Hong Kong: Downgrading GDP forecasts

Hong Kong GDP growth was surprisingly slow in 3Q, at 2.9% year-on-year. Consumer spending has been growing at a slower pace and there are risks ahead, as the trade dispute looks set to hurt the economy through logistics, exports and eventually, wage growth in export-related industries. As such, we're cutting out forecasts

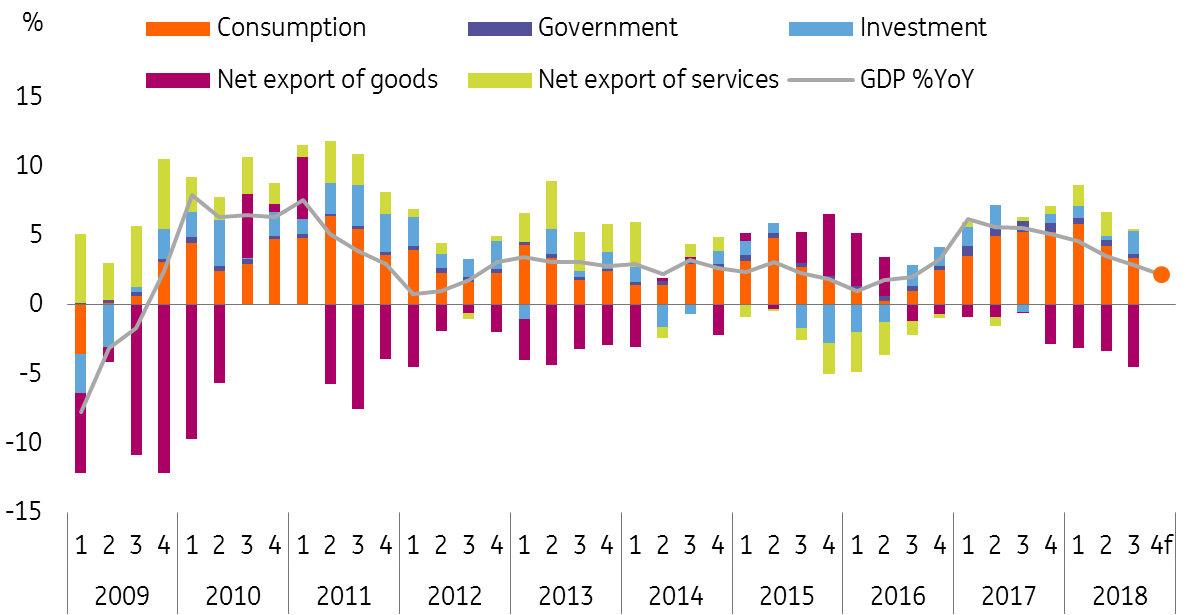

Hong Kong GDP growth slowed more than expected

GDP slowed to 2.9% year-on-year in 3Q18 from 3.5% previously. It was the slowest rate since 3Q16.

The main factor behind the slowdown was consumption. While this still grew 5.2% YoY in 3Q18, it was the slowest growth rate since 1Q17. We believe this is a result of consumers making large down payments on residential properties, which reduced the pool of money available for other purchases.

The other unexpected effect is that front-loading export activities in China have distorted export and import growth data. We believe that this distortion will continue in 4Q18 as tariffs on $200 billion of Chinese imported goods into the US will increase to 25% on 1 January 2019.

