Geopolitics, policy and sustainability to forge new electric vehicle partnerships

Countries and companies are increasingly wary of possible shortages of raw materials going forward and seek to secure supply. Battery metal demand is also evolving as demand shifts between chemistries. Current interdependence is significant and actors seek to reduce supply risk in light of the energy transition

China dominates downstream EV battery supply chains

China has massively pushed electric vehicle (EV) sales in recent years which has helped to further develop the battery supply chain. China’s dominant role in battery metals supply chains, as well as export restrictions in other countries, risk slowing down the pace of EV adoption.

EV supply chains are expanding, but for manufacturing, China remains the key player in the battery and EV component trade. In 2022, 35% of exported electric cars came from China, compared with 25% in 2021, according to the International Energy Agency (IEA).

The rapid increase in EV sales during the Covid-19 pandemic and increased geopolitical tensions have exacerbated concerns about China’s dominance of lithium battery supply chains. The risks associated with the concentration of production are in many cases heightened by low substitution and low recycling rates. For example, in EV batteries, there is no substitute for lithium.

More than 80% of the world’s lithium is mined in Australia, Chile and China, the latter of which also controls more than half of the world’s processing and refining.

Chinese companies (including BYD and CATL) have also made significant investments in projects overseas; in Australia, Chile, the Democratic Republic of the Congo (DRC) and Indonesia. In Chile, the second-biggest lithium producer after Australia, only two companies produce lithium – US-based Albermarle Corp. and local firm SQM, in which China’s Tianqi Lithium Corp. has more than 20% stake. They mainly make lithium carbonate – 90% of which goes to Asia.

China dominates many elements of the downstream EV battery supply chain, from material processing to the construction of cell and battery components. China only accounted for about 15% of global lithium raw material in 2022 but around 60% of the battery metal is refined there into specialist battery chemicals. China also produces three-quarters of all lithium-ion batteries. This is a result of Beijing’s early push towards electrification, particularly through subsidising EVs.

Meanwhile, Europe is responsible for more than one-quarter of global EV assembly, but it is home to very little of the supply chain apart from cobalt processing at 20%. Like the US, Europe is currently pushing hard to develop its battery supply chain, but this takes time and sourcing dependencies remain.

China is the least expensive place to process lithium because of lower construction costs and an already large, processed chemistry engineering base. In 2022, 35% of exported EVs came from China, compared with 25% in 2021, according to the IEA.

Battery cell manufacturing is concentrated in China (2022)

Rising trend of vertical integration of EV and battery production

With uncertainties from metal supply chains, some automakers – which have set EV sales targets – have been looking into expanding their businesses into mining in the hope of securing a long-term supply of raw materials. In January, General Motors (GM) announced that it had formed a joint venture with mining company Lithium Americas, which would give GM exclusive access to lithium from a mining site in Nevada, US.

Ford, through its joint venture with battery company SK Innovations, will receive a $9.2bn loan from the US Department of Energy (DoE), the largest single loan in the DoE Loan Programs Office history, to develop battery plants in Tennessee and Kentucky. Stellantis has entered separate joint ventures with Samsung SDI and LG Energy Solution to build battery plants in the US and Canada, respectively. Other firms such as Tesla, BMW, VW, Hyundai, and Honda are similarly investing in building battery manufacturing capacity.

In the coming few years, we are going to see more partnerships – not just trade partnerships, but strategic partnerships – made along the EV battery supply chain. The future of the EV industry is vertical, ‘mine-to-wheel’ collaboration. This means that early efforts of long-term planning and relationship building will become increasingly important.

Energy transition at risk as resource nationalism gains momentum

The energy transition has become a pillar of policy for many governments while global trade and political tensions have prompted a reconsideration of global supply lines.

The global incidence of export restrictions on critical raw materials has increased more than five-fold in the last decade. In recent years, about 10% of the global value of exports of critical raw materials faced at least one export restriction measure, according to a report by the Organisation for Economic Cooperation and Development (OECD).

The rise in resource nationalism could slow down the pace and increase the cost of the energy transition, impacting the scale of investments, supply and prices.

