How net flows can help keep 10Y Bunds over 0%

Already caught in the slipstream of globally rising rates, a deteriorating overall net flow backdrop in eurozone government bonds should contribute to keeping the 10Y Bund yield above 0%

Why the ECB has been reluctant to abandon the 'transitory inflation' story

There has been a significant rise in interest rates since mid-December. The shifting policy stance of major central banks in light of high and more persistent price pressures than anticipated is one factor, which German Bunds have not escaped.

Though European Central Bank policy tends to lag behind its Federal Reserve and Bank of England counterparts, as policymakers have been more reluctant to abandon the transitory inflation picture, the 10Y Bund yield has now crossed over the 0% line.

One reason for this is that even while clinging on to the ‘transitory inflation’ story, the asset purchase programmes have been scaled back considerably, the trajectory laid out suggesting an end of net asset purchases by the end of this year.

The asset purchase programmes have been scaled back considerably

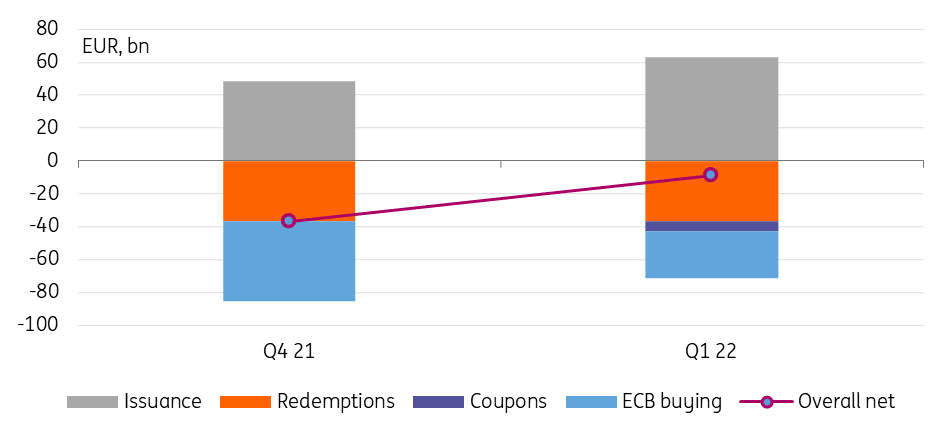

And this already impacts the near term cash flow picture for Bunds. In the final quarter of 2021, German central government gross capital market issuance amounted to €48.5bn. We estimate that the ECB bought an almost equal amount of central government longer-term debt over the same time via the pandemic emergency purchase programme (PEPP) and asset purchase programmes (APP). Taking into account that bonds worth €37bn matured, the overall outstanding market size of Bunds shrunk by around that magnitude in 4Q21.

German net flow picture deteriorates considerably in 2022...

The ECB has created facts on the ground by plotting a path towards ending QE

The first quarter of 2022 paints a less favourable flow picture for Bunds

The first quarter of 2022 paints a less favourable flow picture for Bunds. Issuance is seasonally higher, factoring in the possibility of syndicated deals potentially above €60bn. While redemptions are at a similar level to 4Q21 coming in at €36.5bn, and coupon payments lend some additional support, ECB buying should slow noticeably – we reckon that Bund purchases will barely reach €30bn. That would put the overall net flow into the vicinity of minus €10bn, still negative but significantly less so than the minus €37bn of the previous quarter.

For the entire year we are looking for an overall net flow in German government bonds of minus €20bn. Taking into account the German debt agency's stated aim of reducing its own holding created during the crisis by €20bn per year, the outcome would be a largely balanced flow picture, contrasting an ultra-supportive minus €130bn estimated for 2021. In other jurisdictions outside of core eurozone countries, most notably France, we are expecting a more obvious flip into a positive cash flow that investors will now have to absorb.

Some countries will see net flow flipping positive in 2022

Core market government cash flows to investors after central bank purchases are still negative but definitely less so. Given the amounts that central banks have accumulated, the stock holdings and reinvestment flows have become more important factors, but we think this will contribute more towards the outperformance of bonds versus swaps and help drive a wedge between EUR rates and their USD and GBP counterparts. It will not, however, help EUR rates escape the reality of overall rising rate levels in the face of central banks' need to tighten their grip on monetary policy. We see 10Y Bund yields ending 2022 at 0.2%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article