EU by 2020. The UK has made a noticeable improvement but is trailing four countries in terms of recycling. In fact, both the UK and EU have produced a higher amount of waste in recent years.

What prevents manufacturers from taking circular initiatives?

Markets for more circular products generally do not emerge spontaneously. The negative externalities of raw material extraction and processing, such as damage to nature and the environment, and climate change, are not yet sufficiently reflected in the prices of linear products and services. As long as this is the case, a more circular product will often be a relatively expensive option. The creation of markets for more circular products is hampered by both supply and demand factors.

Supply-side obstacles:

High costs...

Pursuing circular initiatives usually results in higher operating expenses due to:

- High transaction costs: Higher costs for locating reusable goods, finding suitable partners, organising return logistics to enable reuse, and negotiating the terms of the collaboration. First movers are also confronted with relatively small purchase quantities and development costs.

- High operational costs: The actual collection and sorting of reusable products, parts and materials has associated costs. Moreover, the international nature of value chains often makes it difficult and more expensive to trace product origins and manufacturing methods.

...and complexity of implementation

Circular strategies still often require intense cooperation between parties who dare to stick their necks out. In addition to the often higher costs, an abundance of caution, lack of knowledge and skills, and insufficient coordination in the production or value chain still often form too great a barrier for the development of more circular products.

Demand-side obstacles:

Uncertain benefits due to higher product prices and price-conscious customers

For many consumers, price is a decisive factor when making purchases. According to previous ING research, for example, 54% of consumers still prefer cheap, short-lived clothing, food or electronic devices over more expensive, longer-lasting versions. This results in price pressure for manufacturers. However, circular awareness among consumers seems to be growing, and there are indications that consumers are increasingly willing to pay a little more for sustainable products.

Which developments facilitate circularity among manufacturing companies?

1. Governments push for circularity

The European Commission and the UK government are committed to moving towards a more circular economy. The most concrete manifestation of this policy is the circular procurement by governments and the requirements for recycling and the use of recyclate in plastic and the tax on plastic packaging. Based on its ‘Green Deal’ and ‘New Circular Economy Action Plan’, the EU is formulating further rules for electronic devices with a focus on repairability and product life extension. The EU Taxonomy establishes criteria that make it possible to classify business activities as circular or non-circular.

2. Digitalisation: data usage and software updates can extend the life of parts and products

Installations in modern factories are becoming increasingly complex and generate massive amounts of data. Electronics, such as integrated software and sensors, can provide critical information about a machine, facilitating life-extending (‘predictive’) maintenance techniques. This can promote more circular use of materials because parts replacement is required less frequently, so fewer parts are used overall, and the replacement of the entire product is necessary less often, which increases its service life and reduces material consumption. Additionally, updating control software allows manufacturers of consumer electronics and capital goods to improve the performance of their products, extending their lifespan before being replaced.

3. Servitisation: offering product use as a service creates circular incentives

Rising technological complexity and far-reaching specialisation increase the ‘knowledge gap’ between manufacturer and user. Manufacturing companies are increasingly providing services alongside the installation of a product, such as maintenance or training in the use of the product. Trends such as ‘product as a service’ along with customer demand for flexible solutions bolster this development. In a circular scenario, the manufacturer may retain ownership of the product and only receive payments for its use (the service provided). The manufacturer – and product owner – then has an incentive to extend the product life and thus postpone more expensive replacements as long as possible.

The strategic steps manufacturing companies can take towards greater circularity

A different value proposition for more value creation and retention…

For manufacturing companies, a different perspective on the value proposition offered – the package of 'benefits' that a company offers its customers – can increase both value creation and value retention and thus the degree of circularity. For example, additional after-sales service can lead to more sustainable use of a delivered machine or appliance, because it is then used correctly and more preventive or predictive maintenance is carried out. The manufacturer’s suppliers can also develop their components or semi-finished products in such a way that they last longer. Consider, for instance, a coating – or better yet, a biodegradable coating – that improves the wear-resistance of a metal part.

…can lead to circular and business benefits

A different perspective on the value proposition can lead not only to circular benefits but also business ones. This starts with a better understanding of customer needs. The customer has a need for a solution to a problem that can be in many different ways. For example, the customer may want a certain task or process to run smoothly, but may not care whether he becomes an owner of the product or just purchases a service using the product.

Three important reasons for servitisation and ‘as a service’

In practice, service innovation often proves more profitable than product innovation. There are important reasons to consider a servitisation or as-a-service (PaaS) model:

- Stronger relationship with the customer: Even after the deal has been closed, customer contact continues regularly, for example by providing repair and maintenance services. Many companies do not know their customers well enough and do not know exactly how their products are used. For example, a manufacturer of air conditioning systems told us he never saw his product again after installation. It is very instructive to look at where your products are and how they are used. This results in a lot of – often negative – feedback from users, but also provides valuable product and customer information.

- Less volatile cash flow: A manufacturer can create a more stable cash flow over a longer period of time because they are not only paid at the time of purchase but also receive periodic payments for the services rendered.

- Step towards a circular model: It helps in the development of a circular business model. Maintenance extends the service life, and taking the machine back makes its reuse possible, in part or as a whole.