Export restrictions on ores and minerals, the raw materials located upstream in critical raw material supply chains, have grown faster than restrictions in the other segments of the critical raw materials supply chain, correlating with the increasing levels of production, import and export, as well as the concentration in a small number of countries, the OECD report found.

Chile’s lithium move is the latest in the global resource nationalism trend

Earlier this year, Chile announced that it would nationalise its lithium industry to boost its economy and protect its environment. The move would in time transfer control of Chile’s lithium operations from Albemarle and SQM, the world’s number one and number two lithium producers, respectively, to a separate state-owned company, posing fresh challenges to EV manufacturers scrambling to secure supplies, with more countries seeking to protect their natural resources. Albemarle and SQM supply Tesla and LG Energy Solution, among other EV and battery manufacturers.

Chile is just part of the global trend with several other countries having taken greater control of their resources. Mexico nationalised its lithium deposits last year, while Indonesia banned exports of nickel ore in 2020.

Current efforts to strengthen EV battery supply chains

EU – The Critical Raw Materials Act (CRMA)

The EU’s Critical Raw Materials Act is one of the cornerstones of the EU’s Green Deal Industrial Plan, together with the Net-Zero Industry Act, which sets a target for the EU to produce 40% of its own clean tech by 2030, such as solar power or fuel cells, partly by streamlining the granting of permits for green projects. The bloc also announced a goal for carbon capture of 50 million tonnes by 2030.

Europe is responsible for more than one-quarter of global EV assembly, but it is home to very little of the supply chain apart from cobalt processing at 20%, according to the IEA.

Global investment in the green energy transition is set to triple by 2030 from $1 trillion last year, the EU said. The bloc will need €400bn of investment a year to decarbonise and meet its target of net-zero emissions by 2050, it estimated.

As part of the Critical Raw Materials Act, the EU has set targets for the region to mine 10% of the critical raw materials it consumes, like lithium, cobalt, and rare earths, with recycling adding a further 15%, and increased processing to 40% of its needs by 2030. The EU also said that no more than 65% of any key raw material should come from a single third country. The EU is almost entirely dependent on imports of these raw materials, particularly from China, with 100% of the rare earths used for permanent magnets globally refined in China and 97% of the EU’s magnesium supply sourced from China.

US – The Inflation Reduction Act (IRA)

The US IRA has established policies that aim to strengthen the entire domestic EV value chain. Under the IRA, battery cells can receive a tax credit of up to $35 per kWh of energy produced by a battery cell, while battery modules can get up to $10/kWh. In the case where battery modules don’t use cells, a maximum of $45/kWh is provided. Moreover, the tax credits for EVs, with the highest level at $7,500, have important qualifying requirements that are tied to battery components and origins. This means that EV manufacturers looking to qualify for the tax credits will need to reroute supply chains and form new business partnerships with new suppliers.

The IRA can also encourage more battery recycling in the US because established battery recycling capacities can help EV manufacturers bypass any sourcing origin requirements for critical minerals. The government is also setting money aside to encourage the research and development of batteries and battery recycling.

It will be time and money-consuming, but the IRA’s policies would in the long-run lead to a more resilient EV supply chain in the US. The IRA has spurred $45bn of announced private-sector investment in the entire value chain as of late March, with more to be expected in the future.

EV criteria: price, income, assembly and sourcing

- The retail price cannot exceed $80,000 for an electric van, SUV, or pickup truck, and $55,000 for any other type of EV.

- EV buyers' gross annual income cannot exceed $150,000 for a single taxpayer, $225,000 for a head of household, and $300,000 for a married couple filing jointly.

- Qualifying EVs' final assembly must be in North America.

- 50% of the value of the battery components must be manufactured or assembled in North America.

- 40% of the value of the critical minerals needs to be extracted or processed in the US or a country with which it has a free trade agreement (FTA), or be recycled in North America.

Source: US Treasury

Investments key to combating China’s dominance in EV supply chains

Investment is key to combatting China’s crucial role in the EV supply chain. But even as the US and Europe continue to ramp up investment, China’s dominance in processing and production is set to continue to grow. Bloomberg New Energy Finance (BNEF) is expecting China’s dominance to continue, with the country accounting for 69% of the world’s battery manufacturing capacity in 2027. Combating China’s dominance in the EV supply chains will be an expensive process. According to BNEF, the US and Europe will have to invest $87bn and $102bn, respectively, to meet domestic battery demand with fully local supply chains by 2030.

