Hong Kong’s future amid protests and a trade war

Hong Kong GDP rose 0.6% YoY in the second quarter, the same as in the first. The latest numbers reflect the impact of the trade war but don't take into consideration the effect of the recent political demonstrations on retails sales and associated jobs. We expect weaker data in 3Q as the protests could well continue at least until local elections in November

GDP report is weak for 2Q but that's just the beginning

- GDP grew 0.6% YoY in 2Q, the same very slow growth rate as seen in 1Q. The low base effect in 2Q has not given a boost to GDP growth.

- Investment is key to Hong Kong's future but its growth rate has gone down further to -12.1% YoY from -7.0% in 1Q.

- Consumption grew by 4.0% YoY, which was slower than the 4.5% growth seen in 1Q.

The direct damaging impact of the trade war

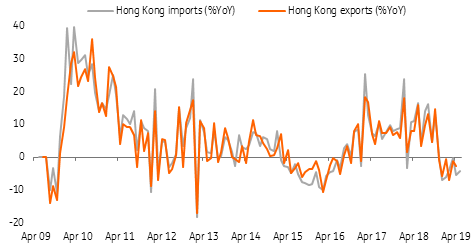

Tensions from the US-China trade war have hit Hong Kong's import-export environment. Total import and export volumes fell by 7.6% in 2018. Freight volumes will be lower in 2019. Moreover, the number of companies engaged in this industry has decreased by 1.5% year-on-year and by about 1% quarter-to-quarter, reflecting the issue of negative investment.

This fall in the number of firms also means fewer people are working in the industry. Employment in the sector fell by 3.6% year-on-year in March and was down by 2.8% quarter-to-quarter. In addition, the number of job vacancies in the industry fell in March by 10.5% year-on-year and was down by 3.2% quarter-to-quarter. Employment in this industry makes up 17% of the total employed population in Hong Kong.

As such, the impact of the US-China trade war on Hong Kong cannot be ignored. Trade-related industries' wage growth and job security will be at risk for the rest of the year.

Hong Kong export-import in contraction due to trade war tensions

Retail sales and tourism hit by protests

Retail sales in Hong Kong have suffered from four months of contraction. A further slowdown is increasingly likely for the rest of 2019 from slower wage growth in export-import trade as well as from protests that shorten shops' business hours, which could also hit employment in the retail industry. Less employment in the import-export sector will also weigh on the retail sector.

The protests are also directly affecting retail sales. Whether it is a small shop on the street or a shopping mall, most of them have had to shorten business hours as they wait for the protestors to leave. People working in the retail industry are also consumers. Retail makes up 8.4% of labour, and with the tourism industry, they make up a combined 15.8% of employment. When these consumers spend less then more shops will face increasing risks of closure; it becomes a vicious cycle.

I want to make an economic comparison between the political unrest to the period that Hong Kong was hit by the deadly SARS virus in 2003. Then, the unemployment rate was as high as 8.4%, a record for Hong Kong, and economically, there are similarities:

- Consumers stay at home, instead of doing shopping, even during weekends or public holidays.

- Shops shorten business hours or even close.

- The two events last for more than a month.

- Tourists avoid visiting Hong Kong

Though we do not believe the protests will hurt the retail industry as hard as SARS, if and when protests become more frequent (not just from Friday evening to Monday dawn). when they last longer than several months and as the become increasingly more combative, there will be even fewer shops open and there will be fewer consumers spending their money.

In short, the retail industry will continue to struggle until the end of the summer holiday or even until the local elections on 24 November.

Hong Kong interest rate trend to follow the US, only generally

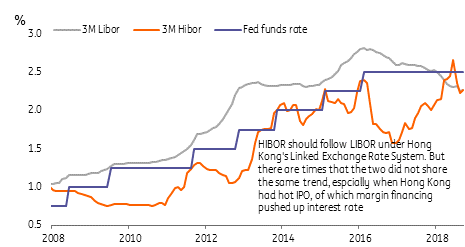

Because of Hong Kong's linked exchange rate, Hong Kong's interest rate trend is roughly in line with US interest rate movements, so HIBOR will follow the trend of LIBOR.

The market estimates that the Fed will cut interest rates two to three times during the remainder of 2019 (our house view is two cuts from the Fed). When the US cuts interest rates, the chances of interest rate cuts in Hong Kong's loan interest rates rise.

However, the current banking competition in Hong Kong is fierce and heavily affected by IPO margin financing. The overall borrowing interest rate could not necessarily be lowered. For example, when there is a hot IPO, margin financing will push up HIBOR even when LIBOR falls because of a Fed rate cut.

HIBOR does not always follow LIBOR

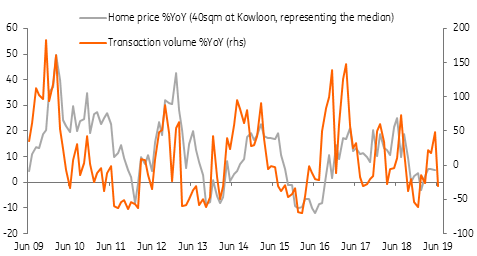

Property market is not going to shine even if the Fed cuts rates

However, if the interest rate on a mortgage is linked to HIBOR, the borrower should be able to enjoy a lower interest rate. So, is a Fed rate cut helpful to the property market? Not necessarily. Interest rates cuts usually reflect the central bank's view on the outlook for the economy. The Fed's cut is no difference. That is, the Fed is not necessarily optimistic about future economic growth.

In addition, the above analysis of a possible deterioration in the Hong Kong job market implies that investors will be more cautious when they invest in retail residential properties as well as offices.

The property market could be quiet for a while. If the number of unemployed or underemployed people continues to rise, I believe that there may be cases of bank foreclosures which will further depress property prices.

Residential property price and transaction volumes

Hong Kong economy in 2H19

We expect GDP in 2H19 continue to be weak. The good news is that the base effect will give a boost to the year-on-year growth rate.

With the base effect, Hong Kong GDP could grow around 1.4%YoY in 2H19. This is a revision from our previous forecasts of 2.0%YoY and 2.5%YoY in 3Q and 4Q, respectively.

We also revise the full year GDP growth to 1.0% from 1.8%.

Two factors to look for for the rest of the year:

- Progress on the trade war, which will affect the import-export business between China and Hong Kong.

- The frequency, duration and combative nature of the protests which could well carry on through the summer

Unless these factors fade, the Hong Kong economy will be weaker in the second half of the year.

Download

Download article

31 July 2019

Good MornING Asia - 1 August 2019 This bundle contains 5 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).