Hong Kong quarterly: which industries will survive the deep recession?

Trade war. Social unrest. Covid-19. These three hits to Hong Kong's economy have resulted in a difficult recovery path. Now, Covid-19 has subsided but social unrest has returned, and there may still be a trade war with the US. Here, we look at which industries have been hurt the most and which ones will hold up better

Hong Kong has had difficulty coming out recession

The economy has been in recession since 3Q19, and fell by -8.9%YoY in 1Q20, which is the deepest contraction since 1974 when the data was first compiled.

The trade war clearly hurt economic growth in 2019, with GDP growth of just 0.7%YoY and 0.4%YoY in the first two quarters of 2019, respectively.

The arrival of social unrest, together with the trade war, brought the economy into recession, with drops of -2.8%YoY and -3.0%YoY in the third and fourth quarters of 2019.

Then came Covid-19.

But just as the pandemic seems to be subsiding in Hong Kong, social unrest is returning. We expect full year GDP growth at -4.1%. This is based on the assumption that there will be no material trade war between China and the US.

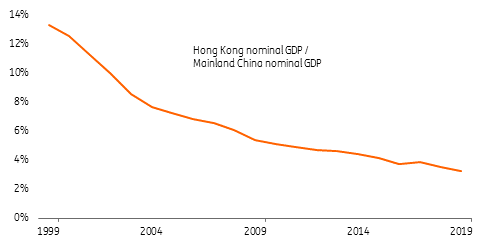

Hong Kong‘s importance to Mainland China in terms of GDP

Who's been hurt most?

Looking at the damage to industry, we believe that a better gauge would be employment data. In Hong Kong, redundancy costs are not as high as in Europe. So when businesses expect a long term downturn, they hire fewer people or even lay off staff.

Industries affected by the trade war

Hong Kong has only a tiny manufacturing sector, so essentially we can describe Hong Kong as not having factories. It provides services to merchandise trade, e.g. sourcing, shipping, port service, freights and trade finance. The number of companies in import/export trade and wholesale fell 2.8% in 2019 compared to 2018. This does not sound a lot. But the number of people employed in this industry fell 7.3%, (around 39,000 people).

The impact of the trade war is therefore large. It's still uncertain whether there will be a new round of tariffs between China and the US. If that happens, it will be the fourth hit to Hong Kong's economy.

Industries affected by social unrest and Covid-19

Attracting Mainland tourists to shop in Hong Kong was a comparative advantage over many other economies in the world due to the lower travel costs, a high standard of restaurants, good services, and no value-added tax. This made Hong Kong appealing to Mainland tourists who want a luxurious shopping experience.

But with social unrest increasing from the second half of 2019, this advantage has gone. While Hong Kong and Mainland China may relax quarantine measures and travel restrictions for each other fairly soon, Mainland tourists are unlikely to visit Hong Kong if the threat to personal security persists.

Social unrest in Hong Kong has been rare in the past. Even the 2014 Occupy Central protest was a very peaceful one. But since 2019, demonstrations have become increasingly violent. Many shops and restaurants closed early to avoid damage. The unemployment rate in the category of retail, accommodation and food services increased from 3.6% at the beginning of 2019 to 6.1% at the end of the year.

Covid-19 further hit the tourism industry and local retail and catering businesses. Unemployment in this category rose further, to 6.8% by the end of March 2020, which was higher than the headline unemployment rate of 4.2%.

As such, airlines, retail and catering will continue to be hit. These industries rely on domestic demand, which is under threat due to high unemployment.

Which industry stands out?

Hong Kong should continue to leverage its financial and legal system to serve the offshore financial needs of Mainland companies. This will continue unless Mainland China’s financial system matures, e.g. via interest rate liberalisation. Hong Kong could have another 10 years to enjoy this privilege.

Businesses of residential property developers should be fairly stable because the unemployed are mostly in the low-income group, which could not afford to buy a private flat even before the triple hits to the economy. But property investors of commercial and retail could stay on the sidelines as they wait for the social unrest to fade and to see how the trade conflict pans out.

While there are policies to encourage the development of technology as an industry in Hong Kong, Shenzhen is located very nearby, and there is already a cluster of well-established tech companies here, as well as a pool of talent from other cities in Mainland China and from the rest of the world, including Hong Kong. As such, Hong Kong can't really compete on this one.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 May 2020

Covid-19: What you need to know This bundle contains 10 Articles