High gas prices triple the cost of hydrogen production

Increasing the use of hydrogen could be an important part of decarbonising industry and reducing our dependence on gas. But the cost of hydrogen production has tripled, making it less appealing. Eventually, when the markets normalise, blue hydrogen is likely to be cheaper than green hydrogen due to rising carbon prices

Introduction: grey, blue and green hydrogen

There are many different ways of producing hydrogen with grey, blue and green hydrogen, being the most important. Natural gas is the main input for grey and blue hydrogen. Electricity is the main input for green hydrogen. Carbon emissions vary considerably between the different forms of hydrogen, with grey being the dirtiest and green being the cleanest.

Value drives of grey, blue and green hydrogen

The economics of hydrogen: gas, power and carbon prices

This article examines the economics of hydrogen, by analysing the impact of gas, electricity and carbon prices on the business case of the various production techniques. In doing so, we examine a hypothetical project at an industrial site near the North Sea coast. We assume that hydrogen can be produced 24/7, so the hydrogen plant runs at a high capacity factor. In producing blue hydrogen, we assume the carbon is captured and stored in a depleted offshore oil or gas field. The CO2 is then transported through a 50km pipeline, not by ships (which is more expensive) and not in an onshore field or salt cavern (which meets more social opposition).

These assumptions are similar to those that actually apply in real-life situations in some coastal European countries, notably the Netherlands, Germany, Belgium, the United Kingdom and countries in the Nordics like Norway and Denmark. These CCS assumptions are near-optimal. As a result, the scenario outcomes are likely to represent the lower cost range of a wide variety of hydrogen production possibilities.

In practice, many project-specific factors determine the eventual outcome of a business case. The factors that have a particularly important bearing on the profitability include whether carbon can be captured pre- or post-combustion, the availability of depleted gas fields to store carbon, sea depths, whether or not existing gas infrastructure can be used to transport carbon or if new infrastructure is required. As a result, our calculations are only illustrative and aim to show the general dynamics of gas, power and carbon prices on hydrogen production. They should not be considered as perfect benchmarks. With that disclaimer in mind, let us have a look at the economics of hydrogen production.

Higher gas prices have tripled the cost of grey and blue hydrogen

Grey and blue hydrogen can be made from gas through Steam Methane Reforming (SMR) while green hydrogen can be made out of water and electricity through electrolysis. The different production techniques use different types of energy. SMR uses gas and, therefore the production costs of both grey and blue hydrogen are dependent on the gas price.

