GCC currency pegs: Unprecedented times, unprecedented measures?

These are unprecedented times in global energy markets. Does the crash in oil prices spell the end for Gulf Cooperation Council's 30-year-old currency pegs? While certain GCC members face significant challenges, GCC authorities have a lot invested in the pegs and have considerable resources to resist devaluation

Pegs have held in good times and bad

The GCC countries - Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE - have been running currency pegs or managed FX regimes against the USD since the early 1970s. Given the dollar-based nature of their economies, the pegs have been seen as an essential anchor for policy credibility (out-sourcing monetary policy to the Federal Reserve) and that has served the region well.

Depending on the price of oil, over the years, these pegged regimes have seen pressure to revalue (strong oil, under-valued currencies seen as inflationary). Or, as now, the pressure to devalue (weak oil, over-valued currencies seen as deflationary). Local authorities have a strong track record of seeing these cycles out.

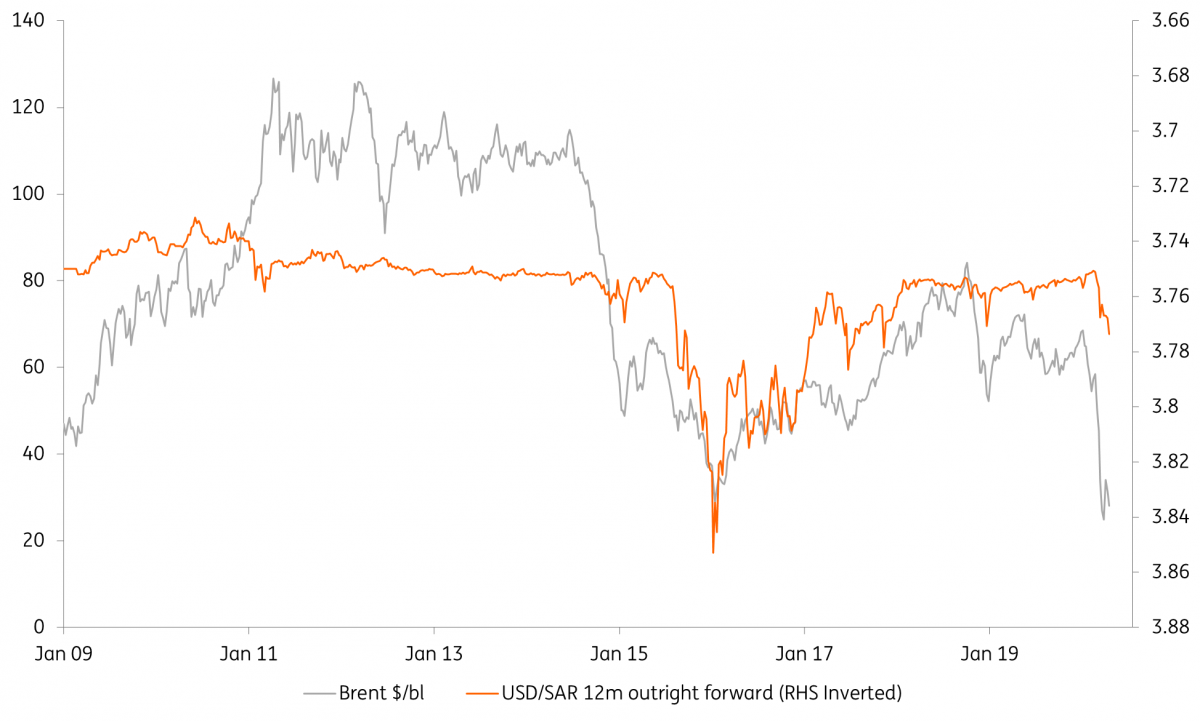

The 3.75 peg in USD/SAR has held through the ups and downs of the oil market

Is this time different?

