Clogged supply chains won’t hold back trade

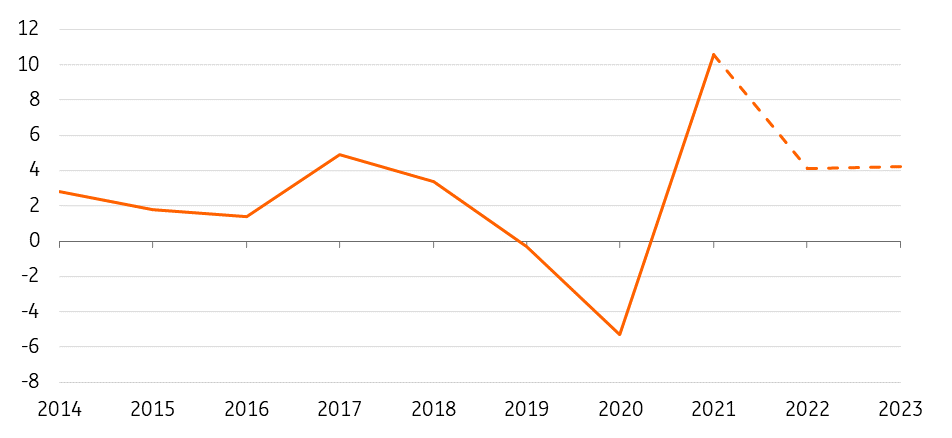

Demand for consumer goods rose strongly last year despite the profound disruption to supply chains due to the pandemic. We expect goods world trade volumes to have increased by 10.6% in 2021. For 2022, global trade should not only normalise in 2022 but continue growing despite still challenging circumstances

World trade normalises and continues to grow despite challenges

Going into 2022, we expect trade growth rates to return to their pre-pandemic levels in line with a continued but weakened global economic recovery. 2021 was an exceptional year driven by pandemic-related catch-up effects. For this year, we pencil in a growth rate in merchandise world trade of 4.1%, while we expect world GDP growth to come in at 4.4%.

Despite ongoing supply chain frictions and average containerised transport costs expected to remain high, a shift by consumers back into services will only be moderate in 2022 because of Covid caution. They might reduce some of their increased spending on the likes of electronics and furniture while resuming spending on services, while seeing higher energy and food prices. Overall, however, the preference for goods remains elevated as recent data on consumer spending in the US or the eurozone shows.

World trade in 2022: Return to pre-crisis growth rates

Global goods trade volume, %YoY

Asia to remain a driving force in 2022

Trade growth remains uneven, however, when you look at different regions. Intra-Asia trade still has strong growth perspectives, following an improvement in Asian industrial production over 2021 as well as significantly higher container throughput. A slowdown of economic activity in China, however, remains a concern for northeastern Asian industrial economies. Here, less real estate construction activity could be offset by more infrastructure investment though.

On a global level, we expect larger flows of oil and oil products alongside the global recovery of road and airline traffic and we think that China should remain a major driver of growth for metals stimulated by the energy transition. We expect global automotive production to increase by up to 10% and that will create extra trade volumes although the semiconductor shortage will remain a limiting factor. Lastly, the implementation of regional trade agreements in Asia and Africa will likely affect regional trade flows positively.

Supply chain slump and elevated tariffs will drag through 2022

Yet, a combination of shipping capacity and container shortages, unforeseen incidents and ongoing labour shortfalls which contributed to spiking container rates last year, might dampen our growth outlook. And 2022 started off with new records here. Based on UNCTAD data, those costs pushed China to Europe port-to-port container costs up to some 15% of the average value of goods transported (up from 2-3%).

The effect of massive port congestion occupying 10-15% of the global fleet capacity feeds back to that disruption. After Chinese New Year we do expect things to improve. But when spot rates come down, term contract rates of large shippers are still being negotiated higher. We concluded earlier that container rates will remain under upward pressure and won’t return to pre-pandemic levels anytime soon.

Risks ahead but trade fundamentals are still solid

The pandemic remains an uncertain factor affecting the outlook for 2022. Supply chain troubles and higher shipping costs also continue to pose risks to growth. At the same time, last year also showed this doesn’t necessarily hamper the world from continuing to trade. We're optimistic given the economic outlook, a hopefully receding pandemic, and clear evidence of richly filled order books. We expect trade volume growth to hold up well this year, resulting in a more moderate but still sound growth rate for world trade.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 February 2022

ING Monthly: The masks, and the gloves, are coming off This bundle contains 15 Articles