Greece: Defying external headwinds

Domestic demand is now taking the token of growth as the external background deteriorates. Ongoing employment recovery represents a short-term hedge, helped by the first mildly expansionary budget in a decade. Beware upcoming elections

Growth unsynchronised with the rest of the eurozone, for the time being

The Greek economic recovery continues at a decent pace, irrespective of intensifying signals of a slowdown coming from peer eurozone countries. Apparently, the combined effect of a ‘clean exit’ from the third ESM programme and the positive effect of the recovery on employment have been supporting consumer confidence, which posted a relative high in December. Unsurprisingly, confidence in retail held up decently well as did confidence in service sectors, backed by a strong performance from the tourism sector. Only, confidence in the export-related manufacturing sector has fallen sharply since August, reflecting an ongoing deterioration of the international backdrop.

Domestic demand-driven acceleration in 3Q18

In 3Q18, the seasonally and calendar adjusted Greek GDP expanded by a healthy 1% QoQ (2.2% YoY) accelerating from an upward revised 0.4% QoQ in 2Q18. After adjusting for a re-classification of 3Q17 data causing a distorting base effect, the data shows that economic growth was driven by gross fixed capital formation and by inventory accumulation, with private consumption providing a minor push. The side effect was a sharp gain of imports, with net exports acting as a drag as a consequence, notwithstanding a decent export performance. On the back of available soft data evidence, it seems likely that a domestic demand driven pattern could have applied also to 4Q18, with private consumption possibly playing a bigger role. Indeed, according to ELSTAT data, employment continued to expand at a healthy 1.7% yearly clip over 3Q18, helping to support disposable income. Interestingly, the concurrent decline in the unemployment rate to 18.6% happened when the labour force was expanding and the pool of inactives was shrinking; undoubtedly a positive signal.

Ongoing employment recovery supports confidence pick-up

Primary surplus target overperformance opened the door to mildly expansionary budget

The acceleration in economic growth has had as a positive side-effect with further progresses on public account data. State budget execution data for the January-November period suggests that Greece should have been able to overshoot its general government budget primary surplus target of 3.5% of GDP for the third year in a row, getting close to a 4% primary surplus in 2018. Such a positive fiscal performance, mainly driven by a significant reduction in primary spending, allowed Athens to approve a budget for 2019 including a set of expansionary measures worth 0.5% of GDP. These will be funded by the recurring element of the fiscal overperformance recorded in the 2016-18 period, while enabling Greece to cancel the implementation of pension cuts that were scheduled for 2019.

As expected, the clean exit from the third programme has not allowed Greece to immediately regain full control of its state finances. Fiscal and reform constraints remain in place under the enhanced surveillance regime, with the medium-term debt relief measures agreed conditional on them. However, the first fiscal expansion in a decade, marks at least a symbolic break with an unprecedented fiscal adjustment. PM Tsipras, having had his budget smoothly validated by the EU Commission, passed his first post-programme credibility test without incident, obtaining an asset that he could leverage upon in a politically dense year.

A political asset that PM Tsipras will try to leverage upon in both European and national elections

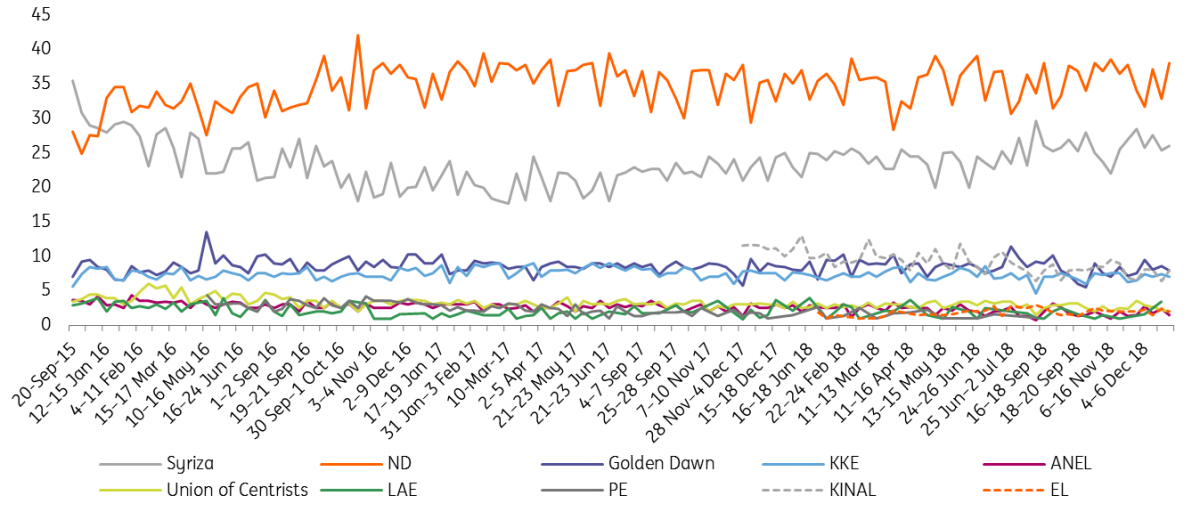

The European Parliament election vote in May and legislative elections, due no later than 20 October, make 2019 a politically dense year. The Prespes Agreement reached between Greece and FYROM to change the name of Greece’s neighbour to Republic of North Macedonia, which was strongly backed by PM Tsipras, was opposed by Panos Kammenos, the leader of ANEL, the junior partner in Greece’s government alliance. In disagreement over the deal, he decided to quit the government before the ratification vote by the Greek Parliament. PM Tsipras subsequently decided to call for a confidence vote in the government, which was held on Wednesday, 16 January. The vote was passed with 151 votes in favour and 148 against out of 300, supported by all 145 Syriza MPs, by defecting lawmakers from the former coalition partner and by independent MPs. After the vote, Tsipras reiterated that his government would remain in power until the end of the current legislature, at the end of October. We suspect this is far from granted, and that he might be tempted to bring Greeks to the polls before then. In the process, in the wake of ANEL’s departure, he is likely to have to try to forge ties with the centre-left, as opinion polls are still signalling that ND, the main opposition party, is still leading over Syriza by an ample margin. In between, he will soon have to reassure lenders in their second post-programme review that his government is still empowered to fulfil its list of to-does. Not necessarily an easy call.

Opinion polls still pointing to ample gap between leading ND and Syriza

The Greek economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 January 2019

ING’s Eurozone Quarterly: Tiptoeing around the ‘r’ word This bundle contains 13 Articles