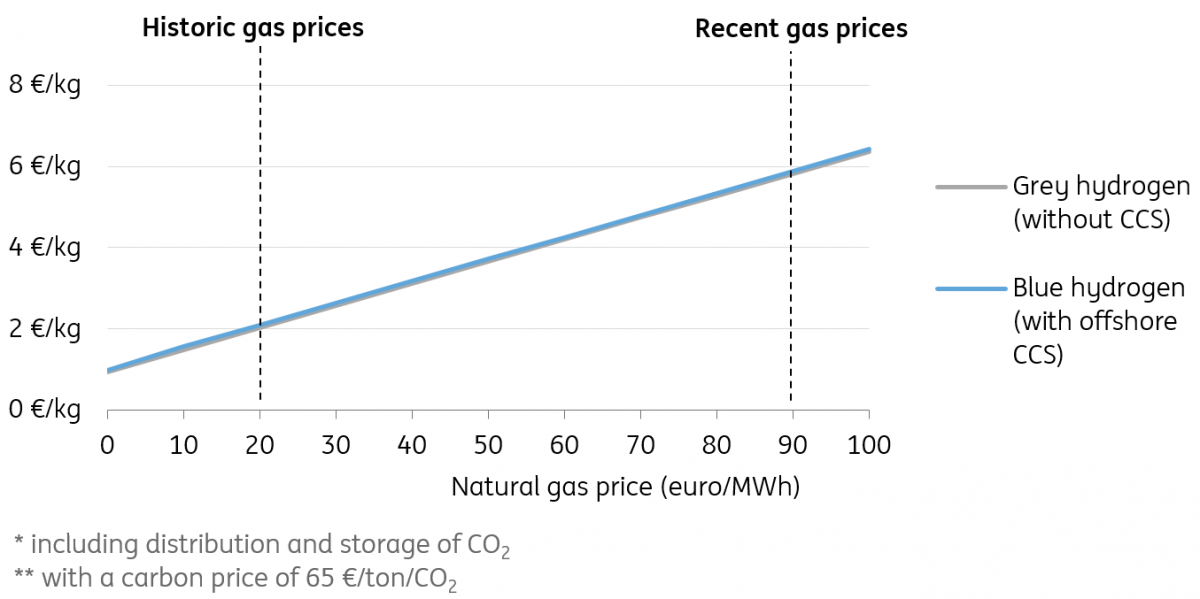

Historically, the natural gas price averages around €20/MWh in North European countries. At €20/MWh, and with the current carbon price of around €65/ton CO2, both grey and blue hydrogen can be produced at around €2/kg in our planning scenario.

During the Covid-19 crisis, gas prices fell to around €3.5/MWh, but recently they have risen to about €90/MWh due to increased demand, low gas reserves and LNG moving to Asia instead of Europe. As a result, the costs of grey and blue hydrogen production have tripled to around €6/kg in our planning scenario.

Note that at current carbon prices of about €60-65 per ton of CO2, the production costs for grey hydrogen (without CCS) and blue hydrogen (with CCS) are almost equal. We will explore the relationship between hydrogen production costs and carbon prices in more detail at the end of this article.

Hydrogen production costs have tripled at current high gas prices

Hydrogen production costs* for different gas prices**

Green hydrogen is twice the cost of grey and blue hydrogen

Hydrogen can also be made by splitting water (H2O) into hydrogen (H2) and oxygen (O2) through electrolysers that run on power. Unlike hydrogen produced from gas (grey and blue hydrogen), hydrogen produced in electrolysers does not create direct carbon emissions (green hydrogen). There are, however, indirect carbon emissions that are created from the power consumption that is required by the electrolysers. However, if renewable power is used, these carbon emissions can be reduced to zero. In reality, power from the national grid is often used, so a country's power mix determines the actual carbon emissions from power consumption.

There are two main types of electrolysers: PEM and alkaline electrolysers, the last one currently being the cheapest technology (see box).