For a start, the GCC members’ progress of diversifying their revenue dependence away from oil has been mixed. Saudi Arabia in 2020 is still expected to earn 63% of government revenues from oil receipts. That figure is as high as 76% for Oman but as low as 39% for Qatar. Second, many countries have achieved limited progress in reining in fiscal spending over the last few years, with government debt/GDP having risen notably in Bahrain (from 66% in 2015 to 102% in 2019 according to the IMF), Oman (15% to 60%) and Saudi Arabia (6% to 23%).

The dependency of GCC markets on oil revenue naturally has a big say in both national budgets and the current account balance

The dependency of GCC markets on oil revenue naturally has a big say in both national budgets and the current account balance. The first chart below outlines IMF figures on the required break-even oil prices in fiscal terms (at which the fiscal balance is zero) and in external terms (at which the current account is zero). Clearly Bahrain and Oman have their work cut out given budgetary break-even oil prices at $80/bl+.

The second chart looks at 2020 IMF forecasts for fiscal and current deficits in terms of GDP. Again Bahrain and Oman stand-out here. That is why Bahrain’s and Oman’s sovereign credit default swaps (the cost of insuring against a sovereign default) trade at 474bp and 699bp respectively, versus levels of 42bp and 64bp for Qatar and Saudi Arabia.

2020 forecasts for i) Break-even oil prices ($/bl) and ii) fiscal and current account balances (% of GDP)

Would a devaluation help?

The case for a GCC voluntary currency devaluation appears weak.

Firstly, the loss of the credible anchor will be costly – e.g. what kind of devaluation is sufficient, who decides policy and what are their motives? Secondly, studies suggest that trade inelasticities mean that devaluations would actually lead to a deterioration in the non-oil trade balance.

What about an involuntary devaluation then? Here the view is that sustained pressure on an exchange rate peg and the ensuing loss of reserves make the existing FX arrangement untenable. An example here was Korea’s attempt to resist devaluation in 1997 during the Asian currency crisis. The Bank of Korea lost 40% of its FX reserves on intervention and then de-valued anyway.

Based on conventional metrics of import cover and short term debt to FX reserves, Bahrain looks the least able to withstand sustained pressure

But, as above, the GCC has a long history of defending currency pegs and still has considerable resources. Notably, Kuwait, Qatar, Saudi Arabia, and the UAE boast substantial sovereign wealth assets. In the case of Saudi Arabia, currency reserves stand at around $500bn, with one of its Sovereign Wealth Funds (PIF) holding $320bn. The strong buffers have also been key in maintaining market confidence, with Abu Dhabi, Qatar, and Saudi Arabia altogether having raised $24bn from international capital markets in April.

Based on conventional metrics of import cover and short term debt to FX reserves, Bahrain looks the least able to withstand sustained pressure. However, we would expect support from fellow GCC members to remain forthcoming for socio-economic and geopolitical reasons but also for fear that allowing one GCC member to devalue would invariably lead to contagion in the region. For reference, the IMF and Bank of International Settlement data forecast Bahrain with a $7.5bn current account deficit this year and $15bn of short-term liabilities to BIS reporting banks.

Oman’s starting point into the current crisis is more favourable but deteriorating at a fast pace as the large fiscal and current account deficits above indicate.

Given Oman’s neutral foreign policy which has been preserved amid the ongoing spat between Saudi Arabia, Bahrain, the UAE and Egypt on the one side and Qatar on the other, it is unclear whether stronger GCC countries would be willing to step in case of need. If push comes to shove and oil prices remain in low gear for a more extended period, we could see a similar situation to that of Bahrain ahead of the bailout in 2018, with investors scrutinizing FX reserves against external debt maturities which remain large over the next few years.

Pressure on pegs likely to remain, however, through 2Q20

While we do not think the pegs will be broken in this cycle, it is hard to see the pressure coming off the pegs in the next few weeks. That pressure typically is expressed through the FX forwards market.

