German consumers react to record-high inflation

Inflation in Germany is higher than it has been in decades and consumers are feeling the impact. In our latest ING Consumer Research survey, we take a look at how consumers adapt their financial planning, spending behaviour, and use of home energy and cars to deal with rising prices

Impact on budgeting and financial planning

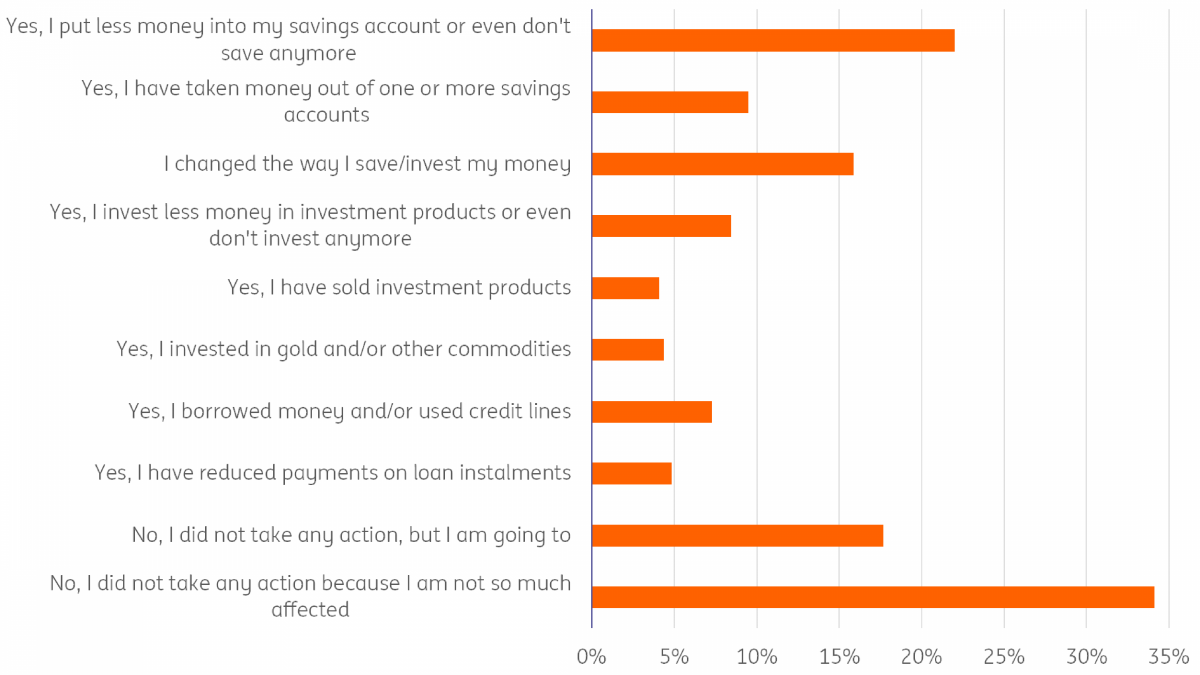

German consumers are feeling the effects of record-high inflation numbers. A representative ING survey shows that nearly every other participant has made changes to their budgeting or financial planning. 22 percent have reduced payments into savings accounts or do not save anymore at all, 10 percent have taken money out of savings accounts to deal with rising prices and 7 percent even felt the need to borrow money or use credit lines.

Have the rising prices impacted your budgeting or financial planning?

Perceived inflation at nearly twice the official figure

While official headline inflation numbers reached a 40-year high in March at 7.3 percent (and went on to top that at 7.4 percent in April), consumers report even bigger numbers as their perceived inflation over the previous 12 months for goods and services they usually buy – 14.0 percent on average, nearly double the official figure. And they don’t expect inflation to stop there: 86 percent think that prices will continue to rise, whereas a mere 2 percent expect an easing of price pressures. 11.4 percent is the average expected price increase over the coming 12 months.

