Why we’re expecting global car market growth to hit the brakes

The global car market is cooling off after a strong rebound last year and a fairly resilient first half of 2024. We assume that it will see a relatively soft landing in the second half before picking up again next year

Major regional markets maintained growth in the first half of 2024

The pace of car sales growth slowed down in the first half of 2024 after a strong rebound of light vehicle sales last year, in line with our expectations. We note that all the three major regional car markets – China, the US and the EU – saw some growth during this period. European car sales (including the EU, the UK and the European Free Trade Assocation) increased by 4.4% year-on-year, according to the European Automobile Manufacturers’ Association. In the United States, light vehicle sales increased by 2.1%, while Chinese car sales grew by 6.1%. Among other prominent national markets, Japan experienced a sharp double-digit decline, while sales in India, Brazil and Mexico remained resilient.

Sales growth set to slow

We envisage a further deceleration in car sales growth during the second half of this year. This is in part due to consumer demand becoming more muted after a post-Covid catch-up phase, but also the mixed economic environment and continuously elevated interest rates alongside uncertainty surrounding both policy and political developments across the globe.

What's more is that used cars have become increasingly attractive again after prices started to drop following better stock positions. We note that 2024's second quarter automotive sector earnings season has had a soft tone, with a number of prominent car and auto part manufacturers revising their full-year outlooks lower.

Taking the industry backdrop into account, we also are trimming our full-year 2024 car sales growth expectation to +1.8% from +2.6% previously. Our update assumes that the bulk of the YoY growth was already realised in the first half of the year. In the second half, we believe car sales growth will be largely flat YoY, remaining only slightly positive. To recap, we now have a more neutral outlook for car sales in the second half relative to the first one, with balance of risks shifting to the downside during the last couple of months. Our second half forecast also implies a slowdown in car sales growth in the three largest markets to the 0-1% range YoY. Given this backdrop, car makers are now facing increased competition, a softer pricing environment and pressure on margins.

Slower second half weighs on FY24 growth

Production volumes to trail the auto sales dynamic

We expect production volumes to trail behind those of car sales and anticipate that production volumes will actually drop by low single digits in the second half of the year relative to the same period last year. Vehicle inventory levels have increased in the important US market and due to a stalling of electric vehicle (EV) uptake in the Western world this year. As a result, we anticipate that the full-year 2024 car manufacturing volumes will decline by 1% to 2% compared to the flat or slightly positive growth we anticipated earlier this year. We believe that this expected contraction in the production programmes should have a greater immediate impact on revenues of auto parts manufacturers.

Auto sector peers feeling the heat

With the majority of 2024's second quarter auto sector player results already out, we will aim to draw initial conclusions about the auto sector peers’ peformance during the first half of this year and the remainder of the year. We have already indicated that the second quarter season was mixed, with multiple revisions of at least some aspects of the initial full-year guidance. In our assessment, car manufacturers were more affected by the changes in the car market environment – including less buoyant EV sales – relative to the car parts manufactuers in the first half of 2024. We believe that one of the reasons was a strong prior-year comparative base for the major car manufacturers which enjoyed a particularly favourable commercial environment, buoyed by the still significant demand backlog from previous years. Now that this overhang has been cleared, original equipment manufacturers may not be enjoying the same pricing power and will have to rely on operational efficiencies to sustain their current relatively high margins.

We also believe that auto parts manufacturers have not enjoyed the same favourable pricing environment in the recent past, and by initiating cost-cutting initiatives earlier have a chance of sustaining their current profit margins more successfully. Furthermore, with supply chain issues largely disappearing into the rear view mirror, major auto parts manufacturers are currently enjoying more orderly production schedules. While auto parts manufacturers are more sensitive to softer production volumes, we have not seen particularly dramatic FY24 guidance revisions from auto parts manufacturers at the mid-point of the year. This could be the result of more conservative production volume assumptions at the beginning of the year, as with ZF Friedrichshafen, which kept its market-wide production volume forecasts of -3% for FY24 intact during the first half earnings release.

