Global trade forecast drops; Section 232 tariffs set to intensify

US imports surged 41.3% in the first quarter of this year, led by medicinal and tech products. But container bookings dropped sharply in April, leading to a lowered 2025 trade growth forecast of 1.2%. Section 232 tariffs are expected to not only remain but intensify, with adjustments and reimbursements to be made amid US stagflation

US imports surge amid anticipation of Trump's tariffs

In anticipation of US President Donald Trump's tariffs, US imports surged at an annualised rate of 41.3% in the first quarter of 2025, led by medicinal, dental, and pharmaceutical preparations. This was followed by computers, peripherals, and parts, marking the highest increase since the third quarter of 2020. Up to February, imports from Ireland (pharma), or Taiwan (computer & electronic products), showed significant increases, but imports from China (computer & electronic products) also rose by 8.3% year-to-date despite the higher tariffs in place since February, according to data from the International Trade Administration (ITA).

Container bookings drop sharply in April, leading to lowered 2025 trade growth forecast

Compared to our base case last month, recent data suggests less front-loading than expected in the second quarter, despite the 90-day tariff pause. Container bookings to the US dropped significantly, shifting from double-digit growth in February to two consecutive 22% year-on-year declines in mid-April, according to data from Vizion. Bookings from China to the US fell by 44% and 49% YoY, respectively. Cancelled container vessel sailings indicate this trend is likely to continue into the first half of May.

Globally, TEU bookings have been declining since late March, culminating in a 12.1% YoY drop by the end of April. With new orders declining in both China and the US, the second quarter overall appears unfavourable for world trade, particularly as the front-loading in the first quarter is followed by a sharper downturn in the second quarter, resulting in fewer goods coming in. While the trade situation remains highly volatile and the drop might prove temporary, we are lowering our 2025 trade growth forecast from 2.5% to 1.2% YoY.

Still, we refrain from predicting a negative number due to several factors:

- Only about 13% of total global exports are directed to the US, indicating that while the US plays a significant role, it is not the sole focus of global trade.

- The trade numbers for this year are expected to be positively influenced by a statistical effect stemming from the low base of comparison in the first and second quarters of 2024, combined with the front-loading observed in the first quarter. Additionally, global merchandise trade volume has increased by 3.6% year-to-date up to February, according to CPB World Trade Monitor data. March also remained strong, as indicated by port and container bookings data.

- Slightly increased trade between other countries and more sourcing into the US from countries facing lower tariffs. Parts of China-US trade are being replaced by trade via other countries in the region.

- (Temporary) exemptions from tariffs for certain goods (e.g., smartphones, computers, chips and other electronics, USMCA-compliant content, pharmaceuticals).

Section 232 tariffs to intensify; adjustments and reimbursements likely amid US stagflation scenario

When it comes to our tariff baseline, we anticipate that the 10% universal tariffs will remain in place throughout President Trump's current term. However, we believe that reciprocal tariffs will be reduced or eliminated completely for some US trade partners over the year as trade deals progress and a stagflation scenario develops in the US. This reduction might only occur after 8 July for some trade partners, though, when the 90-day reciprocal tariff pause ends, and could extend well into the second half of the year.

For the EU, for example, we currently anticipate a reduction in reciprocal tariffs as the second half of the year progresses. Despite the EU's efforts to secure a deal by delaying its countermeasures for 90 days until 14 July, offering a €50 billion trade deal that includes LNG purchases and soybeans to reduce the trade deficit, and proposing 0% tariffs on cars and industrial goods, achieving a satisfactory agreement remains challenging. This is largely due to demands from the US, with Trump, for instance, having insisted on $350 billion in energy purchases and the need for consensus among all EU member countries. If a deal fails to materialise before 8 July, the EU will introduce its countermeasures covering €21 billion of US exports as voted for on 9 April, while exploring further retaliatory measures.

Section 232 tariffs could be slightly modified. They've already been adjusted for car parts, allowing automakers to reclaim 3.75% of the value of US-manufactured vehicles for one year, and this is set to drop to 2.5% in the following year. We don't expect a change in the rate of Section 232 tariffs – those on cars, steel, and other articles will remain at their 25% levels – but further reimbursements are likely to cushion the blow from additional tariffs.