The practical steps that have the greatest impact

A transition to servitisation is almost always a complex network operation, involving customers, suppliers and new partners. In contrast, setting up one circular activity, such as refurbishment, is largely an internally focused activity that is much less far-reaching. In that case, changes to the business model are limited to purchasing, relationships with partner companies and internal activities such as repair and replacement of parts. This makes such practical circular innovations more attainable for manufacturing subcontractors and smaller manufacturing companies.

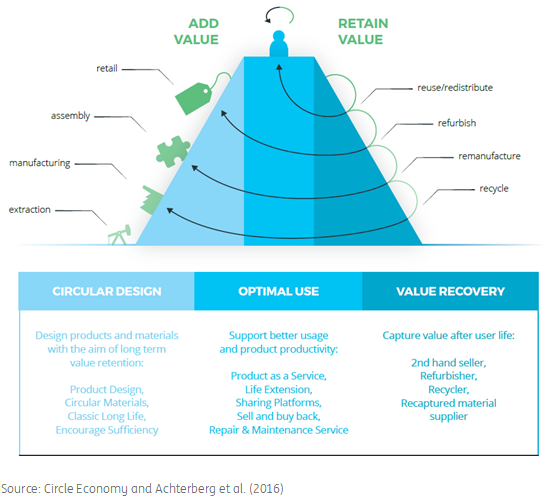

Circular steps on the ‘value hill’

The value hill concept can serve as a guide for putting circularity into practice. The central theme is value retention. Recycling – already widely implemented – is only a jumping-off point. Manufacturing companies that are truly committed to pursuing circularity make value retention a priority and organise their activities in such a way that they gradually become more circular. The value hill offers the necessary starting points.

Activities aimed at retaining the value of products on the ‘value hill’

1. Focus on value retention: identify loss of value

In circular innovations, the focus is on preserving value. In order to increase value retention, it is important to determine what loss of value occurs at the time of production, during product use and after product use. Focusing on this from the product design stage is the best way to prevent unnecessary loss of product value.

2. Create a circular product design

Circular product design focuses on business activities in a product’s design, production and distribution phases. Various circular design strategies are possible:

- Design for product bonding and trust: design products to last longer and to be handled with care by the user.

- Design for product durability: design more robust products.

- Design for standardisation and compatibility: design modular products with standardised components or interfaces that fit with other products.

- Design for ease of maintenance and repair: design products so that they are easier to maintain and repair and thus easier to keep in good condition.

- Design for upgrading: design products so they can be adapted through future modification or upgrading.

- Design for dismantling and reassembly: design products so they consist of as few different – and preferably reusable – materials and components as possible, with connections that are reversible.

3. Optimise product use

At the top of the value hill, the use phase can be made as long and intensive as possible so that there is no loss of value and fewer products and materials are needed overall. Three circular business models are useful in this regard:

- Product life extension: maintaining, repairing, modernising and reusing products or components.

- Sharing platforms: facilitating increased product utilisation via an intermediary platform.

- Product as a Service (PaaS): providing access to products instead of ownership, through rental, lease or pay-per-use arrangements.

4. Minimise loss of value at end of life

Down the value hill, there are various ways of restoring or recovering product value. All the way at the bottom is recycling (see also the R-ladder). The downside is that by the time recycling occurs, a lot of value has already been lost. Reuse, refurbishing and remanufacturing provide greater value retention and often require less energy to put the old materials or product components back in use. Large manufacturers, such as Philips and Bosch/Siemens, are developing – in addition to ‘access for service’ concepts – use cases for the reuse of complete systems, components and materials.

Finally: organise circularity in cooperation with suppliers and external partners

A more circular approach to manufacturing can only be achieved by working together with partners. These include suppliers, customers and supporting network partners, such as recycling companies and financial backers. Cooperation proves to be an indispensable element of all circular innovations.

Vepa puts circularity in practice, thanks in part to circular tenders

Dutch furniture maker Vepa is benefitting from the increasing number of customers opting for circular alternatives. The government also plays an important role in this. Vepa is already well on its way to completely waste-free business operations by using its own residual flows and those of third parties as raw materials for new products. Vepa’s chief executive Janwillem de Kam says: “We achieved this by working with regional partners to reuse residual materials in innovative ways. We make pressed tabletops out of our own wood waste, acoustic fillers from our upholstery offcuts, new parts from steel waste and a whole new furniture collection from PET plastic that we fish out of the Amsterdam canals in partnership with Plastic Whale”.

From production to broader services

Unburdening customers by providing a complete solution rather than a product can have many benefits: more satisfied customers, more revenue, and opportunities for a more circular approach. Aebi Schmidt, which produces gritting machines and sweeping machines, among other things, now offers the municipalities it serves not just machines but a way to get roads clean as quickly as possible. By providing intense support, through logistics advice and training in the proper operation of the machines, for example, Aebi Schmidt was able to optimise driving routes, which in a specific situation reduced the number of required machines from 20 to 18, making the overall operation much more economical and sustainable. Vanderlande has also found that providing a service can prevent less than optimal use of delivered products. This approach also saves a lot of material and energy at Vanderlande. Both companies operate a business model that combines servitisation with sustainability.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article