Greece: Waiting for the exit debate to become serious

The Greek economy is finally back on a recovery path, driven by domestic demand. While the growth pace has so far been unspectacular, things are improving

Back on a recovery path

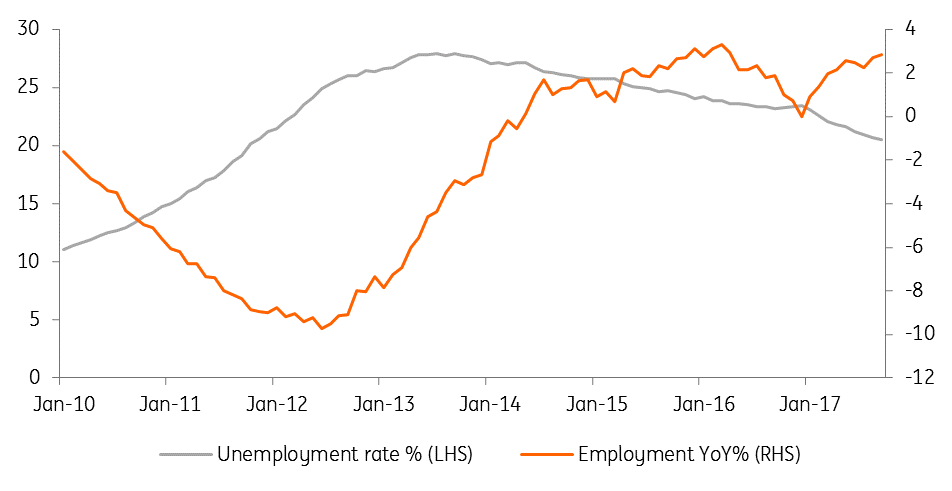

Macroeconomic fundamentals have been improving in Greece. Labour market indicators have turned around. In 3Q17 employment was growing at 2.6% year-on-year, helped by a strong summer tourism season. The unemployment rate continues to decline, reaching 20.5% in September.

Crucially, the combination of an improving economic backdrop and consistent signals that fiscal austerity had come to an end, have been reviving confidence indicators, and consumer confidence in particular.

The approval of the 2018 budget was accompanied by the so-called social dividend - money handouts paid to Greek citizens hit particularly hard by the crisis, agreed with the institutions within the framework of the Third Greek programme. Public finance developments over 2017 have been positive in general, with good chances that Greece will meet its 1.75% of GDP primary surplus target. To be sure, tax collection issues remain but the government proved able to compensate by controlling expenditure.

Turnaround evidence showing up in labour market data

Approval of the omnibus bill might just open the door

Looking forward, Greek economic developments will clearly depend on a smooth end to the third European Stability Mechanism (ESM) programme. The approval from the Greek parliament of an omnibus bill meant to close 50 out of 60 prior actions is expected to open the door to the completion of the Third Review, possibly by the end of January.

Soon after that, the Greek government is expected to tap the market with a new bond to create a cash buffer given the end of the programme in August 2018.

Consumers getting more upbeat on growth/fiscal relief evidence

Grexit strategy expected to pick up

February might also be the time when discussions on the way Greece will exit its third programme will get serious. So far, this has remained within the Greek borders, with the Bank of Greece governor Yannis Stournaras backing the idea of a precautionary credit line as a safety net and Prime Minister Alexis Tsipras sticking to his clean exit view.

European partners will not be allowed to sit on the fence for much longer and will have to take a clear stance, which will have to include their ultimate view on the future of debt relief.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 January 2018

ING’s Eurozone Quarterly: All systems go This bundle contains 13 Articles