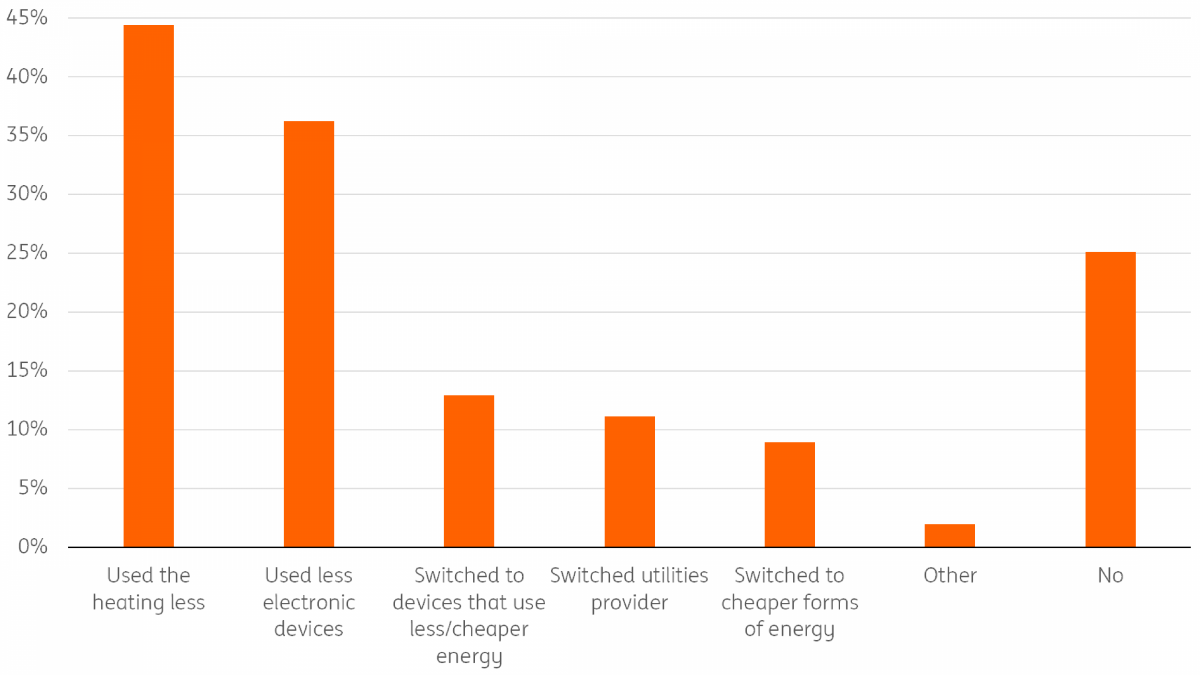

Energy prices have played a large role in driving up inflation. Nearly 80 percent of German consumers report that energy costs with respect to their home have increased during fall and winter. Out of those, 44 percent have responded by using less heating. Over a third have reduced the use of electric and electronic devices.

Have the rising energy prices led you to try to save more than before on utilities (electricity, natural gas, heating, etc)?