Consumption contribution slowed substantially

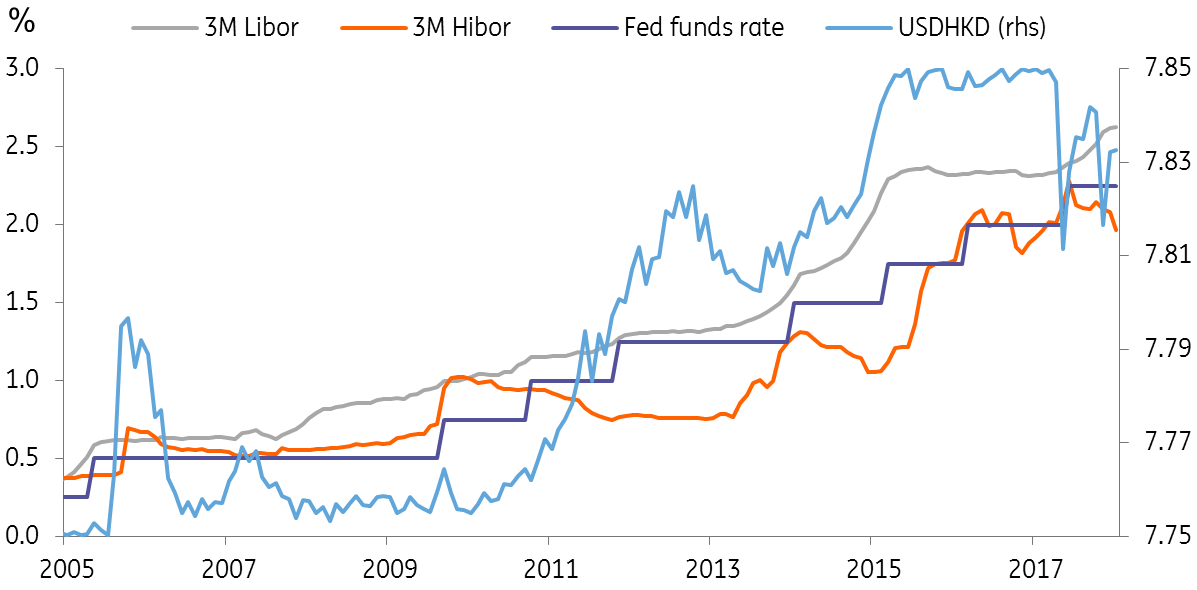

Rising interest rate during economic downturn

The exchange rate system is not helping the economy. As the Federal Reserve is going to raise the Fed Funds Rate into 2019, Hong Kong interest rates should follow suit in theory under Hong Kong's linked exchange rate system. That is, the economy faces a downturn at the same time interest rates are rising.

On the Hong Kong dollar, after sticking to HKD7.85 per dollar, the upper bound of the linked exchange rate system, the HKD is heading towards 7.80, the mid-level of the range of 7.75 and 7.85 (spot rate: 7.83).

There are opposing forces that are driving the HKD:

- On the one hand, falling interbank interest rates (HIBOR) attract activities that buy US dollars and sell HK dollars in the market.

- On the other hand, banks in Hong Kong have raised lending and deposit interest rates to close the gap of USD and HKD, and should strengthen HKD against USD.

Whether the HKD will continue to strengthen to 7.80 depends on whether banks in Hong Kong continue to raise interest rates when the next Fed rate hike arrives, possibly in December.

Fed funds rate is affecting HIBOR and hence HKD

Hong Kong housing transactions fall after prices reach high

Growth will be even slower in coming quarters

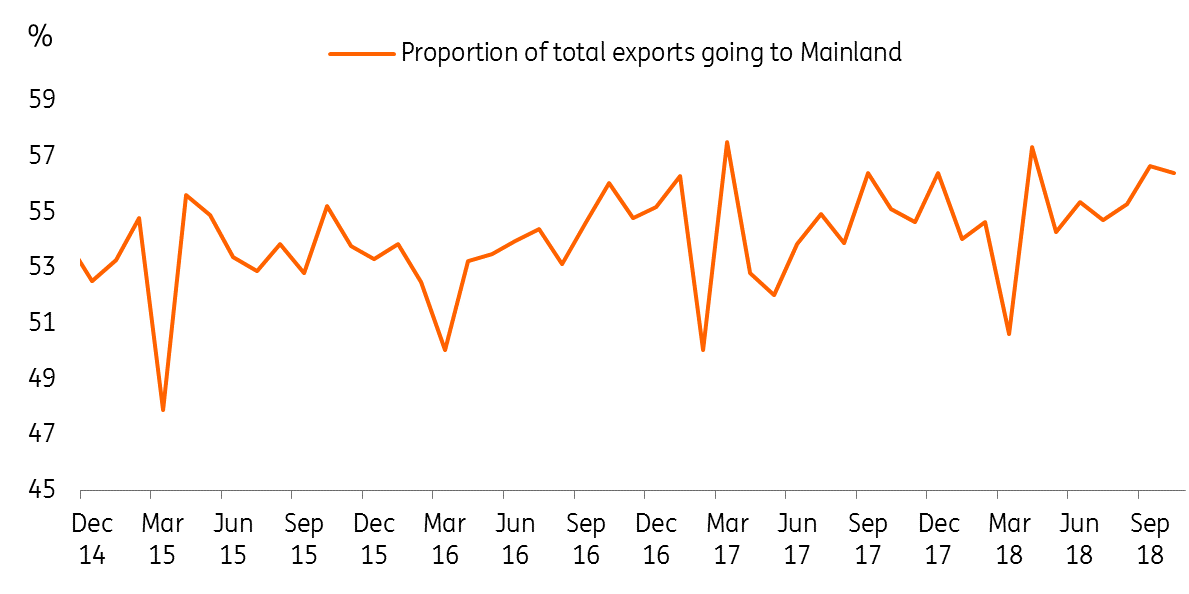

The trade dispute between China and the US will continue to hurt import and export activities as more than half of exports go to Mainland China. And consumption activities will still be constrained by the money that has been spent on down payments. These individuals will need to rebuild their savings pool and therefore are likely to spend less in coming quarters. In addition, a falling stock market and housing market could fuel a negative wealth effect, and hurt consumer sentiment.

To cushion the economy, we expect that the government will speed up the construction of public housing to cushion some of the negative impact.

Considering all these factors, we revise our GDP growth forecast downward to 2.2% YoY for 4Q18 from 2.8% YoY and to 3.3% for 2018 from 3.6%. For 2019, we predict growth of 2.2% compared to a previous forecast of 2.6%.

Hong Kong exports rely on Mainland China

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 November 2018

Good MornING Asia - 19 November 2018 This bundle contains 2 Articles