How Germany responds to the changing face of trade is vital

Germany's export-based model has served it well but there's still a focus on traditional sectors. However, competition is growing, not least from China. How Germany adapts will be crucial for its economic future

It's all about exports

The German export-based economic model has been subject to international criticism for years. It's always focused on large trade and current account surplusses, which have not really changed over the last decade. Compared to the peak in 1990, Germany’s share in world exports has fallen by four percentage points. Exports of goods have tripled since 1990 as have imports.

Around every fourth job in Germany depends on exports. Measured as a percentage of GDP, exports of goods and services reached an all-time high of 47.3% in 2018, falling slightly to 44% in 2020. At the beginning of the millennium, this share was only at 30.8%, rising almost without interruption until last year, while in other countries there was a stabilisation or even a trend reversal.

Germany’s share in world exports compared to the US, China and Japan

Traditional sectors are still in the lead

Germany's success story is built on traditional sectors. Germany ranks first in the global export of automotive products, chemicals and pharmaceuticals. The automotive sector, in particular, faces profound challenges given ambitious climate goals. With the automotive sector being by far the most important branch of industry in Germany in terms of sales, it is no wonder that a transition which secures its growth and employment contribution is needed.

The pandemic has shown, however, that traditional sectors should not be written off, as they can quickly become new future markets, as is the case for the pharmaceutical sector. It is estimated that Mainz-based biotech company, BioNTech, could alone lift the German economy by 0.5% in 2021.

Germany’s share in world exports and other leading export countries per sector

Germany’s world rank in brackets

Surprising global growth markets

Although the German economy is characterised by traditional sectors, surprising growth markets have opened up in recent years in both the US and China. While some of these markets are very small in terms of value, the average growth performance over the past five years is impressive nevertheless. Demand for forestry products and wood and wooden cork wickerwork rose strongly. Pharmaceutical products (+17.8% in China, +8.1% in the US) were also in demand. Traditional products such as motor vehicles and parts only saw minor growth in China (+3%) and a decline in the US (-3.8%) over a five-year average period.

Exports to China

By product (percentage change 2015-2020)

Exports to the US

By product (percentage change 2015-2020)

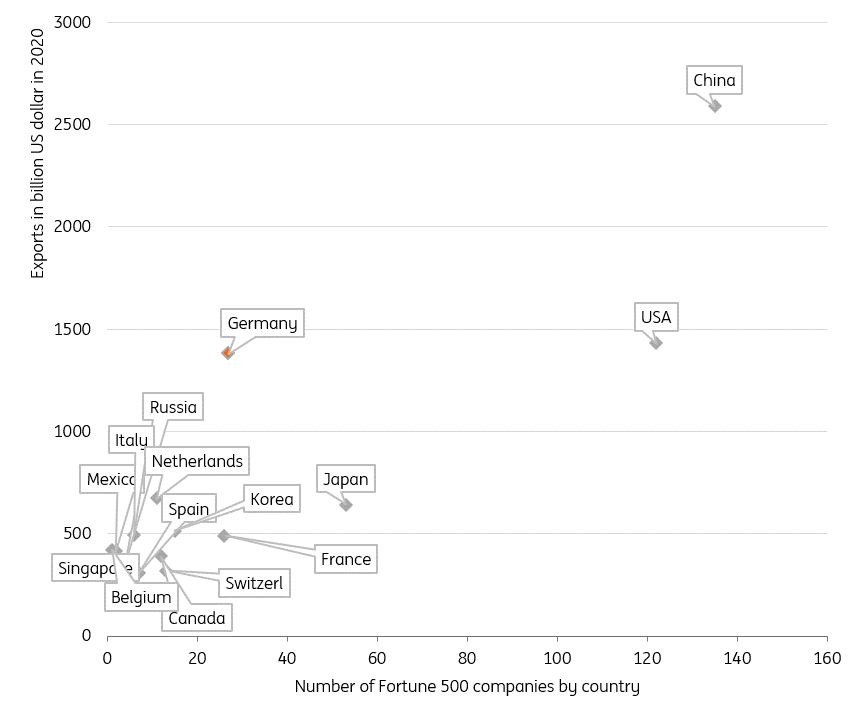

Does company size matter for exports?

Although only a few German companies are among the largest in the world, the country still ranks third in terms of worldwide exports. Companies which operate in product niches, the so-called Mittelstand and its hidden champions, are largely unknown by the public and have a turnover of less than five billion euros, but they've been a major factor in Germany’s export success for decades. Varying by estimates, more than 1,500 companies in Germany rank among the hidden champions, half of all those estimated in the world. A list of hidden champions conducted in 2019 up to 2016 shows that most companies are active in the manufacturing industry with a specific focus on machinery followed by electronics and optical products.

Yet, competition is coming. China’s 10-year plan to transform China into a manufacturing leader and into a high-tech powerhouse by 2025 is moving at full speed. China targets 10 strategic industries, which will be detrimental to Germany's future. In addition to the ‘Made in China 2025’ strategy, there is a new guideline of developing 10,000 ‘little giants’ for niche sectors and 1,000 enterprises that are market leaders in a single industry – mirroring, in a way, Germany's model.

At the same time, German companies are more dependent on foreign input. While in Germany the ratio of foreign value-added to the export volume of the manufacturing sector remained relatively stable between 2005 and 2016 (the latest available data in the OECD’s TiVA databank) at around 25%, China’s ratio fell from almost 30% in 2005 to 17%, driven by China’s plans to reach self-sufficiency.

Number of Fortune 500 companies and exports

Billions of US dollars

How attractive still is Germany for foreign investors?

Even if large, well-known companies are building up new locations in Germany, worldwide FDI flows and stocks have declined over the years. While in 2018, Germany received a strong inward FDI flow, in 2019 inflows decreased by more than 50% measured as a percentage of total world FDI flows. When looking at the stock level, both inflows as well as outflows have decreased significantly over the years. In China, on the other hand, an almost continuous trend can be observed for the stock and flow level, while in the US FDI flows remain strong, overall.

Foreign direct investment in Germany, China and the USA

Percentage of world total

Make Germany's core economic competencies fit for the future

Germany's success is built on its export strength coupled with an outstanding competence among others in the automotive industry, in healthcare and mechanical engineering. This export-based economic model will not change anytime soon and it doesn't necessarily have to. Since German corporations play a lesser role in the New Economy, one of the main tasks of the new government must be to make Germany's core economic competencies fit for the future. The pandemic has shown that traditional sectors can become new future markets.

Download

Download article

20 September 2021

The formidable challenges facing Germany’s new leader This bundle contains 2 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more