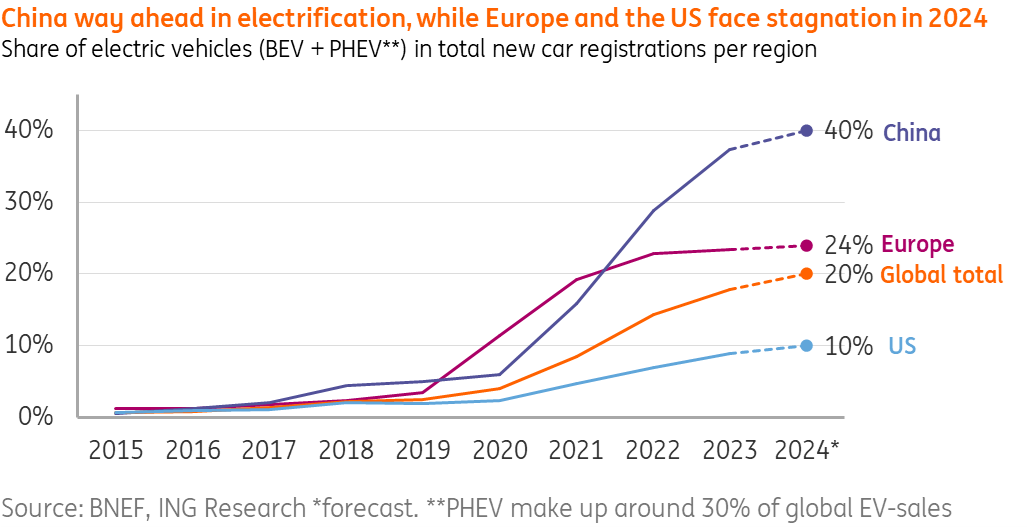

Electrification slows in Western world while China pushes forward

The electrification trend faces headwinds in the US and Europe this year after the first wave of the shift to EVs has come to an end. The uptake is decelerating, and we expect EV penetration rates – for plug-in hybrid EVs (PHEVs) and battery electric EVs, or BEVs – to grow just slightly to 24% in Europe and 10% in the US (from 23% and 9% respectively). This can be illustrated, for example, with Tesla’s first half 2024 delivery figures that stood behind last year’s numbers and earlier price reduction actions to ramp up orders, showing eroded enthusiasm among Western EV-driving prospects. This stands in contrast with China’s continued efforts to ramp things up, with an expected share of no less than 40% of total new car sales in 2024. As such, Chinese EV sales are approaching 10 million on an annual basis, making up almost 60% of global sales and leaving a gap with the rest of the world.

There’s a combination of reasons behind this year’s slowdown of EV uptake in the Western world:

- Residual values of EVs are under pressure because of price cuts and ongoing technological improvements (including longer ranges). This has led to a more cautious approach among leasing and rental companies and higher monthly terms. Higher interest rates also add to that.

- Many car drivers keen to make the shift already drive electric (early adopters). New EV drivers, however, are increasingly dependent on more expensive public charging and infrastructure hasn’t kept up with electrification in many countries.

- General affordability of EVs is still a critical factor, especially for those driving less mileage. Consequently, in Europe the winding down of government incentives for consumers in its largest market (Germany) led to a significant slowdown in sales in the first half of 2024.

- Electric cars produced in the West are generally less profitable for manufacturers as competition has mounted and supply chains continue to rely on China. This holds back a rapid introduction of more affordable smaller cars consumers are waiting for. Imposing tariffs on Chinese cars doesn’t help the energy transition as incumbent manufacturers are less urged to introduce new EV models.

At the same time, in China, manufacturers already upscaled their supply chains (including battery production) for EVs and even created excess capacity, which is also a reason to keep the growth figures running and push forward with exports. All in all, China still pushes the global EV share to an expected 20% in 2024.

Lower battery prices could support EV uptake into 2025

Things may start to improve for EVs as battery prices (making up 30-40% of production costs) have started to come down again. At the same time, competition continues to intensify – for example, China’s most advanced brand BYD is making inroads and has ramped up deliveries by 18% YoY in the first half of 2024. BNEF expects global lithium-ion prices to come down to $133 per kWh, down more than 20% from 2022 when prices were pushed upward by potential raw material shortages. This allows manufacturers to lower prices moving forwards in an effort to attract new consumers. However, policy remains an important driver here – especially for the US, as a new administration could temper EV growth ambitions and change the course from next year.

Hybrid cars are enjoying a comeback

In several countries, hybrids tend to be a thing of the past as the focus has now fully shifted to BEVs. However, with a more gradual path forward outside of China, hybrids are making a comeback and this especially holds true for conventional hybrids.

More new combustion engine (ICE) models are equipped with batteries to regenerate energy. For car makers, these models are often more profitable than EVs, and the fuel economy of this ICE-generation is progressing, enabling them also to contribute to CO2 reduction standards. At the same time, this offers an attractive and more environmentally friendly proposition to consumers. In the EU, this share of new car sales could exceed 30% in 2024 (2023: 26%), whereas in the US, the fraction of conventional hybrids is about to end up close to 10% this year. Several manufacturers, including Volkswagen are also introducing new generations of PHEVs with much longer electric ranges, which allows for much more electric mileage and could also revive plug-in hybrids in the years to come.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article