Gold Monthly: The rally stalls

Gold hit an all-time high above $2,450/oz in May. However, prices have already drifted 5% from last month’s peak after stronger-than-expected US jobs data and after China’s central bank halted its gold purchases

Stronger dollar, subdued China buying could dent gold

Strong US jobs dash Fed bets

Gold has risen almost 12% year-to-date, mostly amid optimism for a Fed pivot to monetary easing this year. Safe haven demand amid the conflicts in Ukraine and the Middle East, as well as buying by central banks, has also supported higher gold prices this year.

However, May’s stronger-than-expected US jobs report has pushed back expectations on when the Fed may start cutting rates. Lower rates typically boost gold, which doesn’t pay interest.

With inflation having remained sticky and the latest jobs numbers beating all expectations, our US economist expects the Fed to push their projections for rate cuts back, so they end up with two cuts in 2024 and four in 2025 instead of three and three.

If the Fed continues its cautious approach to easing, gold prices risk a pullback. We expect gold prices to remain volatile in the coming months as the market reacts to macro drivers, tracking geopolitical events and Fed rate policy.

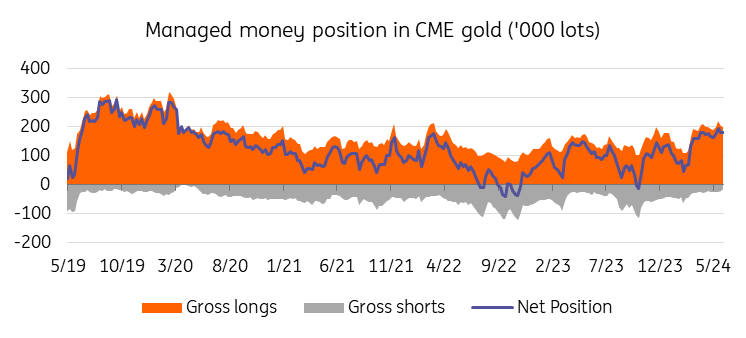

Gold net long positions hit a four-year high in May

China halts buying gold for reserves

China halted buying gold for reserves in May after the precious metal surged to a record high, ending an 18-month buying spree. Gold held by the People’s Bank of China was unchanged at 72.80 million troy ounces in May, according to data released last week. This marked the first time the country’s central bank did not add to its reserves since October 2022. This has left gold vulnerable to more downside pressure.

Gold demand from central banks posted its strongest start to any year on record in the first quarter, with China being the biggest buyer. Gold tends to become more attractive in times of instability when investors pile into safe-haven assets as a hedge against the economic climate, geopolitical tensions or inflation.

China’s appetite for gold started to fade in April, when the People's Bank of China bought only 60,000 troy ounces, down from 160,000 ounces in March, and 390,000 ounces in February. Gold’s record-breaking rally might dent demand for now.

China ends gold buying spree in May

ETF flows turn positive in May

Global gold ETFs saw inflows in May following a 12-month losing streak, according to the World Gold Council. During the month, Europe and Asia led global inflows while North America and other regions registered mild losses. Global gold ETF holdings rose to 3,088 tonnes by the end of the month.

Investor holdings in gold ETFs generally rise when gold prices gain, and vice versa. However, gold ETF holdings have been in decline for much of 2024, while spot gold prices have hit record after record, until ETF flows finally turned positive last month.

Gold ETFs see net inflows for the first time since May 2023

Gold may see more downside

We expect gold prices to come down slightly from their current levels this quarter as the Fed continues its cautious approach, and with geopolitics already being factored into the current price. We see prices averaging $2,300/oz in the second quarter and an annual average of $2,255/oz in 2024. We see prices peaking in the fourth quarter, averaging $2,350/oz on the assumption that the Fed starts cutting rates in the second half of the year and the dollar and yields weaken.

ING forecast

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article