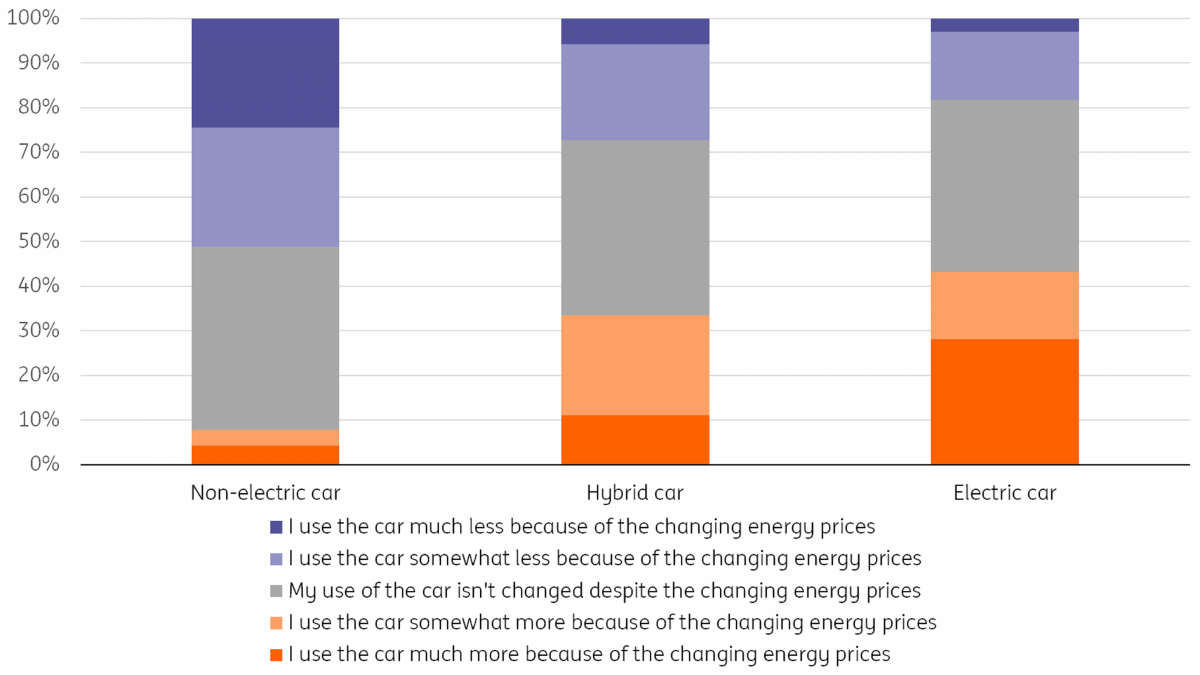

Car use is down, but not so much for electric vehicles

But it’s not just energy for home use that has become more expensive – German consumers are feeling the inflation at the gas pump as well. More than half of those who own a conventionally powered vehicle report that they have reduced its use. This number is considerably lower for owners of hybrid and electric vehicles; here, 33 percent and 43 percent, respectively, even report increased use due to changing energy prices. These are most probably the ones that own more than one car with different types of power train and have shifted their driving habits from conventional to electrical use.

Have the changing energy prices led you to use your car less or more?

(Without those that reported a change in use unrelated to energy costs)

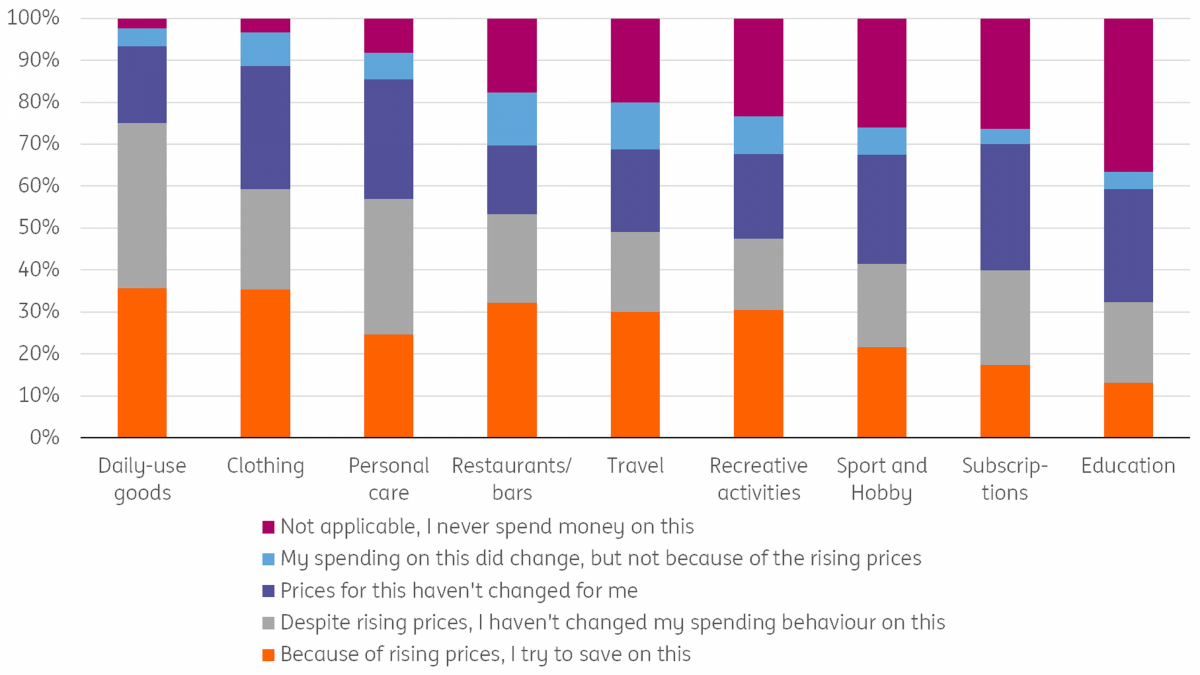

Three in four report having to deal with rising prices for daily-use goods

Aside from energy costs, consumers are also impacted by rising prices across many different types of expenses. Daily-use goods such as food and groceries top the list with 75 percent of participants reporting price increases, even though more than half of these have not yet changed their spending habits.

How has the rise in prices affected your spending on the following?

Supporting those that are most impacted will be a challenging task

Those that have actually changed their spending behaviour are mainly trying to benefit from sales and special offers (84 precent), switching to cheaper brands is somewhat less popular (56 percent). Just over a fourth have even reduced their consumption to deal with rising prices. Special offers and cheaper brands can only go so far in helping people maintain their level of consumption; and those that feel the worst pressure from rising prices are probably the ones that in the past have already made the most use of these options.

Supporting those that are most severely hit by rising prices will prove a challenging task – especially as a number of difficult political decisions lie ahead that could fuel the fire of rising prices even more.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article