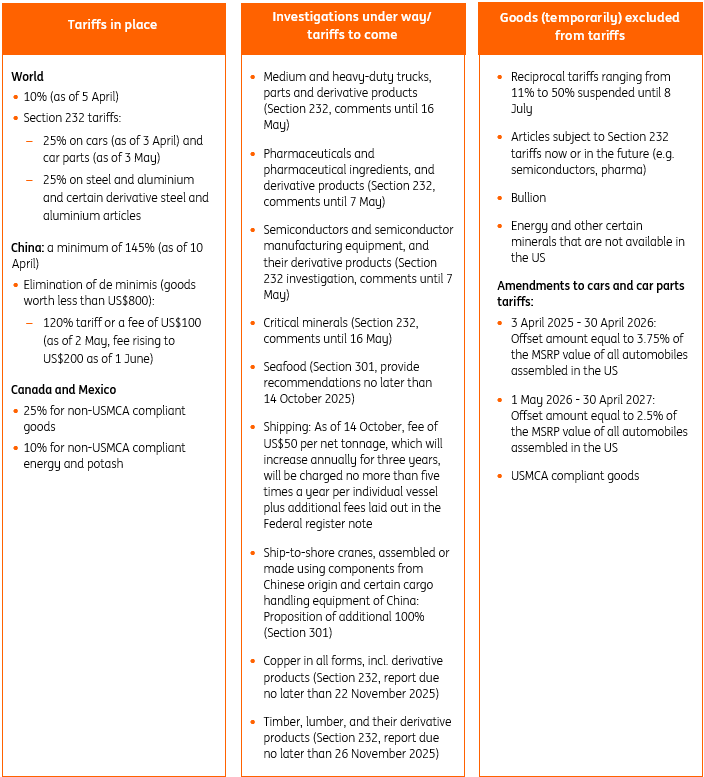

Still, we expect that they'll remain in place. Some countries, such as the UK and Japan, may negotiate exemptions – but Section 232 (or 301) tariffs are based on more substantial grounds than IEEPA tariffs. These measures are designed to bolster the US manufacturing sector and are unlikely to be lifted for most trade partners. Additionally, the list of products subject to upcoming Section 232 tariffs is extensive (see the second column in our chart below), including pharmaceuticals and their ingredients.

For Europe, this means that while a reduction in reciprocal tariffs would be welcome news, tariffs on pharmaceutical products – accounting for 20% of the EU’s exports to the US – would partially offset the 10ppt reduction in reciprocal tariffs, making it even more challenging to achieve a mutually beneficial deal.

Tariff overview: tariffs in place, to come and current exemptions

The pessimistic scenario: trade deals fail, trade partners retaliate and global trade slumps

Despite some goods entering the US being exempt from tariffs, the significant uncertainty surrounding tariffs and accurate customs declarations may still deter customers from purchasing goods altogether. This suggests that at least part of the inflicted damage will persist.

Here, the 90-day tariff pause does not result in major trade deals, merely reinstating the bulk of reciprocal tariff rates. Even halving tariffs on Chinese goods does not materially change trade inflows. The imposition of Section 232 tariffs exacerbates the situation, further deterring trade flows. The prevailing uncertainty and market turmoil could cause consumers worldwide to hesitate when purchasing goods, potentially leading to a substantial downturn in global trade.

Combined with reciprocal tariffs and countermeasures, trade in goods could slump into negative territory, resulting in a projected -0.7% drop in 2025.

2026 trade outlook sees partial recovery

With anticipated improvements in trade relations in 2026, trade in goods is expected to recover to some extent. However, we do not foresee a complete rebound to previous average growth numbers (of around 3%), given the 10% baseline tariff and ongoing reshuffling in trade flows. This results in a forecasted YoY growth rate of some 2%.

What remains is immense uncertainty, meaning this likely won't be the last time we reconsider our forecasts.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 May 2025

ING Monthly: The world is caught like a deer in the headlights This bundle contains 14 Articles