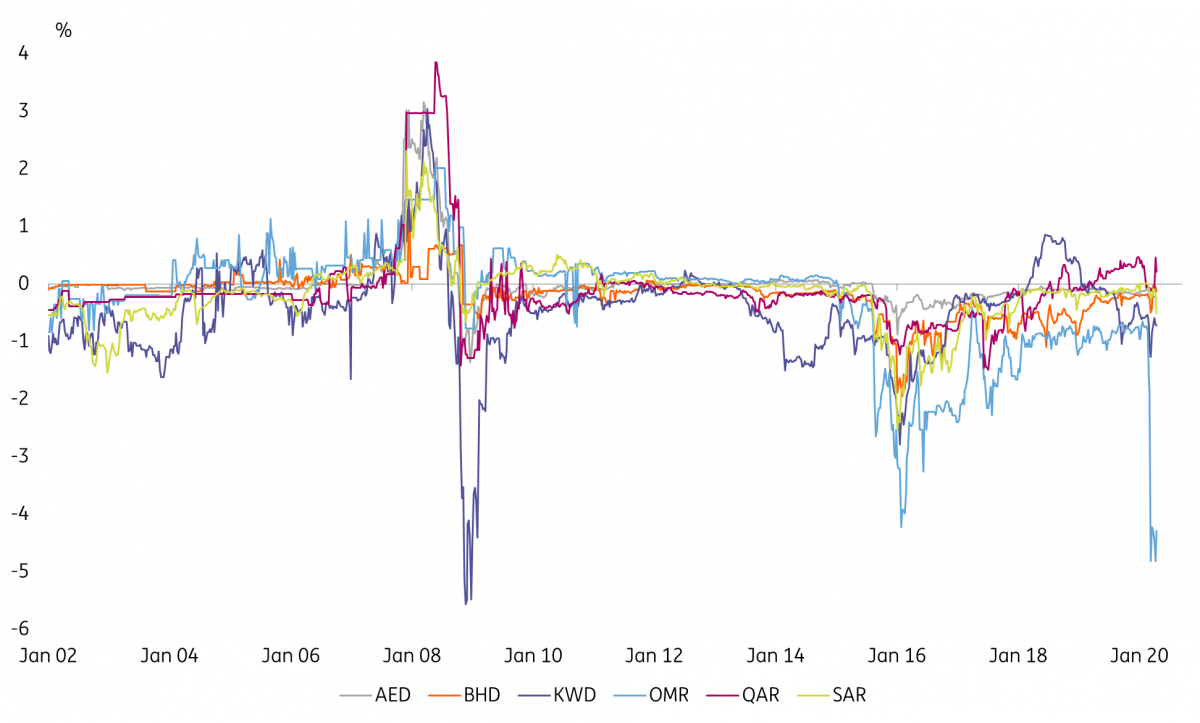

Below we show the current stress in the 12-month FX forwards market, seen as a gauge of where these GCC spot rates could be trading in twelve months’ time. At the moment, as in the CDS space, the Omani Rial is under the most pressure with a 5% depreciation priced in over the next twelve months.

There is a real risk of a repeat performance in the June 2020 WTI contract when it comes to expire on 18 May

As our commodities team noted today, there is a real risk of a repeat performance in the June 2020 WTI contract when it comes to expire on 18 May – just as we saw heavy WTI losses on the back of the May 2020 contract expiration yesterday. And until we don't have better transparency on lockdown exit strategies and a better picture of the demand destruction in oil markets, that we'll see a sustainable rebound in crude oil prices.

Implied (via FX forwards) twelve month change against USD

It, therefore, looks like the more vulnerable of the GCC currencies, Oman and Bahrain, can stay under pressure in the FX forwards market through the Spring. But based on strong support within the GCC bloc and what should be a second-half recovery in Brent crude to the $35/45 (according to our team), we see GCC pegs intact and implied yields on the FX forwards dropping back to levels seen through 2018/2019 as the summer progresses.

Download

Download article

21 April 2020

In case you missed it: First tentative steps towards normalisation This bundle contains 12 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more