More attention needed on battery recycling and emissions reduction

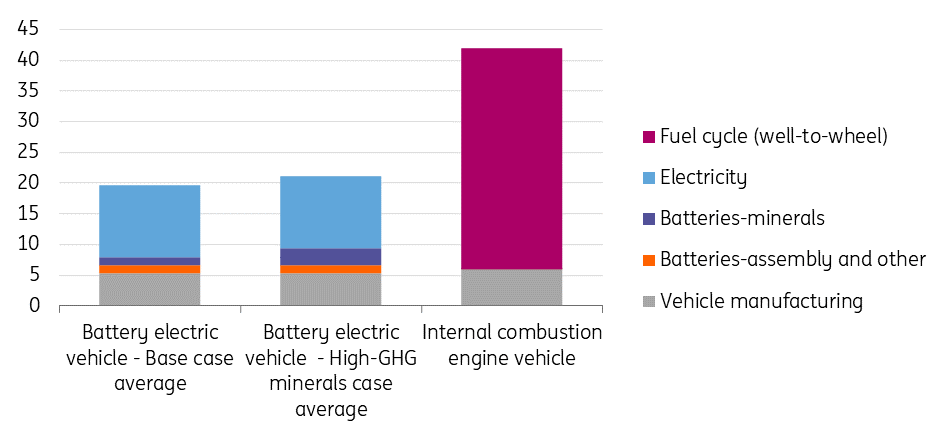

Recycling and emissions reduction along the EV battery supply chain is an area that has not yet received sufficient attention but will become increasingly important for companies to manage. Battery electric vehicles (BEVs) on average show significant environmental advantages compared to internal combustion engine (ICE) vehicles when life-cycle emissions are calculated. The portion of BEV life-cycle emissions coming from battery mining and processing is relatively low, but the pressure to decarbonise battery mining and production will only grow as the demand for EVs increases.

Comparative life-cycle GHG emissions of a mid-size BEV and ICE vehicle

There are several common practices to reduce emissions in EV battery mining and processing. First, companies are trying to use clean electricity to power their operations. This primarily includes buying Power Purchase Agreements (PPAs) from renewable developers. Second, mining companies are also taking initiatives to switch to low-carbon fuels – such as biodiesel – for their truck fleet.

Third, both mining and battery production companies have been engaged in boosting circularity for their product value chains. Today, the global capacity for battery recycling remains limited. In general, lithium-ion batteries' lifespan can last between 100,000 and 200,000 miles, or about 15 to 20 years of driving, after which it needs to be recycled in some way.

In the US, lower than 5% of lithium-ion batteries were recycled in 2019. For instance, US start-up Redwood Materials has been partnering with automakers Ford and Toyota, as well as battery producer Panasonic Holdings, to establish a closed-loop battery ecosystem. Redwood Materials recently obtained a $2bn loan commitment from the US Department of Energy to build and expand its pilot battery recycling facility. In Europe, Renault is collaborating with optimised resource management company Veolia and science-based company Solvay to advance EV battery metal closed-loop recycling.

Recycling EV batteries and decarbonising battery production will help companies boost company environmental, social, and governance (ESG) credentials. Recycling, specifically, can also help enhance supply chain security. Over the next few decades, we will see recycling become more mainstream among battery and EV manufacturers. McKinsey forecasts that EV battery recycling capacity will grow at 25% per year until 2040. Recycling lithium-ion batteries is increasingly becoming a priority for many countries and EV companies in order to reduce their dependencies on the mining of raw materials.

Policy and politics will continue to play a role in EV supply chains

Policy and politics will play an increasingly large role in the future of EV supply chains. To secure battery metal supply, we expect to see countries and regions such as the US and EU forge new trade partnerships. We expect governments' EV policies to focus more on batteries and metals, and we also expect EV companies to further partner up with battery manufacturers and mining companies. The sustainability of mining and battery manufacturing will affect company decisions in the long term, but its impact will be limited until there has been a huge uptake in EV adoption.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 July 2023

Supply chain challenges signal a bumpy road ahead for electric vehicle adoption This bundle contains 3 Articles