Commodities and the Russia-Ukraine crisis

As tensions between Russia and Ukraine grow, so does the risk that it spills over into global commodity markets. A conflict against the two nations and/or tough sanctions against Russia has the potential to significantly tighten commodity markets

Tough sanctions would rattle commodity markets

Several commodity markets are starting to price in some geopolitical risk around the growing tension between Russia and Ukraine. There is still plenty of uncertainty over how the situation will evolve, but it is still worthwhile to look at what the potential impact could be should tension boil over into a conflict.

A scenario where the West fails to react with tough sanctions against Russia if it were to invade Ukraine means that the potential impact for commodity markets would be more limited, although the uncertainty would still likely be bullish in the short term. There would still be a risk to Russian gas flows via Ukraine to Europe. While, depending on the scale of any invasion, it could also potentially have an impact on the production and export of Ukrainian agricultural commodities, including corn and wheat.

However, in a scenario where the West reacts strongly with sanctions that target key Russian industries, this could have a far-reaching impact on the commodities complex. It could potentially lead to a significant tightening in energy, metal, and agri markets, which would provide only a further boost to an asset class which already has an abundance of positive sentiment in it.

Even if sanctions are not imposed on certain industries, financial sanctions could still make trade difficult, as it would be an obstacle for making payments.

Energy related sanctions would hit Europe the most

The European natural gas market is most vulnerable. The region is already dealing with an extremely tight market. Therefore, any further reduction in Russian gas flows to the region would leave the European market exposed. Russia is the dominant supplier of natural gas to Europe, with it usually making up anywhere between 40-50% of European gas imports. Nord Stream 2, which is now complete, is awaiting regulatory approval before Russian gas can flow through it. However, the US has already made it clear that in the event of sanctions, Nord Stream 2 would be targeted.

It would be difficult for Europe to stomach sanctions which effectively cut off Russian gas supply, or at least a large portion of these flows, given the region’s dependency on Russian gas and the ongoing energy crisis. Therefore, the EU would likely be less willing to go for an aggressive approach that cuts off Russian gas completely.

Gas exports and imports

Crude oil impact

Sanctions would also be a risk for the oil market. Russia is the second-largest crude oil exporter after Saudi Arabia, with crude and condensate volumes averaging in the region of 5MMbbls/d. Any potential action taken, which impacts a large share of these exports, would likely push the global market into deficit and would be extremely bullish for oil.

Europe would once again likely feel the impact the most, with around a quarter of its imports coming from Russia. While Asia, and in particular China, is a large importer of Russian oil. However, Western sanctions would unlikely have a significant impact on flows to China. In fact, sanctions could lead to increased Russian oil flows to China at discounted values.

The importance of Russia and crude oil

The aluminium market: Memories of 2018

We don’t have to go back too far to see the impact that sanctions on Russian aluminium producer, Rusal had on the global aluminium market. US sanctions against Rusal rattled the aluminium market in 2018, with Russia the largest aluminium producer, after China. Russian primary aluminium production makes up around 6% of global output, and 15% of ex-China output. The global aluminium market is in deficit now and so any disruption to these flows would only push the market further into deficit.

Sanctions could also possibly have an impact on output from European aluminium smelters. As we are currently seeing, smelting capacity in Europe is having to shut down due to high power prices. In a scenario, where sanctions impact Russian gas flows, this would only drive European energy prices higher, risking even further capacity restrictions in the region.

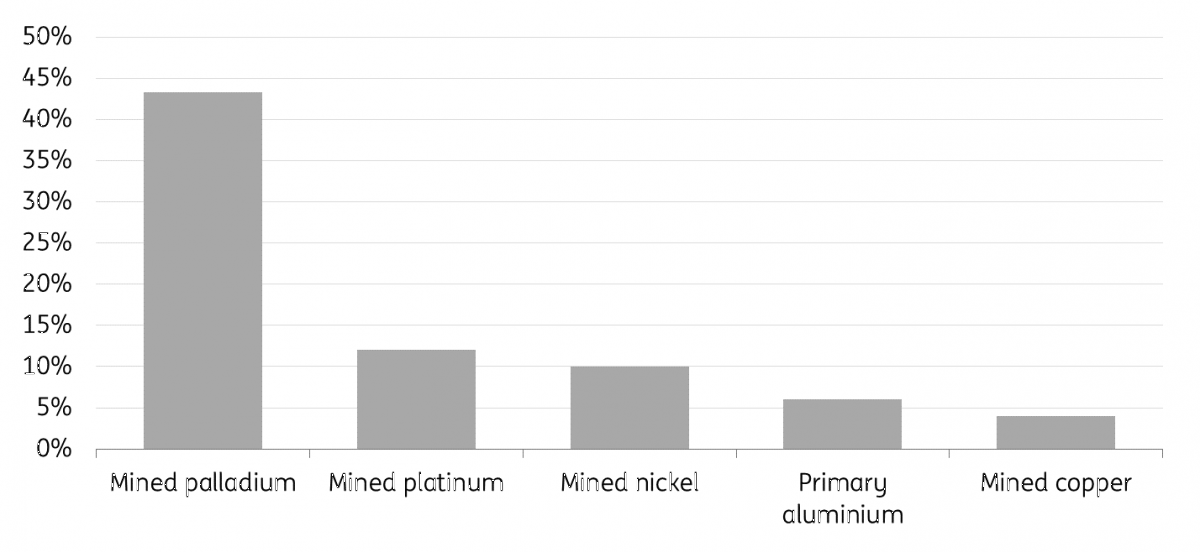

Russia is a sizeable producer of nickel, copper, palladium and platinum. Therefore, some of these markets could also tighten up significantly.

Russian share in global production for selected metals (%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 February 2022

ING Monthly: The masks, and the gloves, are coming off This bundle contains 15 Articles