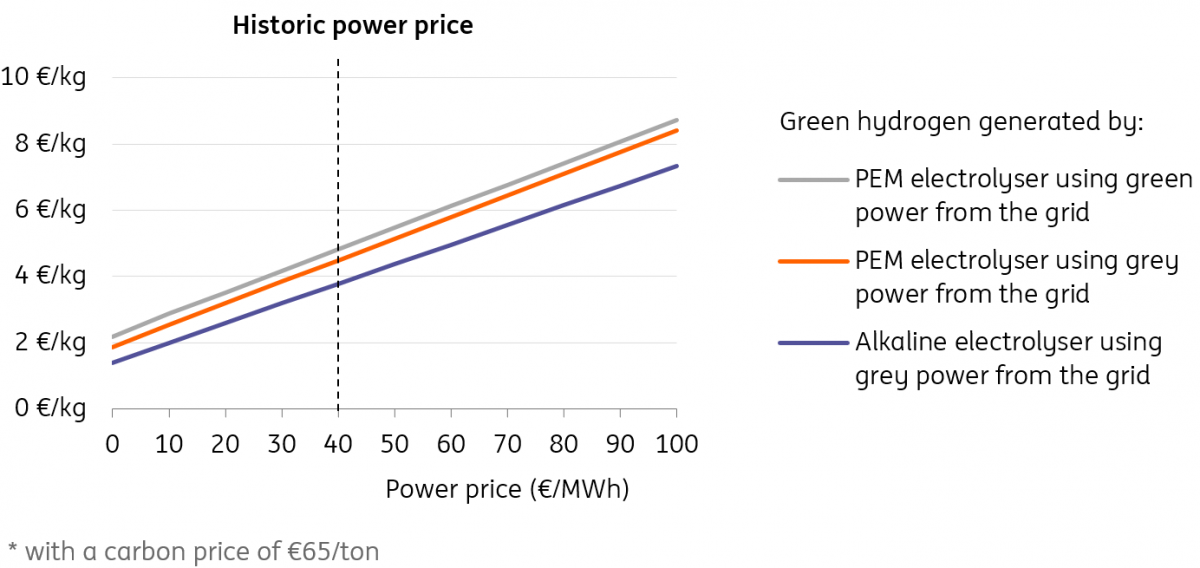

For our example, we have investigated the range of production costs of green hydrogen. The lower bound is represented by the cheapest technology (Alkaline) using power from the grid. The upper bound is represented by the PEM electrolyser using green power from the grid. Green power is a bit more expensive than grey power from the grid, as the buyer needs to pay for the Guarantees of Origin that proves that the power comes from renewable sources.

Hydrogen costs are c.€3.80-€4.80 with power prices of c.€40/MWh, which is the long year average in the Northwest European power market (Germany and the Netherlands). So green hydrogen is about twice as expensive to produce compared to grey and blue hydrogen (roughly €2/kg).

Power markets are both very tight and volatile

Power markets are currently very tight and volatile. Power prices were trading above €300/MWh at the beginning of October. Hence the costs of green hydrogen have soared because expensive power from the grid is used.

Hydrogen could also be produced with power that comes directly from renewable sources such as offshore wind turbines. A hydrogen manufacturer who owns wind turbines does not run the market risk of volatile power prices, as the effective price they pay is determined by the capital and operational costs of the turbines over the lifespan of the asset. The so-called Life Cycle Costs of Electricity (LCOE) for offshore wind, currently ranges from €45-130 in countries like Germany, the Netherlands and the UK, according to Bloomberg New Energy Finance. So in theory there is a limit to the cost of power if hydrogen producers own renewable assets. However, the technique of directly producing hydrogen from wind turbines is still in its infancy.

Given the large price differential of grey and blue hydrogen with green hydrogen, it is remarkable to see that most governments tend to focus on green hydrogen in their ambitious hydrogen plans. We look more closely at that in this article.

Production costs for green hydrogen are about €3.80-4.80/kg at historical power prices

Production costs of green hydrogen for different power prices

Alkaline versus PEM electrolysers

Electrolyses is the application of an electrical current to a substance to produce a chemical reaction. Electrolysing water causes the decomposition of water molecules (H2O) into their parts; hydrogen (H2) and oxygen (O2).

There are two main techniques available for the electrolyser.

- Alkaline electrolysers are the oldest and most established technology. The commercialisation of alkaline electrolyser technology started in the 1920s in Canada. Triggered by rising demand for ammonia, a raw material for fertilisers, many large alkaline systems were built during the 1930-1970s.

- Polymer Electrolyte or Proton Exchange Membrane (PEM) electrolysis is a newer technology that has some advantages over alkaline electrolyses, such as having a smaller footprint and greater operating flexibility. Both can be useful when the reliability of local green power sources fluctuate depending on solar and wind conditions.

Our analysis is not concerned with the specifics of these technologies other than how they affect the different production costs of hydrogen.

