France: Hard times for Macron

The last consumer spending figures were weak in July, while consumer confidence declined in August. The economic situation is not helping a government weakened by the departure of its most popular minister

Household spending showed signs of weakness in July

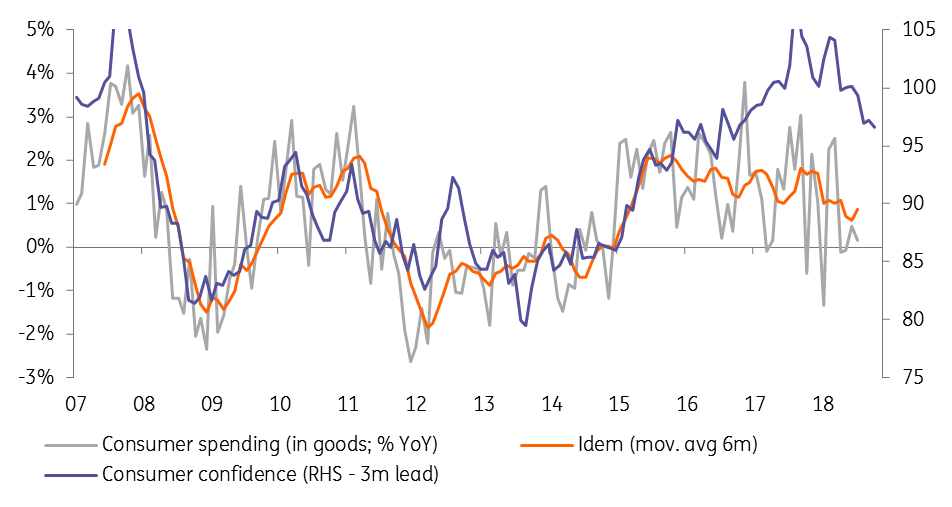

Figures published this week by INSEE showed that household spending increased by a limited 0.2% month-on-month in July. Spending growth is still below 1% on the year. Looking at the long term trend, it seems that spending growth has been declining slightly since mid-2015 despite improvements in consumer confidence. Indeed, consumer confidence, which was also published this week, was at 96.6 in August, which is consistent with spending growth of almost 2% a year.

What the survey showed, however, is that the trend in consumer confidence is now down. While 96.6 remains a higher level than in any month between 2015 and 2016, it has been on a downward trend since December 2017 (104.3). Looking at the components, it appears that households are more positive about their savings now than in December, but this further improvement has been counterbalanced by returning pessimism about the economic outlook and, since June, a return of unemployment fears.

The latter comes from the fact that the unemployed population has increased almost every month since March despite an increase in hiring intentions and labour market reform (the effect of ending subsidised contracts has abated since June). In the service sector, the last PMI surveys showed that the improvement in the unemployment rate in recent quarters could pause unless there is an increase in demand.

An air of déjà vu

It seems that the reform atmosphere and initial optimism generated by President Emmanuel Macron is now giving way to a more traditional French story: increasing savings are limiting spending, which is limiting demand and therefore employment growth, especially as external demand growth is subdued.

Macron therefore enters his second year in a more difficult economic situation, and in a weaker political position: his approval rating has declined from 40% to 32% in the Ipsos political barometer since April. Moreover, the resignation this week of his environment minister Nicolas Hulot, one of the heavyweights of the Philippe team and the most popular political figure in the government and among French political leaders (in July Ipsos barometer), has weakened Macron despite Hulot’s efforts to minimise the impact of his decision. The departure deals a blow to Macron's image as a reformist. If his most popular minister does not believe that reform is possible in France, Macron will have his work cut out convincing others.

We currently expect a weak rebound of GDP in the third quarter. On the investment front, with high capacity utilisation and a high level of order books, we remain optimistic for 2018 but household spending will take more time to recover and adjust to higher oil prices. While private consumption growth should barely accelerate from the 1.1% reached in 2017, we think that GDP growth should reach 1.8% in 2018 and 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

29 August 2018

In case you missed it: Deal or no deal? This bundle contains 7 Articles