Greece in 2021: Between vulnerabilities and opportunities

The tourism-related service sector is a lingering point of vulnerability for the Greek economy. The transition towards a proper recovery path might be helped by the inflow of grants from the European Union

Lockdown and tourism dependence weighed on 2Q20

Greece suffered the Covid-19 shock with somewhat of a delay. Having been little hit by the infection in the first quarter, it fully felt the shock over the second when the economy contracted by an unprecedented 14% quarter-on-quarter. This reflected the effect of containment measures on an economy particularly vulnerable due to the very high share of tourism activities. Social distancing and restrictions on mobility weighed heavily on both domestic demand and exports of tourism services. We suspect the same factors will limit the scope for a rebound in 3Q20 GDP comparable with what has been seen in other peripheral countries. It's worth noting that the preliminary estimate has not yet been published.

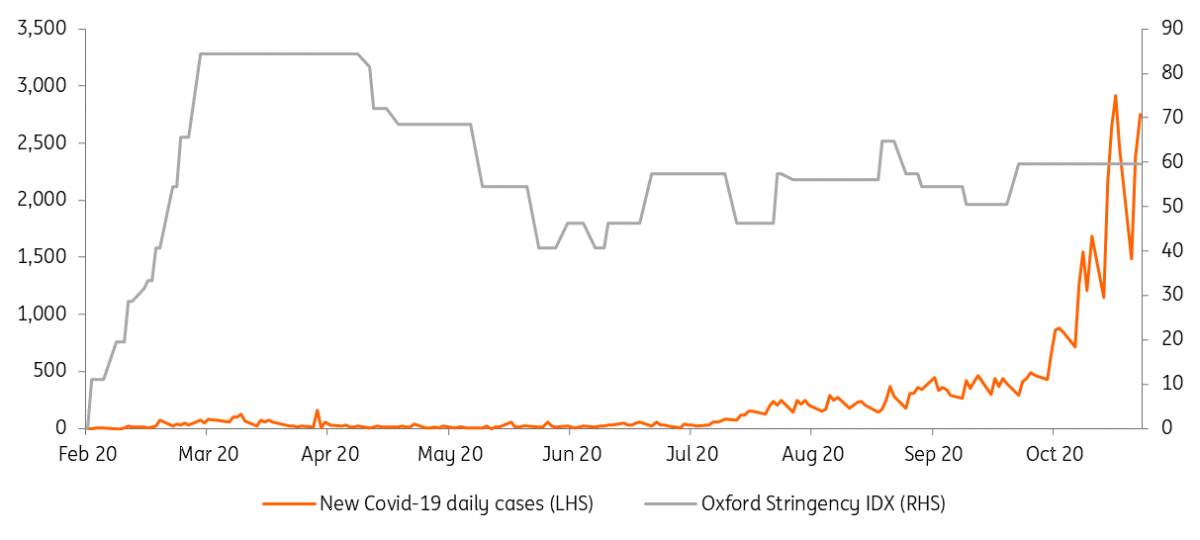

Less restrictive during the second wave

New soft lockdown at the heart of a likely 'W'

Prime Minister Kyriakos Mitsotakis, confronted with the risk that rising Covid-19 cases is putting excessive pressure on the Greek healthcare system, recently announced a three-week nationwide lockdown. As elsewhere, this is a softer version of what was seen in April and May but should be enough to depress growth through the domestic demand channel. Recently published August employment data suggests that support measures, while backing job retention, could not stop a fall in employment which went together with an increase in inactivity. With the unemployment rate at 16.8%, domestic demand looks set to act as a drag on growth in the fourth quarter of this year. We are currently pencilling in an 8% QoQ rebound in 3Q, and a 2% QoQ fall in 4Q20, with downside risks for the latter.

Services businesses and households scarcely comforted by reopenings

Slow fiscal push reversal not a big source of concern in 2021

Uncertainty about the development of the pandemic is unlikely to be dispelled until the beginning of 2021. Should a vaccine be rolled out, 2021 will hopefully be the year when Greece will find a way to unwind extraordinary measures while preparing for a genuine recovery. Before Covid-19, the country was just emerging from a multi-year economic and financial crisis with ample labour market slack, and so we suspect that the process will have to be dealt with carefully.

Fresh resources might still be needed over the first half of 2021, and this will limit the scope for a meaningful improvement in public account ratios. Also, public finance developments will be subject to uncertainty related to the potential activation of state guarantees issued as part of the emergency Covid-19 measures. To be sure, given the low share of Greek debt held by private investors, this should not upset the market too much.

Recovery fund inflows an opportunity for 2H2011 and beyond

On a positive note, 2021 will also be the year when grants from the EU Recovery and Resilience Facility will start flowing into the Greek state coffers to fund eligible projects. Given the good share of funds Greece is entitled to, these might act as a growth accelerator over the second half of next year. Against this backdrop, it will be extremely interesting to see whether the projects financed and the related reforms will make Greece more attractive in the eyes of foreign investors. If this is the case, chances are that growth-wise, 2022 will turn out better than 2021.

The Greek economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 November 2020

The Eurozone in 2021 This bundle contains 12 Articles