Global sustainability bonds to surpass €1 trillion mark in 2022

In 2021, €875 billion of bonds were issued in all currencies where the use of proceeds was linked to green, social, sustainable and SDG frameworks. In 2022, this market is set to surpass the €1 trillion mark. We believe that the sustainability € market will also continue its progression with issuance expected to reach €410bn

Global sustainability bonds to surpass €1 trillion market value in 2022

| €1.3tr |

We forecast the all currencies sustainable market to reach €1.3 trillion in 2022 |

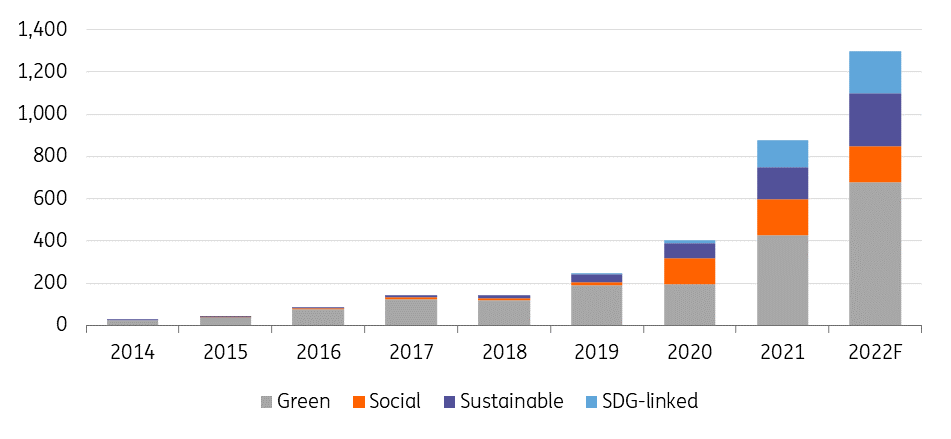

This year, some €875bn of bonds with a minimum size of €100m were issued where the use of proceeds was defined as green, sustainability, social and SDG-linked. This amount is around three times bigger than what was issued in 2019 when the market really started to take off. By the end of 2022, we forecast the global investable sustainability market to surpass the €1 trillion bar, reaching an equivalent of €1.3 trillion.

Global sustainability issuance (all currencies - minimum €100m size) - in € billion equivalent

While the Covid-19 pandemic slowed down issuance, green bonds will surge again

We believe that the green bond framework will continue to be the most commonly used framework by issuers. While the Covid-19 pandemic in 2020 slowed down green issuance, 2021 proved that plenty of “green“ projects remain in the pipeline and we believe that growth will continue in 2022 as commitments to reduce CO2 emissions have yet to materialise across the globe. Despite a COP26 meeting that some would consider disappointing, the pressure to reduce CO2 across the globe is intensifying. The efforts of the European Union to draw a clear taxonomy should also bring more confidence to the market and ease concerns about bond greenwashing. All in all, we estimate the multi-currency green bond market to reach an equivalent of €680bn in 2022.

We expect a boost from North America

While the European continent has been a leader in sustainability finance, we expect North America to start to play a bigger role as pressure to consider sustainability builds. In April 2021, the Biden administration announced a 50-52% reduction target in US greenhouse gas pollution from 2005 levels by 2030 and plans to be a net-zero carbon emissions nation by 2050. According to the US federal government, the rise in temperature and impact on the climate will cost the country $500bn in economic losses per annum until 2090. Joe Biden’s Green New deal could cost US$93tr to implement. Within this plan, the country would spend US$2tr on clean energy during the first term of Biden’s presidency.

Time for supranational entities to accelerate their sustainability investment programmes

With the plan to support Africa’s economic development and develop electrification and energy projects across the continent, the African Development Bank has been active in the sustainability bond market since 2014. In order to meet their low-carbon economy goals by 2030, African countries would need to invest a total of US$3tr. The African Development Bank has worked with governments and the private sector and has launched a US$25bn programme to run until 2025. The bank printed an equivalent of US$2bn in green bonds between 2014 and 2021.

We would expect additional bond issuance from recurrent issuers such as the European Investment Bank, the Asian Investment Bank, and the International Bank for Reconstruction & Development. Altogether, these supranational banks issued €65bn of green bonds between 2014 and 2021.

The € currency sustainability bond market will also reach a new record in 2022

| €410bn |

of sustainability bonds could be printed in € in 2022 |

This year, the market saw €387bn of sustainability bonds with a €250m minimum benchmark printed in euros. This compares with €231bn in 2020. Supranationals, subnationals and agencies were the most active on the € market and issued a large part of the existing social bonds to support worldwide economies against the impact of the Covid-19 pandemic. Financials and corporates saw their issuance multiplied by almost three times and SDG-linked bonds surged to €31bn exclusively supported by corporates.

Sustainability issuance in € currency (bn) - minimum bond size €250m

Corporates and financial institutions to bring most of the growth

Our expectation is that corporates will print €100bn of green, sustainability and SDG-linked bonds. Compared to the €82bn printed in 2021, this growth may appear modest but with total corporate bond issuance expected to reach €290bn in 2022, €100bn represents c.35% of the total. In 2021, corporate sustainable issuance represented 24% of total corporate bonds and 10% in 2019. SDG-linked bonds should continue their ascent with industrials showing some preference for this framework, offering the possibility to concentrate on specific goals. Out of the €100bn, we forecast €55bn to be issued under an SDG-linked format.

Financial institutions printed c.€88bn in sustainable bonds in the first 11 months of 2021, of which €17 was in covered bonds. We expect sustainable financial issuance to rise further in 2022 to €110bn, of which €20bn will represent covered bonds.

Supranationals, subnationals and agencies' issuance could be more moderate in 2022

Combined Government and SSAs EUR sustainable issuance stood close to €214bn in 2021, but it could moderate somewhat next year. We believe governments will print around €55bn next year compared to €61bn in 2021, as we expect fewer large new entrants to the market.

On the supranationals, subnationals and agencies’ side, our expectation is that this segment will be in for a breather in 2022, remaining around the same level as in 2021, of c.€145bn. In the social bond space, the EU’s SURE (the European Union's instrument for temporary Support to mitigate Unemployment Risks in an Emergency) will no longer be a driver of the market, while the large French agencies CADES and UNEDIC have signalled stable to lower funding targets. On the other hand, the European Union’s €250bn green bond programme to finance the Next Generation EU's recovery plan should gain further traction and we would expect the EU to sell tranches totalling €50bn in 2022. One upside risk to our forecasts is the potential further involvement of KfW in Germany’s green transition under the mandate of the German Federal Ministry for the Environment.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article