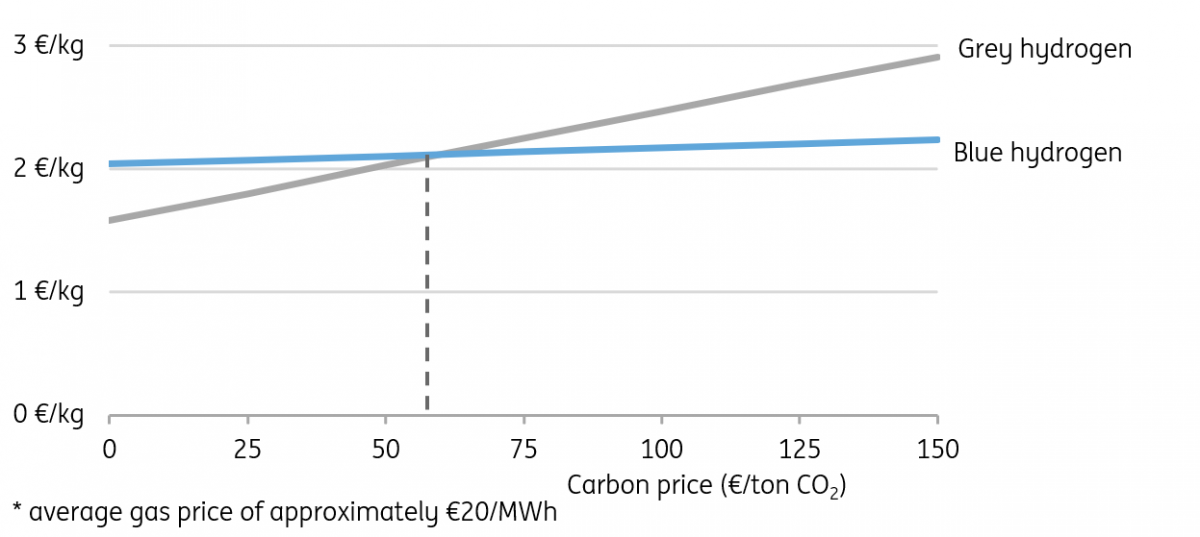

Blue hydrogen becomes cost competitive with grey hydrogen at current carbon prices of €60-65/ton

Currently, most of the hydrogen is produced from gas and the resulting carbon emissions are not captured and stored (grey hydrogen). This is not surprising, given the fact that carbon prices were relatively low until 2021. Grey hydrogen was the cheapest form to produce and as a result, most real-life hydrogen production has been very carbon-intensive and accounts for 2.2% of global carbon emissions.

Gas-based hydrogen production can be made less carbon-intensive by capturing and storing carbon emissions (blue hydrogen). The carbon price determines whether it is cheaper to emit a ton of carbon (grey hydrogen) or to capture and store the carbon emissions and to save on the carbon price (blue hydrogen).

We estimate that under normal conditions in energy markets, it becomes cost-efficient to capture and store carbon emissions from hydrogen production at carbon prices of about €60-65/ton. Carbon prices have been trading in this price range recently and we expect prices to stay in this range given the EU Fitfor55 strategy. So, hydrogen producers have a strong incentive to invest in blue hydrogen once the infrastructure to transport and store hydrogen, is in place.

CCS becomes profitable with carbon prices at approximately 60-65 euro/ton and higher

Hydrogen production costs as a function of the EU carbon price under normal gas markets*

Power markets do not support the production of green hydrogen anytime soon

Our main conclusion so far is that green hydrogen (using renewable power) is much more expensive to produce than grey and blue hydrogen (using gas). We therefore further investigated what power price is required to make green hydrogen cost-competitive with grey and blue hydrogen.

The production costs of grey and blue hydrogen are about 2 euro/kg based on the average gas prices of about €20/MWh and a carbon price of around €65/ton. Power prices need to be as low as €1/MWh for extended periods of time to make green hydrogen cost-competitive. Those are unrealistically low levels of power prices for two reasons. First, historical power prices are around €40/MWh in many Northwest European power markets. Second, current power prices are extremely high and recently passed €300/MWh in some European power markets.

Nevertheless, even in current power markets, power prices can be very low during the day, at times when there is a lot of power generation from wind turbines and solar panels. But hydrogen production is a year-round 24/7 business, so a couple of hours of low or even negative power prices, doesn't make much of a difference. Electricity simply won’t be free most of the time even in power markets dominated by renewables, as renewables and the backup facilities to store power are capital intensive.

Another complication is the fact that gas and power prices are closely related, as most of the time gas-fired power plants set the power price in European power markets. So, low power prices require low gas prices, but that would make grey and blue hydrogen cheaper compared to green hydrogen.

All in all, it is not likely that power markets will make green hydrogen cost-competitive with grey and blue hydrogen anytime soon. In that respect, it is somewhat surprising that most governments focus on green hydrogen production in their ambitious hydrogen plan. The US is an exception to this practice, with a balanced approach to both grey, blue and green hydrogen.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 October 2021

Hydrogen: The complete picture This bundle contains 4 Articles